The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Rxsight Inc (NASDAQ:RXST)

- On July 8, RxSight cut its 2025 revenue guidance from $160 million–$175 million to $120 million–$130 million. “Guided by insights from our second quarter underperformance and building on our long-term vision, we are evolving our commercial approach to re-direct more of our focus toward supporting customer success within new and existing practices,” said Dr. Ron Kurtz, Chief Executive Officer and President of RxSight. The company's stock fell around 39% over the past five days and has a 52-week low of $6.32.

- RSI Value: 20.9

- RXST Price Action: Shares of Rxsight fell 5.4% to close at $8.00 on Friday.

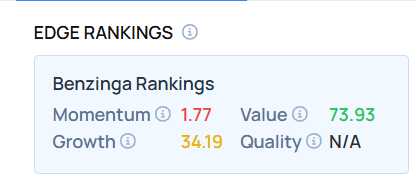

- Edge Stock Ratings: 1.77 Momentum score with Value at 73.93.

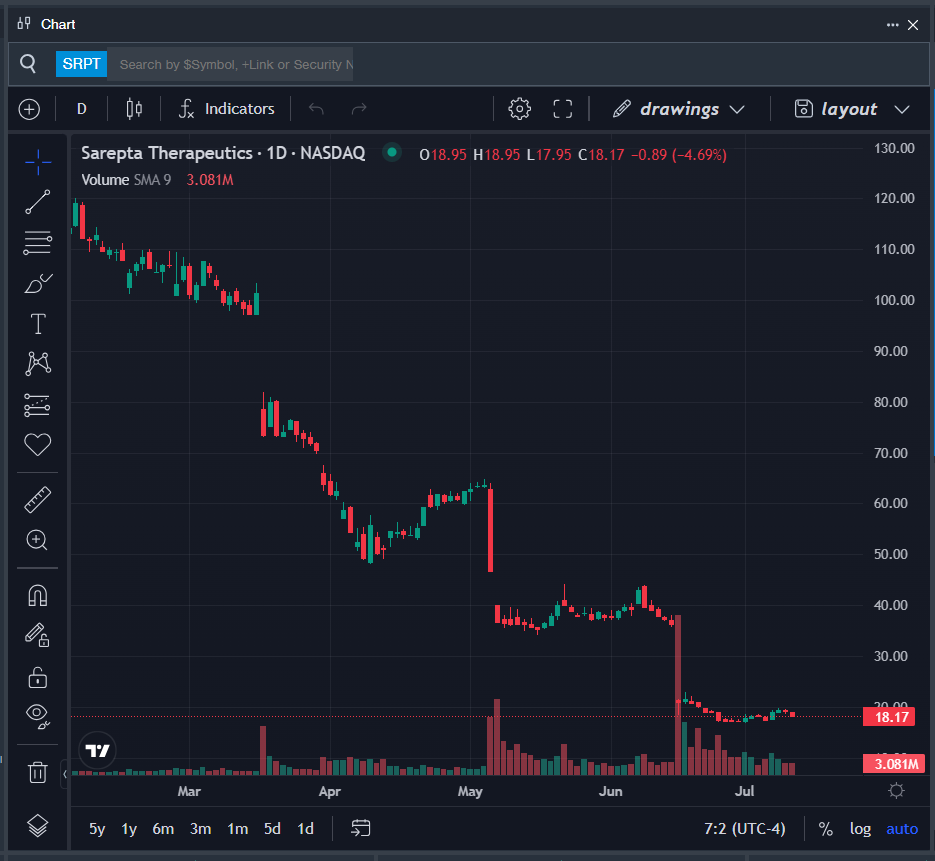

Sarepta Therapeutics Inc (NASDAQ:SRPT)

- On June 25, HC Wainwright & Co. downgraded the stock from Neutral to Sell and cut its price target on the stock from $40 to $10. The company's stock fell around 13% over the past month and has a 52-week low of $16.88.

- RSI Value: 27

- SRPT Price Action: Shares of Sarepta Therapeutics fell 4.7% to close at $18.17 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in SRPT stock.

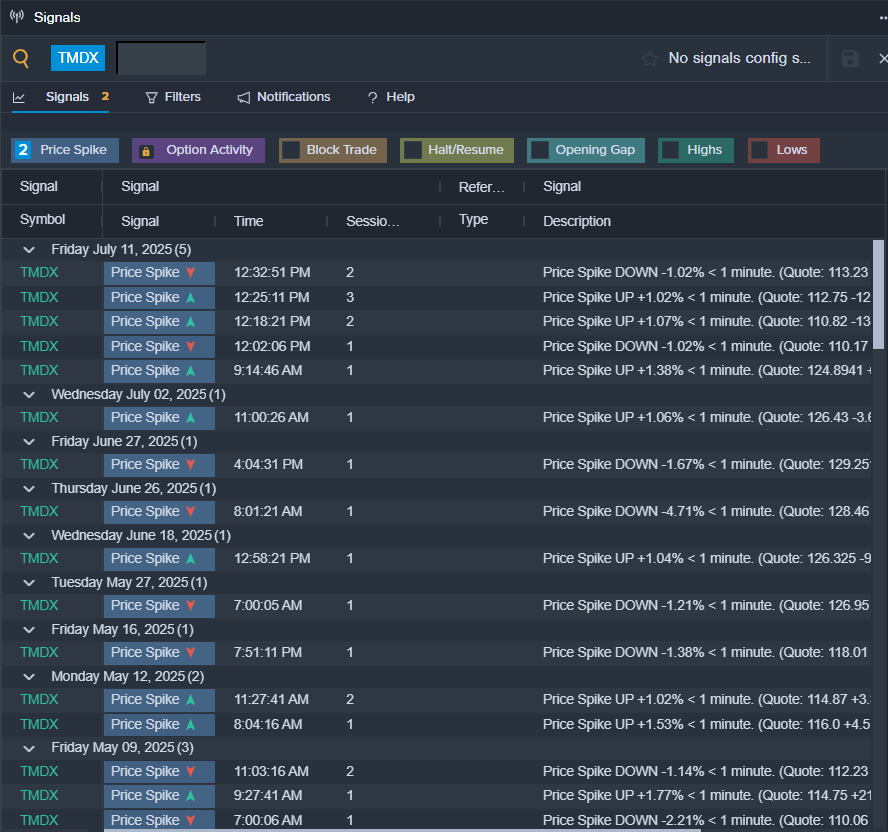

TransMedics Group Inc (NASDAQ:TMDX)

- On May 8, TransMedics Group reported better-than-expected first-quarter financial results and raised its FY25 sales guidance above estimates. “Overall, we are very pleased with our first quarter performance, which we believe underscores the unique attributes of our business and the ability to deliver strong top and bottom-line financial results,” said Waleed Hassanein, MD, President and Chief Executive Officer. The company's stock fell around 21% over the past month and has a 52-week low of $55.00.

- RSI Value: 27.1

- TMDX Ltd Price Action: Shares of TransMedics fell 9.9% to close at $112.46 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in TMDX shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock