Synopsys, Inc. (NASDAQ:SNPS) will release earnings results for the third quarter fiscal year 2025 after the closing bell on Tuesday, Sept. 9.

Analysts expect the Sunnyvale, California-based company to report quarterly earnings at $3.75 per share, up from $3.43 per share in the year-ago period. Synopsys is projected to report quarterly revenue of $1.77 billion, compared to $1.53 billion a year earlier, according to data from Benzinga Pro.

On Sept. 3, Synopsys announced expanding AI capabilities for its leading EDA solutions.

Synopsys shares rose 1.8% to close at $609.08 on Monday.

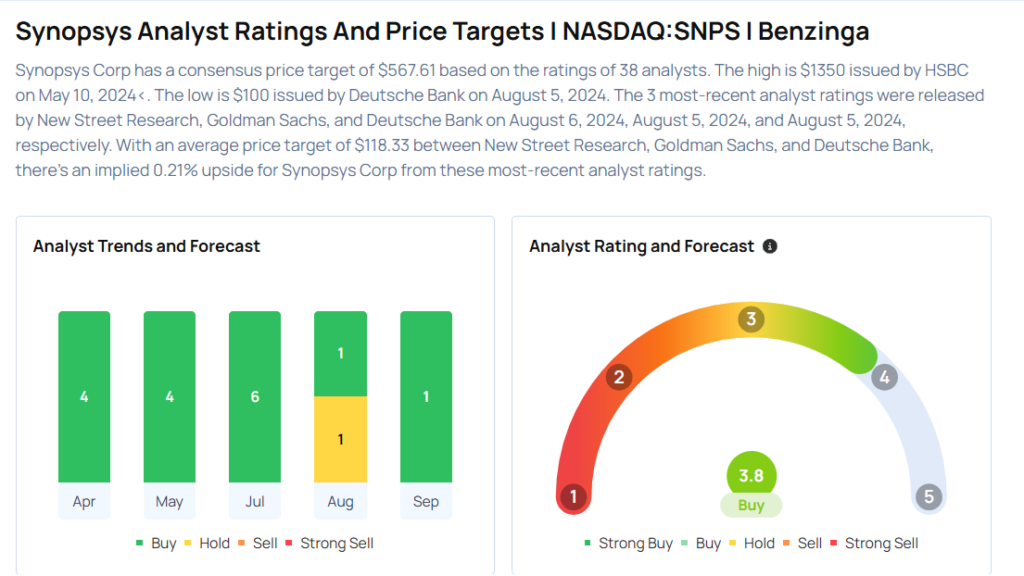

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Keybanc analyst Jason Celino maintained an Overweight rating and raised the price target from $610 to $660 on Sept. 3, 2025. This analyst has an accuracy rate of 62%.

- Rosenblatt analyst Blair Abernethy maintained a Buy rating and raised the price target of $625 to $650 on July 25, 2025. This analyst has an accuracy rate of 76%.

- Piper Sandler analyst Clarke Jeffries maintained an Overweight rating and boosted the price target from $615 to $660 on July 21, 2025. This analyst has an accuracy rate of 60%.

- B of A Securities analyst Vivek Arya maintained a Buy rating and boosted the price target from $575 to $625 on July 16, 2025. This analyst has an accuracy rate of 81%.

- Needham analyst Charles Shi maintained a Buy rating and raised the price target from $650 to $660 on July 15, 2025. This analyst has an accuracy rate of 60%

Considering buying SNPS stock? Here’s what analysts think:

Photo via Shutterstock