The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Portillos Inc (NASDAQ:PTLO)

- On Sept. 10, Portillo lowered its same-store sales and unit growth guidance. The company's stock fell around 20% over the past month and has a 52-week low of $6.00.

- RSI Value: 23.5

- PTLO Price Action: Shares of Portillos fell 0.2% to close at $6.13 on Friday.

- Edge Stock Ratings: 91.92 Momentum score with Value at 93.51.

America’s CAR-MART Inc (NASDAQ:CRMT)

- On Sept. 4, the company reported a first-quarter loss of 69 cents per share, compared with a net loss of 15 cents per share in the year-ago period. Quarterly sales of $341.312 million (down 1.9% year over year) missed the Street view of $359.208 million, driven by fewer retail units sold. “From a consumer demand standpoint, application volume was up over 10%. We deployed and implemented LOS V2 in the beginning of the quarter, which has a more advanced underwriting scorecard, and the enablement of risk-based pricing embedded within the tool,” said President and CEO Doug Campbell. The company's stock fell around 23% over the past month and has a 52-week low of $33.50.

- RSI Value: 27.5

- CRMT Price Action: Shares of America’s CAR-MART fell 2.3% to close at $34.55 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in CRMT stock.

Cheesecake Factory Inc (NASDAQ:CAKE)

- On Aug. 15, Raymond James analyst Brian Vaccaro maintained Cheesecake Factory with an Outperform rating and raised the price target from $70 to $73.. The company's stock fell around 10% over the past month and has a 52-week low of $36.78.

- RSI Value: 23.1

- CAKE Ltd Price Action: Shares of Cheesecake Factory fell 2.9% to close at $56.53 on Friday.

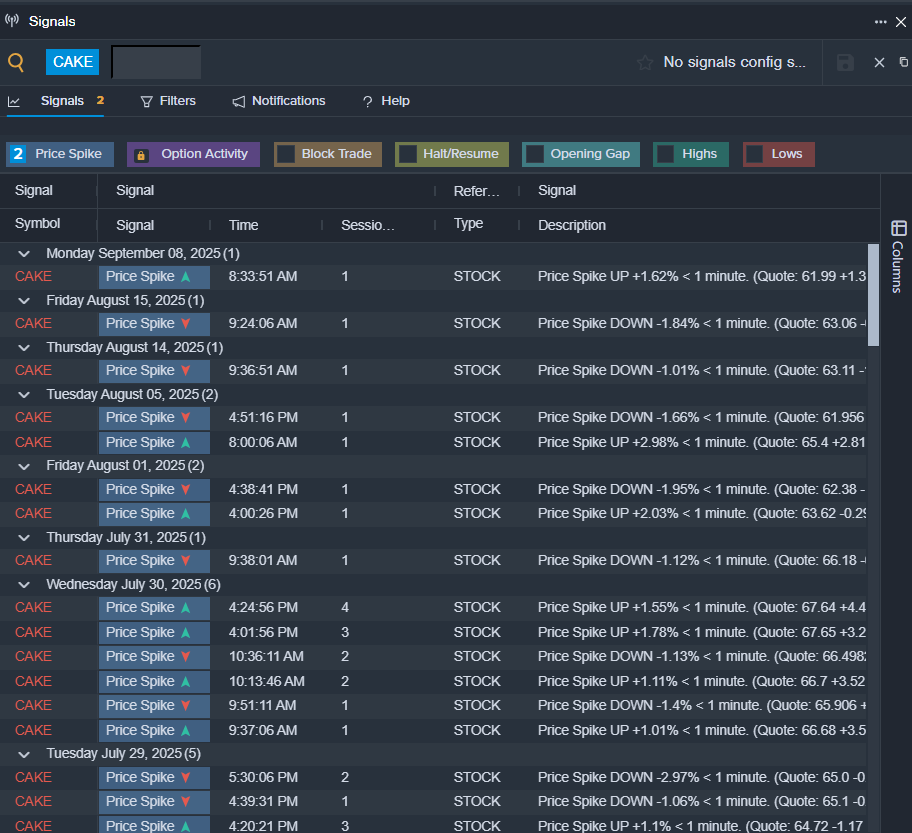

- Benzinga Pro’s signals feature notified of a potential breakout in CAKE shares.

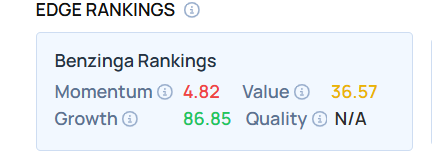

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock