The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Automatic Data Processing Inc (NASDAQ:ADP)

- On Oct. 29, the company reported quarterly revenues of $5.18 billion, beating the analyst consensus estimate of $5.14 billion. Revenues increased 7% year-over-year. ADP maintained its prior revenue growth outlook of 5%-6% or $21.6 billion-$21.8 billion, versus the analyst consensus estimate of $21.8 billion and adjusted diluted EPS growth of 8%-10%, or $10.81-$11.01, versus the analyst consensus estimate of $10.92. The company's stock fell around 11% over the past month and has a 52-week low of $255.16.

- RSI Value: 25.6

- ADP Price Action: Shares of ADP rose 0.8% to close at $259.22 on Tuesday.

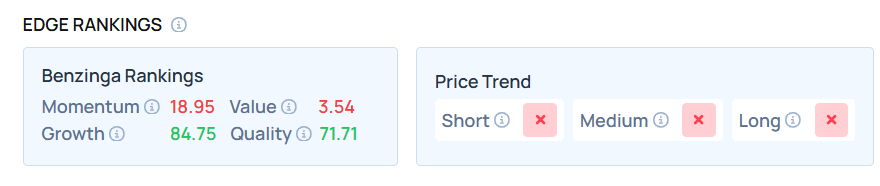

- Edge Stock Ratings: 18.95 Momentum score with Value at 3.54.

Alamo Group Inc (NYSE:ALG)

- Alamo Group will release financial results for the third quarter of 2025 after the closing bell on Thursday, Nov. 6. The company's stock fell around 7% over the past month and has a 52-week low of $157.07.

- RSI Value: 26.3

- ALG Price Action: Shares of Alamo Group fell 1.5% to close at $174.79 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in ALG stock.

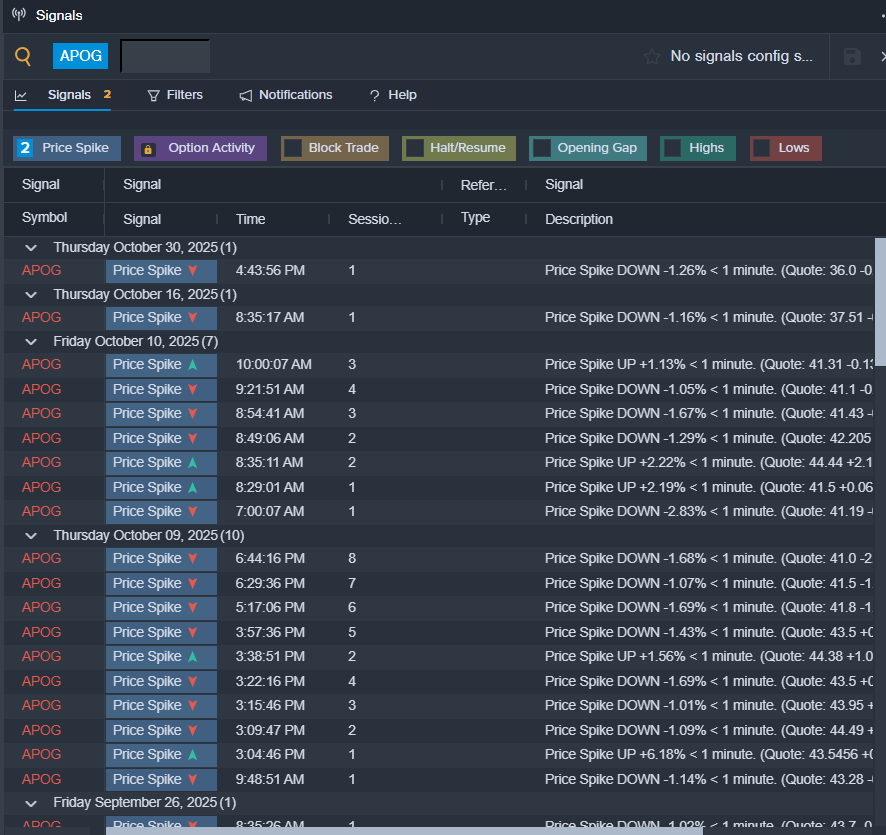

Apogee Enterprises Inc (NASDAQ:APOG)

- On Oct. 9, Apogee Enterprises reported better-than-expected second-quarter financial results. “We delivered solid second quarter results led by revenue growth in Performance Surfaces and Architectural Services,” said Ty R. Silberhorn, Apogee’s Chief Executive Officer. “Our team remained focused on executing our strategy and tariff mitigation plans in what continued to be a dynamic operating environment.” The company's stock fell around 33% over the past five days and has a 52-week low of $1.52.

- RSI Value: 26.7

- APOG Price Action: Shares of Apogee Enterprises fell 1.1% to close at $35.27 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in APOG shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock