The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Keurig Dr Pepper Inc (NASDAQ:KDP)

- On Aug. 25, Keurig Dr Pepper announced the acquisition of JDE Peet’s. The company's stock fell around 12% over the past month and has a 52-week low of $28.58.

- RSI Value: 28.7

- KDP Price Action: Shares of Keurig Dr Pepper gained 0.4% to trade at $29.22 on Thursday.

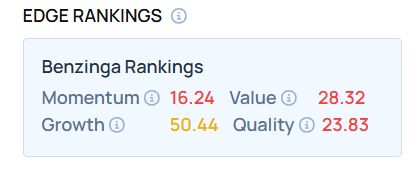

- Edge Stock Ratings: 16.24 Momentum score with Value at 28.32.

Constellation Brands Inc (NYSE:STZ)

- On Sept. 2, Constellation Brands cut its FY26 outlook, citing macroeconomic headwinds affecting consumer demand. "We continue to navigate a challenging macroeconomic environment that has dampened consumer demand and led to more volatile consumer purchasing behavior since our first quarter of fiscal 2026," said Constellation Brands President and CEO Bill Newlands. The company's stock fell around 14% over the past month and has a 52-week low of $144.81.

- RSI Value: 27

- STZ Price Action: Shares of Constellation fell 0.2% to trade at $146.12 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in STZ stock.

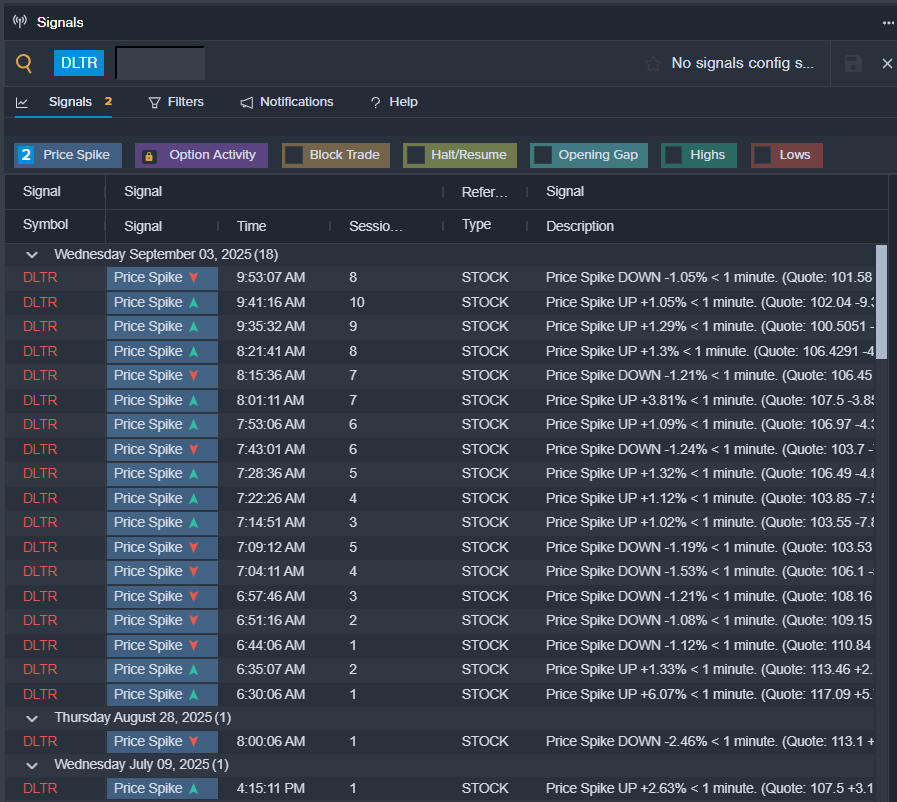

Dollar Tree Inc (NASDAQ:DLTR)

- On Sept. 3, Dollar Tree posted stronger-than-expected second-quarter sales and earnings. The discount retailer’s second-quarter sales increased 12.3% to $4.567 billion, beating the consensus of $4.484 billion. Same-store net sales increased 6.5%, driven by a 3% increase in traffic and a 3.4% increase in average ticket.. The company's stock fell around 14% over the past five days and has a 52-week low of $60.49.

- RSI Value: 26

- DLTR Ltd Price Action: Shares of Dollar Tree fell 3.1% to trade at $98.92 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in DLTR shares.

How do other stocks rank? Get the full BZ Edge Rankings breakdown here.

Read This Next:

Photo via Shutterstock