The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Bath & Body Works Inc (NYSE:BBWI)

- On Nov. 20, Bath & Body Works reported worse-than-expected third-quarter financial results and issued FY25 EPS guidance below estimates. "Our third quarter results were below expectations, and we are lowering our outlook for the remainder of the year reflecting current business trends and continuation of recent macro consumer pressures," said Daniel Heaf, chief executive officer of Bath & Body Works. The company's stock fell around 35% over the past month and has a 52-week low of $14.28.

- RSI Value: 29.3

- BBWI Price Action: Shares of Bath & Body Works rose 8.6% to close at $16.90 on Tuesday.

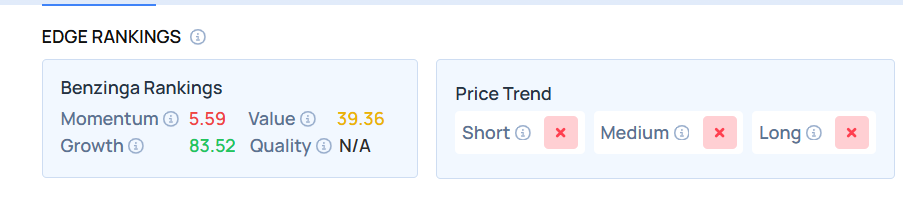

- Edge Stock Ratings: 5.59 Momentum score with Value at 39.36.

Lotus Technology Inc – ADR (NASDAQ:LOT)

- On Nov. 24, Lotus Technology posted a third-quarter loss of 10 cents per share, versus a year-ago loss of 30 cents per share. Dr. Daxue Wang, Chief Financial Officer, said, “Our efforts in cost discipline and inventory optimization are reflected in the significantly narrowed loss for both the quarter and year-to-date. We remain focused on prudent resource allocation and margin enhancement, while also preparing for a more dynamic operating environment in the quarters ahead.” The company's stock fell around 31% over the past month and has a 52-week low of $1.06.

- RSI Value: 29.5

- LOT Price Action: Shares of Lotus Technology rose 3.2% to close at $1.29 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in LOT stock.

H & R Block Inc (NYSE:HRB)

- On Nov. 6, H&R Block reported better-than-expected first-quarter financial results. “Fiscal 2026 is off to a strong start, not only in the financial results we are reporting but also in the plans we are preparing to execute in the coming quarters,” said Jeff Jones, president and chief executive officer. The company's stock fell around 20% over the past month and has a 52-week low of $41.38.

- RSI Value: 26.9

- HRB Price Action: Shares of H & R Block rose 1.3% to close at $41.94 on Tuesday.

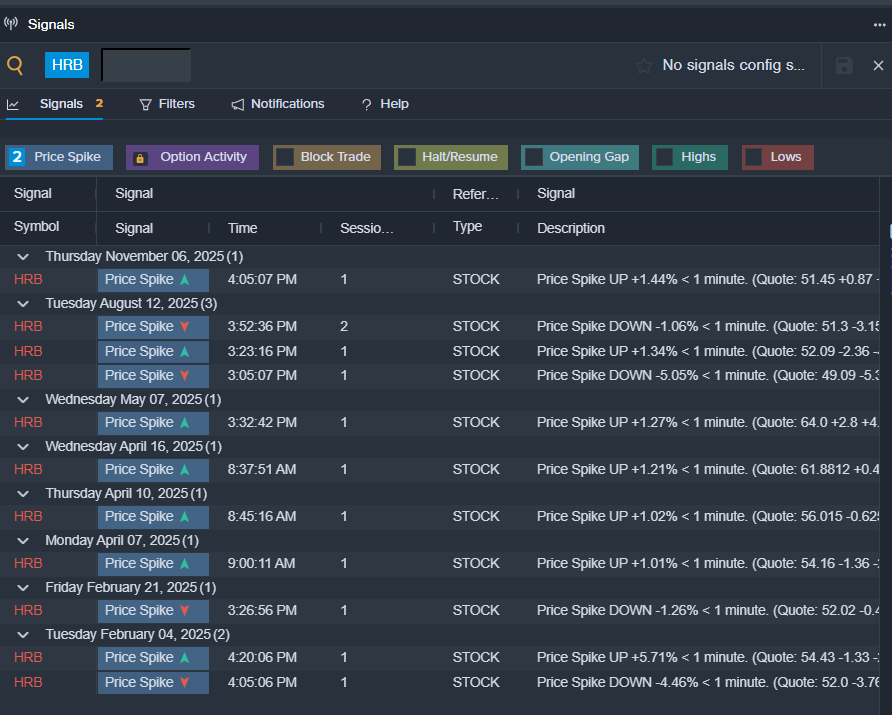

- Benzinga Pro’s signals feature notified of a potential breakout in HRB shares.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock