The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Eve Holding Inc (NYSE:EVEX)

- On Aug. 14, Eve Holding announced it secured its $230 million registered direct offering. “Eve’s dual listing in the United States and Brazil is aligned with our continuous effort to diversify our investor base, bringing new stockholders from different locations,” said Eduardo Couto, Chief Financial Officer at Eve. The company's stock fell around 38% over the past month and has a 52-week low of $2.61.

- RSI Value: 29

- EVEX Price Action: Shares of Eve Holding fell 0.5% to close at $3.75 on Tuesday.

- Edge Stock Ratings: 65.95 Momentum score.

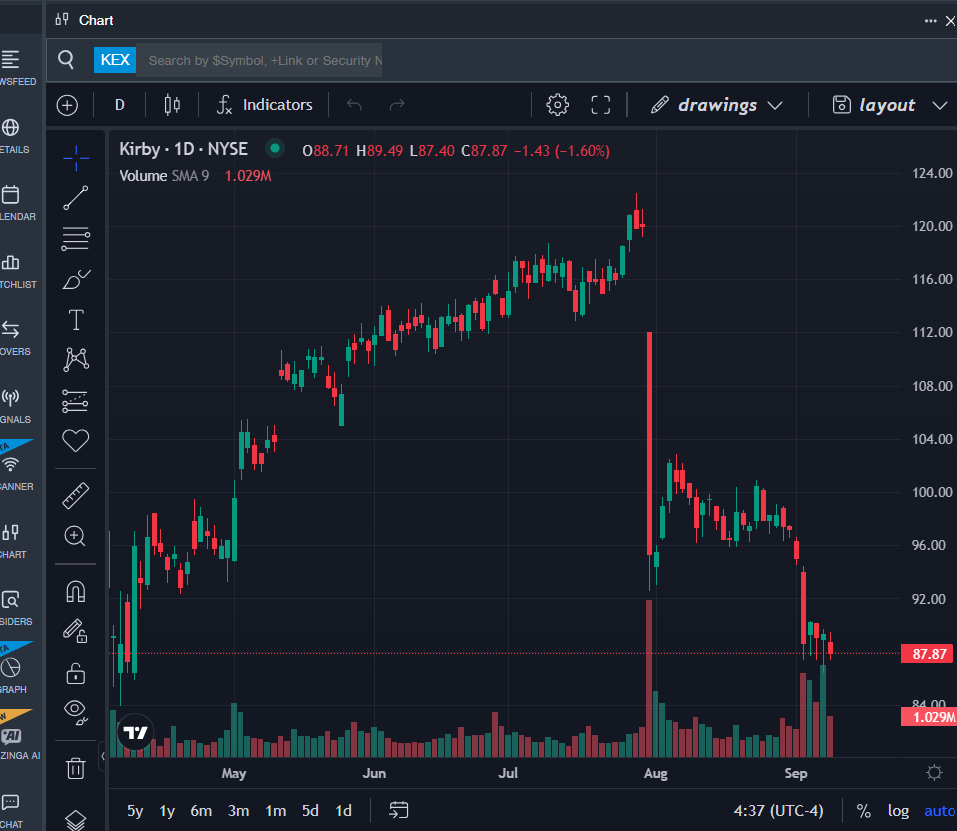

Kirby Corp (NYSE:KEX)

- On Sept. 8, Kirby expanded share repurchase authorization to 8.8 million shares. “The additional share repurchase authorization reflects confidence in the ultimate earnings power of our company and our ability to consistently generate strong free cash flow,” said Chief Executive Officer David Grzebinski. “We remain committed to our long-term capital allocation strategy that includes returning free cash flow to shareholders over time.” The company's stock fell around 10% over the past month and has a 52-week low of $83.94.

- RSI Value: 28

- KEX Price Action: Shares of Kirby fell 1.6% to close at $87.87 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in KEX stock.

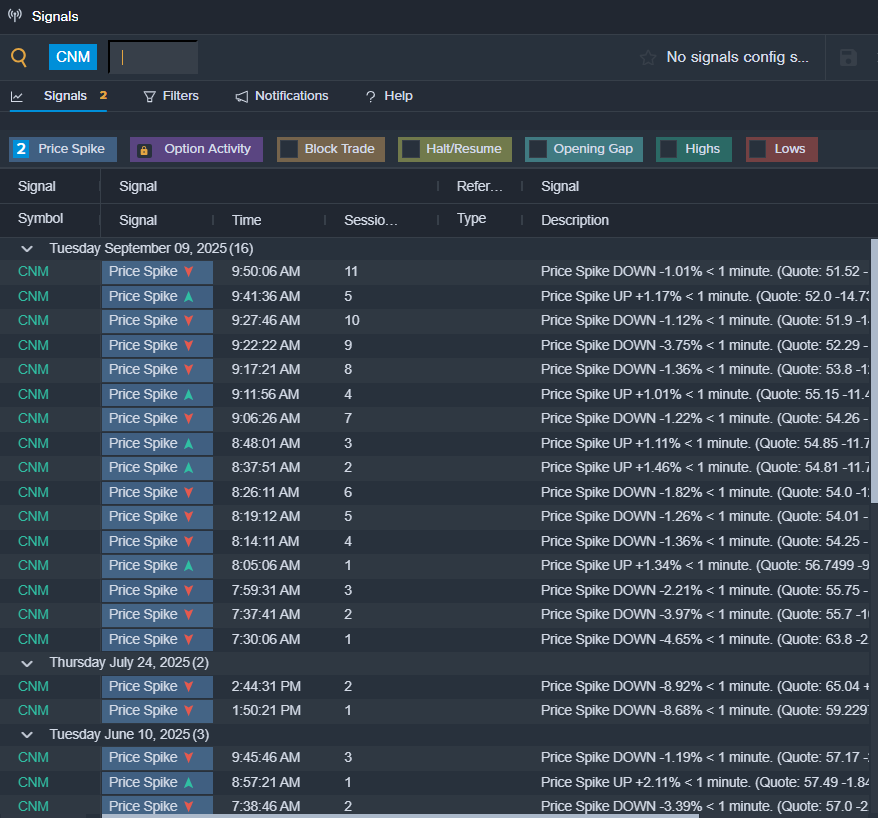

Core & Main Inc (NYSE:CNM)

- On Sept. 9, Core & Main reported mixed second-quarter financial results and narrowed its FY25 sales guidance below estimates. “I am proud of our associates’ dedication to supporting customers in delivering critical infrastructure projects,” said Mark Witkowski, CEO of Core & Main. The company's stock fell around 23% over the past five days and has a 52-week low of $37.22.

- RSI Value: 12.3

- CNM Ltd Price Action: Shares of Core & Main dipped 25.4% to close at $49.70 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in CNM shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock