The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Inotiv Inc (NASDAQ:NOTV)

- On Nov. 17, Inotiv reported preliminary fourth-quarter and FY25 revenue results. Robert Leasure Jr., President and Chief Executive Officer, commented, “During the fourth quarter of fiscal 2025, we continued to execute on the financial goals we discussed during our investor day in May. We have continued to see strong contract awards in our Discovery and Safety Assessment services business, which grew sequentially in the fourth quarter and were up 60% over the same period last year. We anticipate that consolidated revenue for the fourth quarter will be in a range of $137.5 million to $138.5 million, in line with our expectations and an improvement over the prior year period.” The company's stock fell around 38% over the past five days and has a 52-week low of $0.66.

- RSI Value: 26.7

- NOTV Price Action: Shares of Inotiv fell 33.2% to close at $0.69 on Monday.

- Edge Stock Ratings: 2.53 Momentum score.

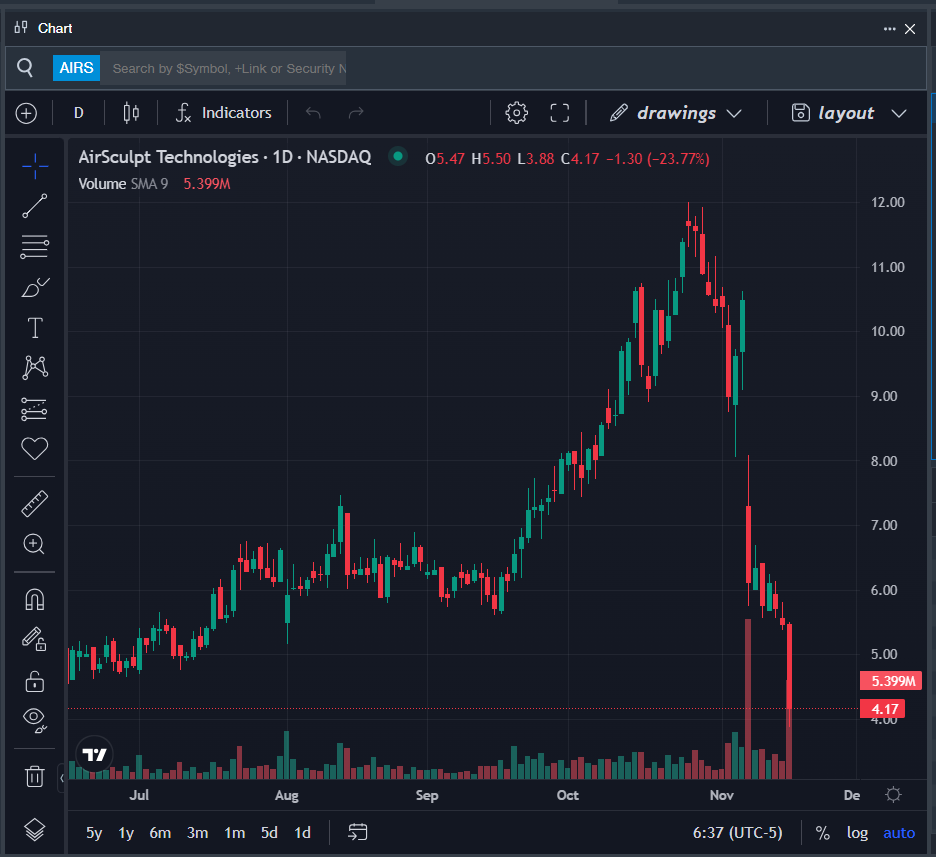

Airsculpt Technologies Inc (NASDAQ:AIRS)

- On Nov. 7, AirSculpt Technologies reported worse-than-expected third-quarter financial results and lowered FY25 revenue outlook. Yogi Jashnani, Chief Executive Officer, said, “During the quarter, we made strong progress on our key initiatives that focused on new growth opportunities, margin improvement, and debt reduction. While third quarter revenue was lower than anticipated, this is reflective of timing, instead of the trajectory of our business.” The company's stock fell around 60% over the past month and has a 52-week low of $1.53.

- RSI Value: 29.3

- AIRS Price Action: Shares of Airsculpt Technologies fell 23.8% to close at $4.17 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in AIRS stock.

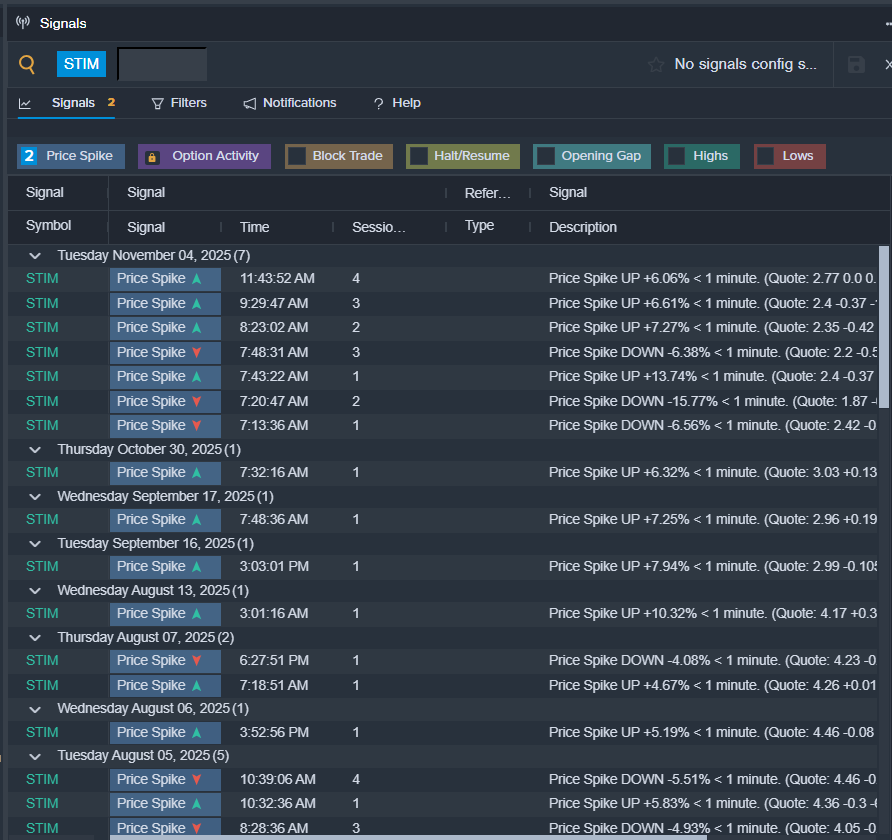

Neuronetics Inc (NASDAQ:STIM)

- On Nov. 4, Neuronetics cut its FY2025 sales guidance below expectations. “Our third quarter results reflect continued progress as we integrate and optimize our combined operations,” said Keith Sullivan, President and Chief Executive Officer of Neuronetics. The company's stock fell around 40% over the past month and has a 52-week low of $0.67.

- RSI Value: 23.9

- STIM Price Action: Shares of Neuronetics fell 17.1% to close at $1.65 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in STIM shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock