As of Sept. 17, 2025, three stocks in the financial sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

PagSeguro Digital Ltd (NYSE:PAGS)

- On Aug. 14, PagBank reported net revenue of R$5.1 billion and recurring net income of R$565 million in the second quarter. “The 2Q25 results emphasize that we are on the right path: we have grown profitably and continue to deliver value to our shareholders, even in a challenging economic environment. We estimate an 18% return to our shareholders, considering the dividends and share repurchase programs announced,” said Artur Schunck, CFO of PagBank. The company's stock gained around 19% over the past month and has a 52-week high of $10.78.

- RSI Value: 82.4

- PAGS Price Action: Shares of PagSeguro Digital gained 10.7% to close at $10.74 on Tuesday.

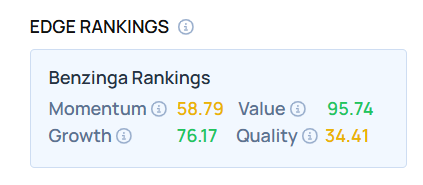

- Edge Stock Ratings: 58.79 Momentum score with Value at 95.74.

Galaxy Digital Inc (NASDAQ:GLXY)

- On Sept. 16, UBS analyst Thiago Batista maintained Credicorp with a Buy and raised the price target from $257 to $318. The company's stock gained around 7% over the past month and has a 52-week high of $33.17.

- RSI Value: 71.7

- GLXY Price Action: Shares of Galaxy Digital gained 3.4% to close at $31.83 on Tuesday.

Credicorp Ltd (NYSE:BAP)

- On Aug. 13, Equinox Gold reported better-than-expected second-quarter financial results. Darren Hall, CEO of Equinox Gold, said, “Equinox Gold is entering a pivotal growth phase. Q2 delivered solid results, led by Greenstone, where mining rates increased 23% and processing rates improved 20% over Q1. Building on that momentum, Q3 is off to a strong start, with quarter-to-date ex-pit mining volumes 10% higher than Q2 and process plant throughput averaging 24.5 kptd over the last 30 days, including more than one-third of the days above nameplate capacity of 27 ktpd.” The company's stock gained around 7% over the past month and has a 52-week high of $271.99.

- RSI Value: 82.4

- BAP Price Action: Shares of Credicorp gained 1.9% to close at $270.79 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock