The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

CubeSmart (NYSE:CUBE)

- On July 31, CubeSmart posted better-than-expected quarterly results. “The rental season saw modestly better seasonal performance compared to last year as key operating metrics maintained their positive momentum throughout the second quarter and into July,” commented President and Chief Executive Officer Christopher P. Marr. The company's stock fell around 9% over the past month and has a 52-week low of $34.24.

- RSI Value: 23.9

- CUBE Price Action: Shares of CubeSmart fell 5.4% to close at $38.91 on Thursday.

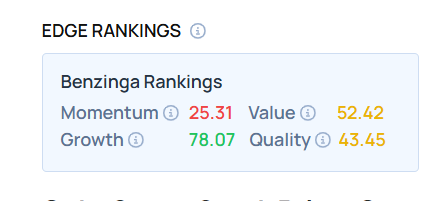

- Edge Stock Ratings: 25.31 Momentum score with Value at 52.42.

LXP Industrial Trust (NYSE:LXP)

- On July 30, LXP Industrial Trust posted second-quarter FFO of $0.16. T. Wilson Eglin, Chairman and Chief Executive Officer of LXP, commented, “We delivered another quarter of solid funds from operations and strong same-store NOI growth. We reached a significant milestone during the quarter with the lease of our 1.1 million square foot development facility in the Greenville/Spartanburg market, which increased occupancy and is expected to contribute approximately $3.7 million to FFO this year.” The company's stock fell around 7% over the past month and has a 52-week low of $6.85.

- RSI Value: 28.5

- LXP Price Action: Shares of LXP Industrial Trust fell 1.5% to close at $7.76 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in LXP stock.

EPR Properties (NYSE:EPR)

- On July 30, EPR Properties posted upbeat quarterly sales. “Our second quarter results demonstrate continued momentum in our business, with solid earnings growth while maintaining our disciplined approach to capital allocation,” stated Company Chairman and CEO Greg Silvers. The company's stock fell around 5% over the past five days and has a 52-week low of $41.75.

- RSI Value: 24.7

- EPR Ltd Price Action: Shares of EPR Properties fell 2.4% to close at $55.04 on Thursday.

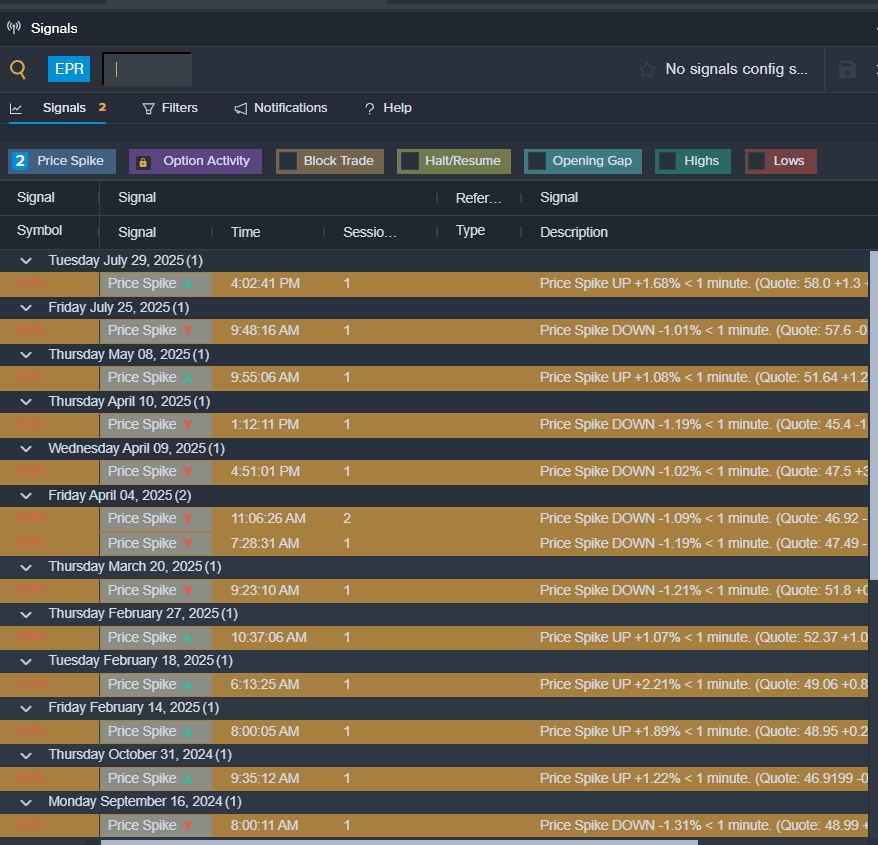

- Benzinga Pro’s signals feature notified of a potential breakout in EPR shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

- Wall Street’s Most Accurate Analysts Spotlight On 3 Financial Stocks Delivering High-Dividend Yields

Photo via Shutterstock