The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Hertz Global Holdings Inc (NASDAQ:HTZ)

- On Oct. 3, Hertz promoted Mike Moore to Chief Operating Officer. “As we continue transforming Hertz for the long term, Mike’s appointment reflects our commitment to disciplined execution and operational excellence,” said Gil West, CEO of Hertz. “Mike’s proven leadership in optimizing our fleet and delivering process rigor, combined with his deep knowledge of our business, make him the right leader to drive results and strengthen our foundation for sustained performance.” The company's stock fell around 19% over the past five days and has a 52-week low of $2.77.

- RSI Value: 28.7

- HTZ Price Action: Shares of Hertz Global fell 10.3% to close at $5.60 on Monday.

- Edge Stock Ratings: 82.78 Momentum score.

Alaska Air Group Inc (NYSE:ALK)

- On Oct. 3, Susquehanna analyst Christopher Stathoulopoulos maintained Alaska Air with a Positive and lowered the price target from $60 to $58. The company's stock fell around 24% over the past month and has a 52-week low of $39.79.

- RSI Value: 24.7

- ALK Price Action: Shares of Alaska Air fell 1.5% to close at $48.46 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in ALK stock.

Ambipar Emergency Response (NYSE:AMBI)

- On June 24, Ambipar Emergency Response reported FY24 net revenue of R$3.25 billion, up 25.4% year-over-year. The company's stock fell around 76% over the past month and has a 52-week low of $0.72.

- RSI Value: 20.9

- AMBI Price Action: Shares of Ambipar Emergency Response fell 4.4% to close at $1.08 on Monday.

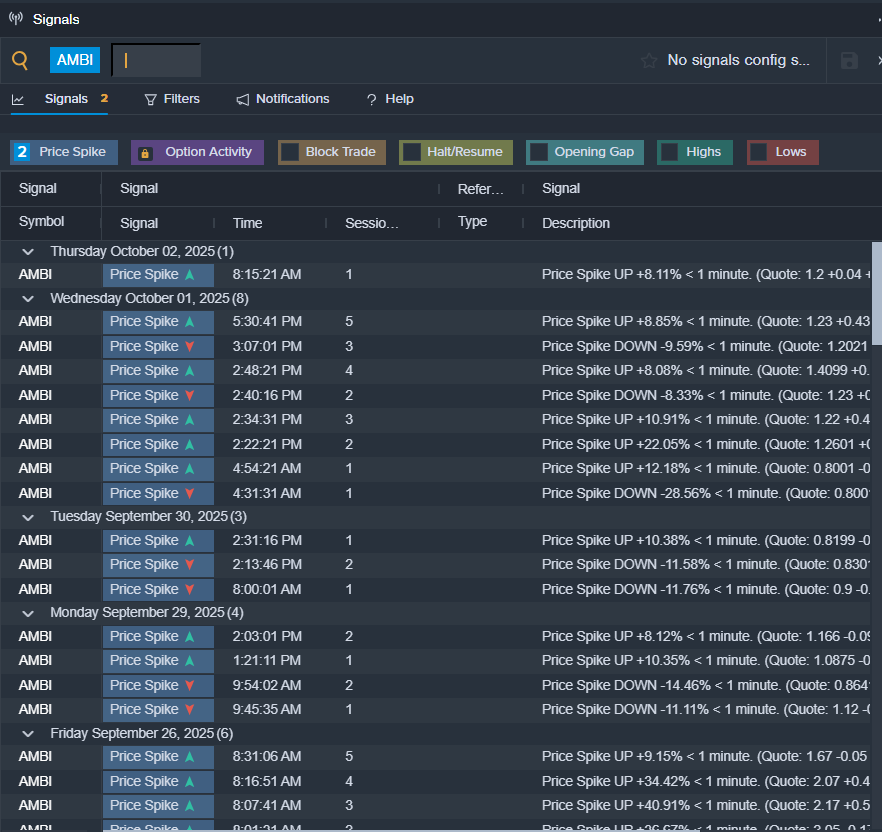

- Benzinga Pro’s signals feature notified of a potential breakout in AMBI shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock