As of July 2, 2025, three stocks in the energy sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Dmc Global Inc (NASDAQ:BOOM)

- On June 26, DMC Global named Jay Doubman to Board of Directors. “We are pleased to welcome Jay to DMC’s board of directors,” said James O’Leary, executive chairman, president and CEO of DMC Global. “Jay’s extensive operational expertise, strategic insight, and proven ability to lead complex, global businesses make him a valuable addition to our board. His experience in building and industrial products aligns well with DMC’s diversified industrial portfolio and growth objectives.” The company's stock jumped around 29% over the past month and has a 52-week high of $15.14.

- RSI Value: 70.1

- BOOM Price Action: Shares of Dmc Global gained 6.2% to close at $8.56 on Tuesday.

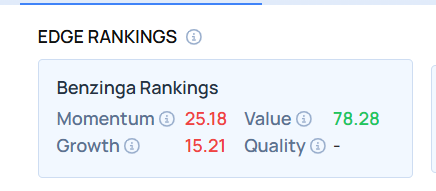

- Edge Stock Ratings: 25.18 Momentum score with Value at 78.28.

Par Pacific Holdings Inc (NYSE:PARR)

- On June 30, Raymond James analyst Justin Jenkins maintained Par Pacific with an Outperform rating and raised the price target from $25 to $30. The company's stock gained around 28% over the past month and has a 52-week high of $28.72.

- RSI Value: 79.4

- PARR Price Action: Shares of Par Pacific gained 6.2% to close at $28.16 on Tuesday.

CVR Energy, Inc. (NYSE:CVI)

- On April 28, CVR Energy posted better-than-expected quarterly results. “CVR Energy’s 2025 first quarter earnings results for its refining business were impacted by planned and unplanned downtime at the Coffeyville refinery,” said Dave Lamp, CVR Energy’s Chief Executive Officer. “With the turnaround at Coffeyville now completed, we are well-positioned for the upcoming driving season, and we currently have no planned turnarounds at either refinery until 2027.” The company's stock gained around 20% over the past month and has a 52-week high of $29.84.

- RSI Value: 71

- CVI Price Action: Shares of CVR Energy gained 3.8% to close at $27.87 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock