The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Gentex Corp (NASDAQ:GNTX)

- On Oct. 24, Gentex reported third-quarter EPS and sales below expectations. "Looking at our regional performance for the third quarter, North American OEM revenue increased approximately 5% quarter-over-quarter, supported by robust production schedules and increased content per vehicle," said Steve Downing, president and CEO of Gentex. The company's stock fell around 16% over the past month and has a 52-week low of $20.28.

- RSI Value: 29.8

- GNTX Price Action: Shares of Gentex rose 0.3% to close at $23.72 on Monday.

- Edge Stock Ratings: 19.72 Momentum score with Value at 72.08.

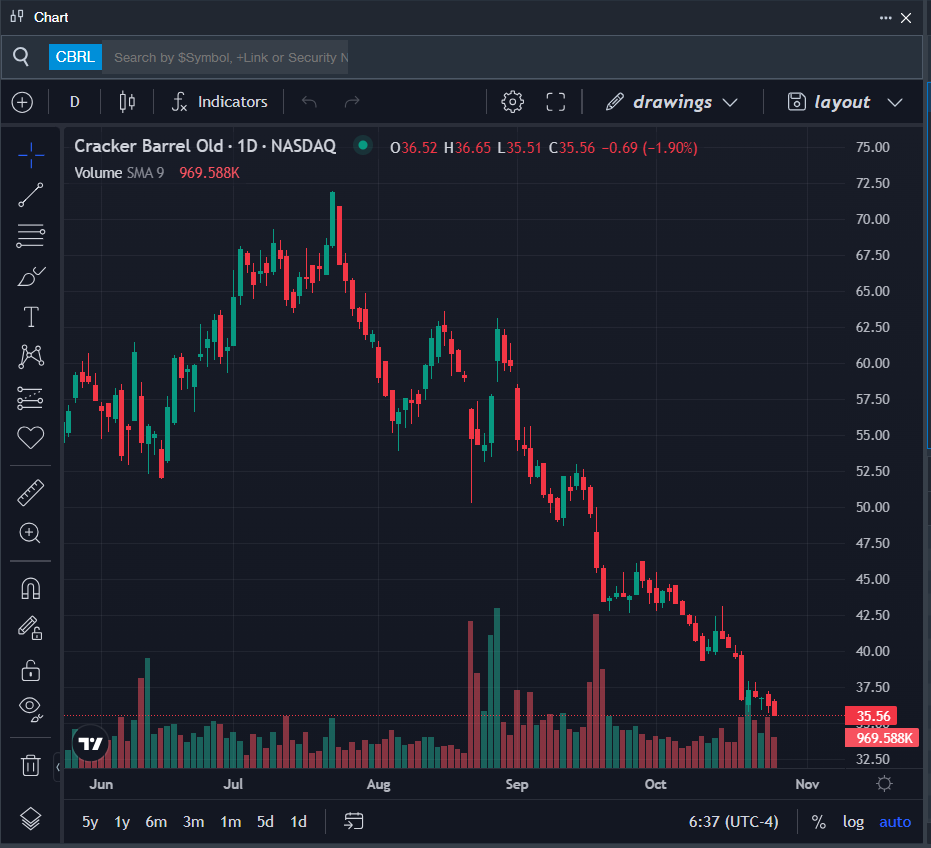

Cracker Barrel Old Country Store Inc (NASDAQ:CBRL)

- On Oct. 17, Wells Fargo analyst Anthony Trainor initiated coverage on Cracker Barrel Old with an Equal-Weight rating and announced a price target of $42. The company's stock fell around 21% over the past month and has a 52-week low of $33.86.

- RSI Value: 23.7

- CBRL Price Action: Shares of Cracker Barrel fell 1.9% to close at $35.56 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in CBRL stock.

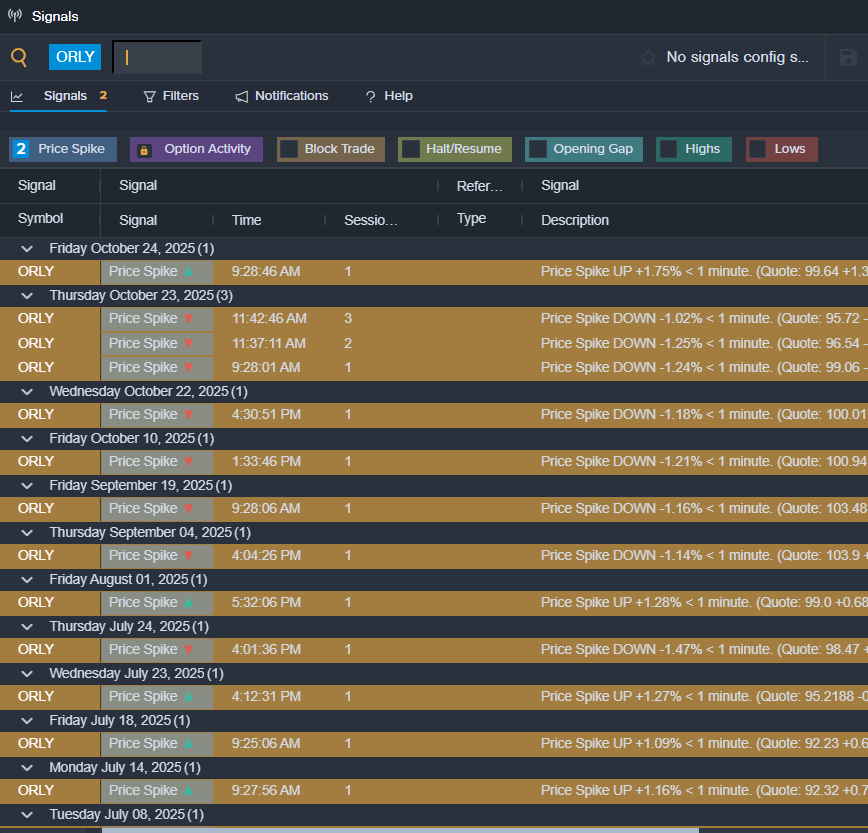

O’Reilly Automotive Inc (NASDAQ:ORLY)

- On Oct. 22, O’Reilly Automotive posted upbeat quarterly earnings. Brad Beckham, O’Reilly’s CEO, said, “We are pleased to report another quarter of solid performance and profitable growth, highlighted by a 5.6% increase in comparable store sales and a 12% increase in diluted earnings per share for the third quarter. Our Team continues to execute our proven business model at a very high level, generating robust sales growth by delivering share gains on both sides of our business. Team O’Reilly’s commitment to providing unparalleled service to our customers drove our strong results, and I would like to thank each of our over 93,000 Team Members for their unrelenting hard work and dedication.” The company's stock fell around 11% over the past month and has a 52-week low of $76.22.

- RSI Value: 25.3

- ORLY Price Action: Shares of O’Reilly Automotive fell 1.5% to close at $95.79 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in ORLY shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock