The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Accenture Plc (NYSE:ACN)

- On Sept. 9, Accenture acquired IAMConcepts, a privately held Canadian company specializing in identity and access management (IAM) services. The company's stock fell around 26% over the past six months and has a 52-week low of $236.67.

- RSI Value: 28

- ACN Price Action: Shares of Accenture fell 3.5% to close at $243.11 on Wednesday.

- Edge Stock Ratings: 10.49 Momentum score with Value at 18.72.

C3.ai Inc (NYSE:AI)

- On Sept. 3, C3.ai missed first-quarter earnings estimates and issued weak guidance. The company's stock fell around 5% over the past month and has a 52-week low of $14.70.

- RSI Value: 28

- AI Price Action: Shares of C3.ai fell 0.8% to close at $15.61 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in AI stock.

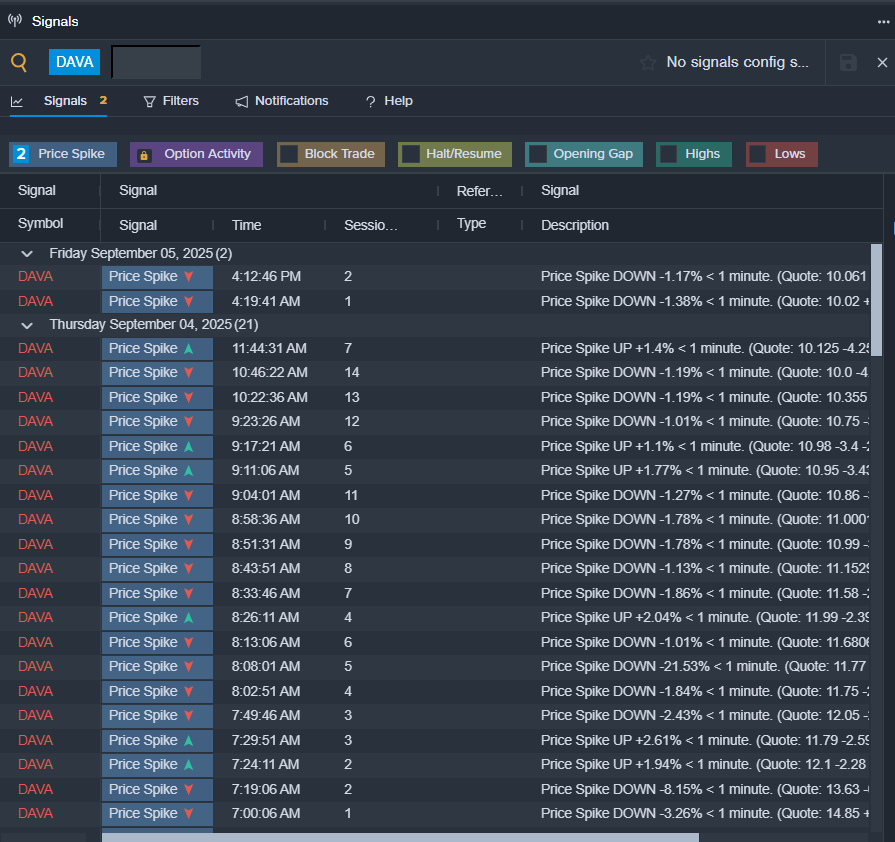

Endava PLC – ADR (NYSE:DAVA)

- On Sept. 4, Endava posted mixed quarterly results. “AI continues to be a strategic focus for many of our clients and we have now passed the point where over half of our people use AI in projects, a clear marker of progress in our journey to becoming AI-native. Endava exited FY2025 with its highest ever quarterly order book, lifting full-year signed value to a record high. Despite the increase in the order book, the short term operating backdrop remains volatile and many clients continue to recalibrate the timing of spending, and therefore our outlook remains cautious,” said John Cotterell, Endava’s CEO. The company's stock fell around 24% over the past month and has a 52-week low of $9.36.

- RSI Value: 25.7

- DAVA Ltd Price Action: Shares of Endava dipped 5.3% to close at $9.40 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in DAVA shares.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock