AHMEDABAD: Riding on the steady growth in share prices of its listed companies, Ahmedabad-based Torrent Group’s market capitalization has touched $10 billion mark.

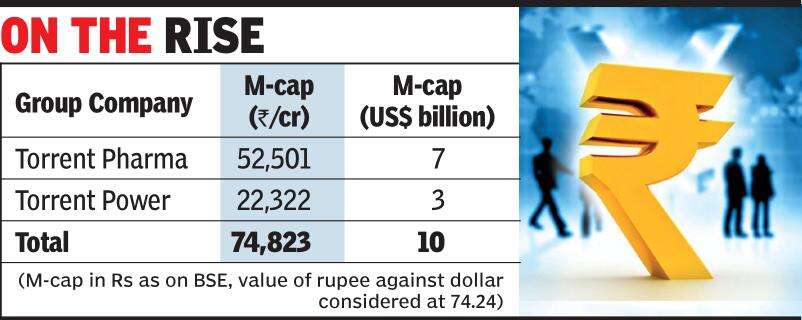

The combined market cap of Torrent Pharmaceuticals Limited and Torrent Power Limited — the group’s two companies listed on bourses — stood at Rs 74,823 crore on Tuesday, which translates into $10.07 billion (considering the value of rupee against dollar at 74.24).

Separately, Torrent Pharma’s m-cap surged to Rs 52,501 crore (about $7 billion) with its stock hitting an all-time high of Rs 3,123.60 in intraday trades on Tuesday before closing at Rs 3,102.50.

With its stock remaining flat Rs 464.45, Torrent Power’s m-cap remained at Rs 22,322 crore (approximately $3 billion) on Tuesday. The company’s stock had touched a lifetime high of Rs 508.85 on June 9, 2021. Its share price has jumped 46% in this calendar year so far.

Torrent Group’s all businesses have demonstrated a track-record of profitable growth aided by sound corporate governance. These businesses are further poised for handsome growth in future, said analysts.

“Torrent Pharma has now become the 8th largest pharmaceutical company in India. Its portfolio is well diversified across India, Brazil, US and Germany with India accounting for 53% of the sales,” said Parth Parekh, fundamental research analyst at Prudent Corporate Advisory.

Stating that the company’s revenues and profits have grown at a compounded annual growth rate (CAGR) of 14% and 17% respectively in the past 10 years, Parekh added, “The return on equity has averaged at a strong 26% during this period. The cumulative free cash flows generated in the past ten years has exceeded Rs 7,500 crore and the company has been re-investing a lot of these free cash flows for inorganic growth.”

Torrent Power, on the other hand, enjoys a strong presence across power generation, transmission, and distribution. “The company has one of the lowest transmission and distribution (T&D) losses in the country. Successful bidding of power distribution license in Dadra & Nagar Haveli and Daman & Diu as well as upcoming renewable power capacities of 815 MW will aid growth going forward,” said Parekh.

The company has a strong balance sheet with one of the lowest debt to equity and net debt to EBITDA ratios in the entire power sector.