The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Amber International Holding Ltd (NASDAQ:AMBR)

- On Sept. 10, Amber International Holding reported a year-over-year increase in second-quarter sales results. Michael Wu, Chairman of the Board and CEO of Amber International, said, "We delivered solid overall performance in the second quarter of 2025 with total revenue reaching US$21.0 million, driven by robust growth in wealth management business achieving a record revenue at US$11.5 million, reflecting the success of our institutional-first strategy and demonstrate the scalability of our digital wealth management platform. Our leadership team has not only strengthened our foundation but has positioned us for accelerated, long-term growth as a leading digital wealth management platform in Asia." The company's stock fell around 44% over the past month and has a 52-week low of $2.20.

- RSI Value: 23.5

- AMBR Price Action: Shares of Amber International fell 7.6% to close at $2.44 on Monday.

- Edge Stock Ratings: 4.40 Momentum score.

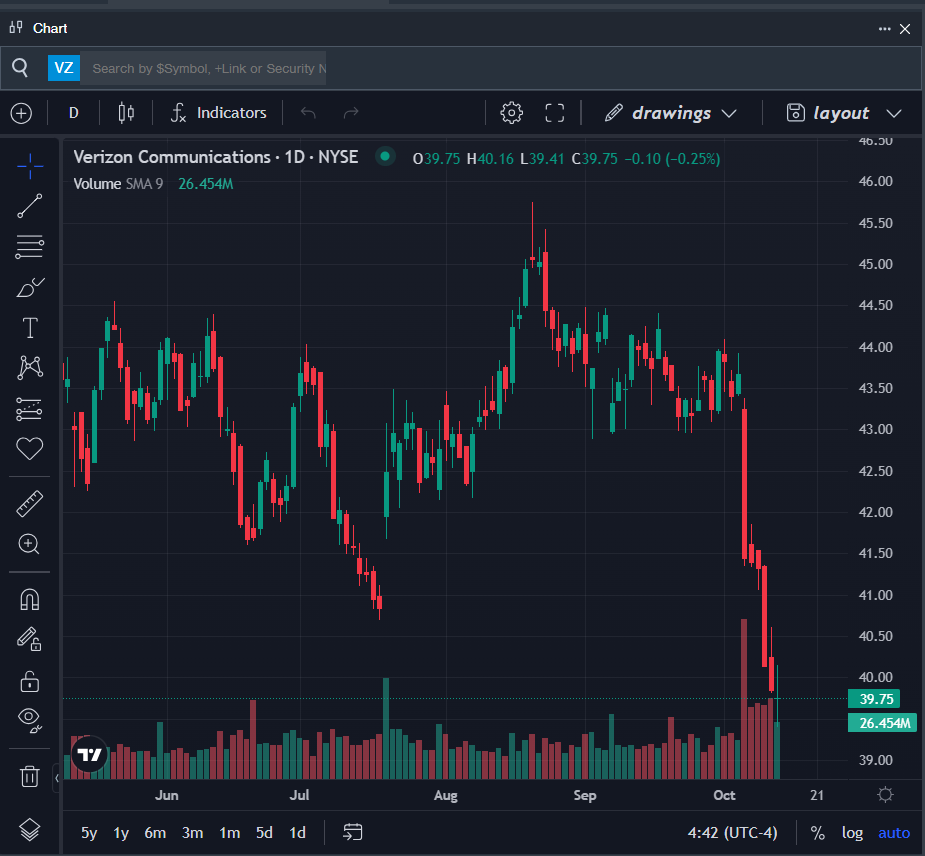

Verizon Communications Inc (NYSE:VZ)

- On Oct. 8, AST SpaceMobile, Inc. (NASDAQ:ASTS) disclosed a definitive commercial agreement with Verizon. Starting in 2026, the partnership will enable direct-to-cellular connectivity for Verizon customers, extending the carrier’s network coverage and enhancing its existing high-quality, nationwide service. The company's stock fell around 9% over the past month and has a 52-week low of $37.58.

- RSI Value: 23.9

- VZ Price Action: Shares of Verizon fell 0.3% to close at $39.75 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in VZ stock.

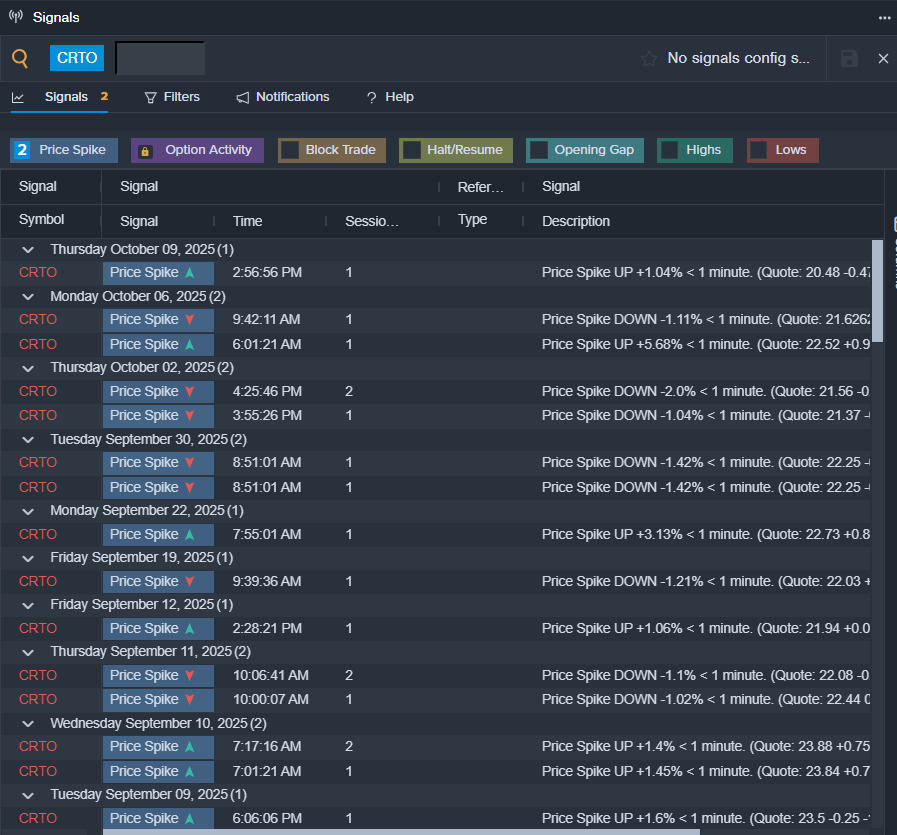

Criteo SA (NASDAQ:CRTO)

- On Oct. 6, Criteo and DoorDash, Inc. (NASDAQ:DASH) announced a new multi-year partnership on Monday to enhance advertising opportunities across DoorDash's marketplace with grocery, convenience, and other non-restaurant retail sectors. Stephen Howard-Sarin, Managing Director, Retail Media Americas at Criteo, said, "This is an exciting moment for Criteo, DoorDash, and the advertisers and retailers we serve. Delivery is the most important new path in the CPG consumer journey, and DoorDash has become a must-buy destination for convenience, grocery and alcohol brands". The company's stock fell around 10% over the past month and has a 52-week low of $19.57.

- RSI Value: 25.1

- CRTO Price Action: Shares of Criteo fell 1.4% to close at $19.65 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in CRTO shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock