Walmart Inc. (NYSE:WMT) will release earnings results for the second quarter, before the opening bell on Thursday, Aug. 21.

Analysts expect the Bentonville, Arkansas-based company to report quarterly earnings at 74 cents per share, up from 67 cents per share in the year-ago period. Walmart projects to report quarterly revenue of $176.16 billion, compared to the $167.77 billion it generated last year during the same quarter, according to data from Benzinga Pro.

The company missed analyst estimates for revenue in the first quarter, but have beaten estimates in nine of the last 10 quarters.

Walmart shares gained 1.3% to close at $102.57 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

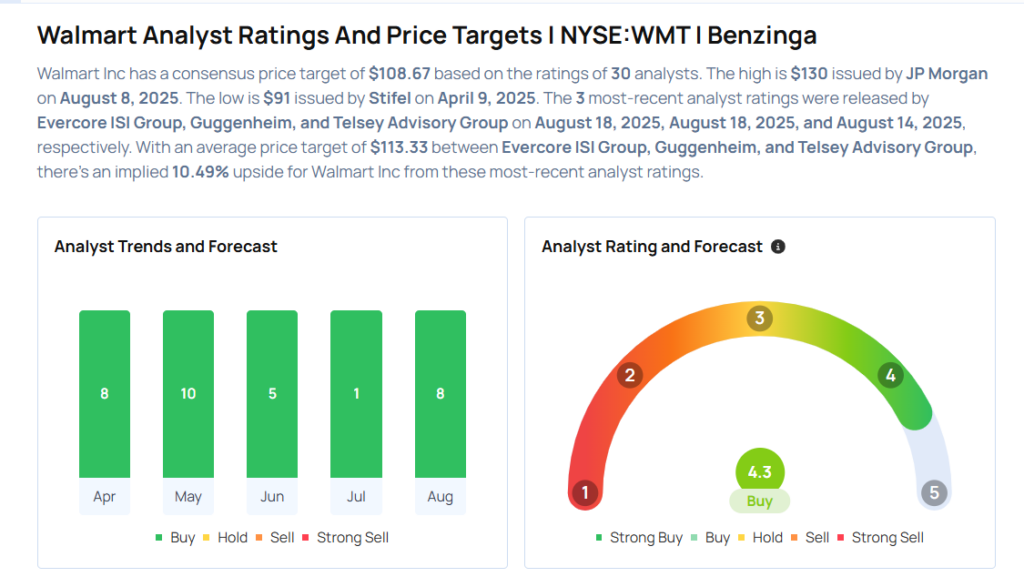

- Evercore ISI Group analyst Greg Melich maintained an Outperform rating and raised the price target from $108 to $110 on Aug. 18, 2025. This analyst has an accuracy rate of 79%.

- Oppenheimer analyst Rupesh Parikh maintained an Outperform rating and increased the price target from $110 to $115 on Aug. 13, 2025. This analyst has an accuracy rate of 72%.

- JP Morgan analyst Christopher Horvers maintained an Overweight rating and boosted the price target from $112 to $130 on Aug. 8, 2025. This analyst has an accuracy rate of 74%.

- UBS analyst Michael Lasser reiterated a Buy rating with a price target of $110 on Aug. 6, 2025. This analyst has an accuracy rate of 80%.

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating and raised the price target from $115 to $120 on July 2, 2025. This analyst has an accuracy rate of 75%

Considering buying WMT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock