A prominent technology analyst has slammed Oracle Corp.'s (NYSE:ORCL) high-profile AI strategy, labeling it “bad behavior” and an “irresponsible investment” that relies on speculative demand, unlike the “healthy” and established customer-driven AI buildouts at Microsoft Corp. (NASDAQ:MSFT), Amazon.com Inc. (NASDAQ:AMZN), and Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google.

Check out ORCL’s stock price here.

ORCL Has A ‘Bad Business’ With ‘Very Low Margins’

Gil Luria, D.A. Davidson’s Head of Technology Research, in a conversation with CNBC, argued that Oracle is “borrowing to provide capacity for startups,” a high-risk move.

He contrasted this directly with its “Big Tech” rivals, who “have all the customers, have cash on hand,” and are building data centers for demand that is “already sold three years in advance.”

Luria's sharpest criticism was aimed at the economics of Oracle’s new AI business, which he called a “bad business with very low margins.” He pointed out that while Oracle's core business enjoys 80% gross margins, the company touted 30-40% gross margins on its new AI deals “as if that’s a good thing.”

Oracle’s $455 Billion Backlog In Question

At the heart of the skepticism is Oracle’s massive $455 billion order backlog.

Luria called the reported deals, such as those with OpenAI, “false promises” and not “real demand.”

He claimed OpenAI has “no intention of living up to those obligations” and views its commitments as a “flexible arrangement” to consume capacity as needed.

See Also: Oracle Stock Soars Despite Missing Q1 Estimates: Here’s Why

Jim Chanos Questions ORCL's Accounting Principles

This analysis is compounded by revelations from famed short seller Jim Chanos, who noted a cornerstone $300 billion OpenAI deal is not scheduled to begin until 2027 and questioned how the startup could realistically finance a $60 billion annual commitment.

Meanwhile, CNBC's Jim Cramer attributed Oracle’s monumental $455 billion backlog to the ‘Stargate' AI infrastructure project, stating, “who else would be placing those orders.”

“We should definitely keep everything they say from now on with a little more grain of salt,” Luria concluded, noting that the recent $100 of AI-driven appreciation in Oracle's stock has “completely gone away,” and that “it makes a lot of sense.”

ORCL Outperforms The S&P 500 Index In 2025

ORCL has gained 36.72% year-to-date as compared to the S&P 500’s 16.74% return. The stock closed 3.88% lower at $226.99 apiece on Wednesday and fell by 0.22% in premarket trading on Thursday. Over the year, it has gained 19.70%.

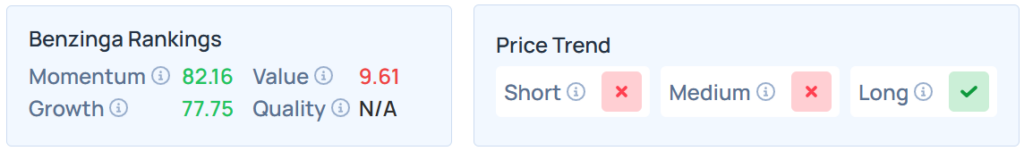

It maintains a stronger price trend over the long term but a weak trend in the medium and long terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock