The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Endava PLC – ADR (NYSE:DAVA)

- On Sept. 4, Endava posted downbeat quarterly sales. “AI continues to be a strategic focus for many of our clients and we have now passed the point where over half of our people use AI in projects, a clear marker of progress in our journey to becoming AI-native. Endava exited FY2025 with its highest ever quarterly order book, lifting full-year signed value to a record high. Despite the increase in the order book, the short term operating backdrop remains volatile and many clients continue to recalibrate the timing of spending, and therefore our outlook remains cautious,” said John Cotterell, Endava’s CEO. The company's stock fell around 34% over the past month and has a 52-week low of $9.12.

- RSI Value: 29.8

- DAVA Price Action: Shares of Endava fell 0.9% to close at $9.15 on Monday.

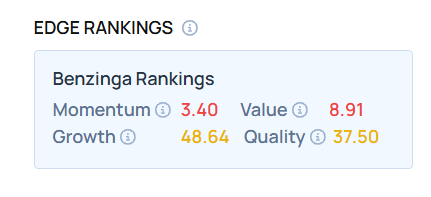

- Edge Stock Ratings: 3.40 Momentum score with Value at 8.91.

Neonode Inc (NASDAQ:NEON)

- On Sept. 3, Neonode announced it expects $15-20 million from a Samsung Electronics patent settlement. The company's stock fell around 84% over the past month and has a 52-week low of $3.80.

- RSI Value: 23.5

- NEON Price Action: Shares of Neonode rose 2.5% to close at $4.15 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in NEON stock.

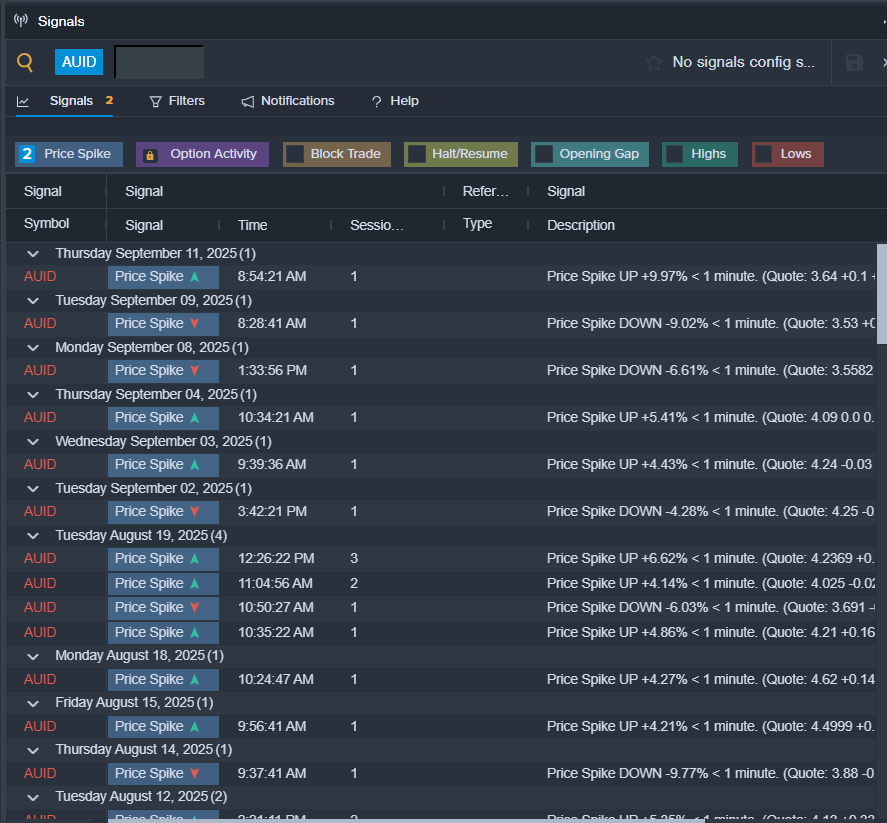

authID Inc (NASDAQ:AUID)

- On Aug. 14, authID reported a year-over-year increase in second-quarter financial results. “In the second quarter, we delivered our highest quarterly revenue in the history of our business, further demonstrating that we are executing our plan to drive growth and value for shareholders,” said Rhon Daguro, authID’s Chief Executive Officer. The company's stock fell around 36% over the past month and has a 52-week low of $2.65.

- RSI Value: 29.54

- AUID Price Action: Shares of authID fell 11.6% to close at $2.75 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in AUID shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock