Celestica Inc. (NYSE:CLS) will release earnings results for the third quarter, after the closing bell on Monday, Oct. 27.

Analysts expect the Toronto, Canada-based company to report quarterly earnings at $1.49 per share, up from $1.04 per share in the year-ago period. The consensus estimate for Celestica's quarterly revenue is $3.04 billion, compared to $2.5 billion a year earlier, according to data from Benzinga Pro.

On July 28, Celestica reported better-than-expected second-quarter financial results and raised its FY25 guidance.

Shares of Celestica rose 4.9% to close at $296.62 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

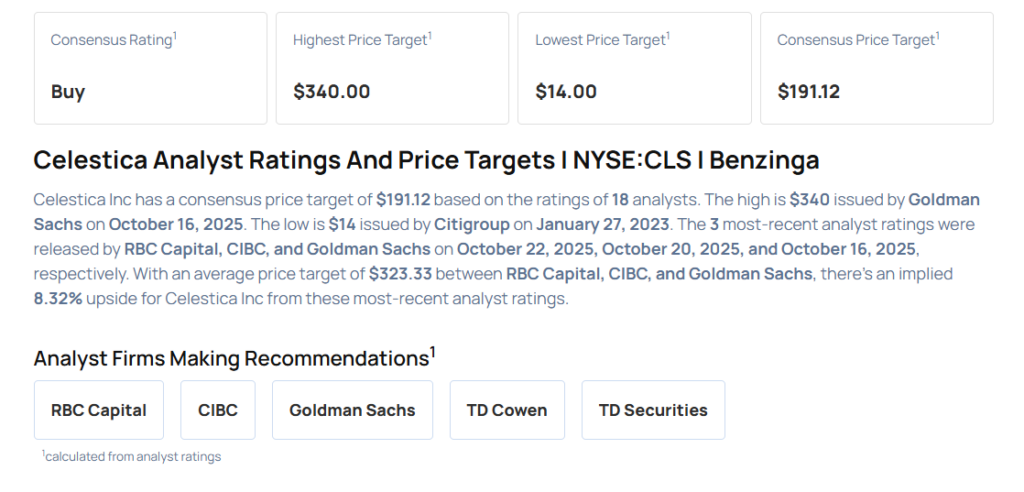

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- RBC Capital analyst Paul Treiber maintained an Outperform rating and raised the price target from $225 to $315 on Oct. 22, 2025. This analyst has an accuracy rate of 77%.

- Goldman Sachs analyst Michael Ng initiated coverage on the stock with a Buy rating and a price target of $340 on Oct. 16, 2025. This analyst has an accuracy rate of 74%.

- TD Cowen analyst Daniel Chan reinstated a Hold rating with a price target of $238 on Oct. 3, 2025. This analyst has an accuracy rate of 78%.

- JP Morgan analyst Samik Chatterjee maintained an Overweight rating and increased the price target from $225 to $295 on Sept. 8, 2025. This analyst has an accuracy rate of 76%.

- Citigroup analyst Atif Malik maintained a Neutral rating and boosted the price target from $172 to $212 on July 30, 2025. This analyst has an accuracy rate of 83%

Considering buying CLS stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock