The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Lucid Group Inc (NASDAQ:LCID)

- On Sept. 2, Morgan Stanley analyst Adam Jonas maintained Lucid Group with an Equal-Weight rating and raised the price target from $3 to $30. The company's stock fell around 27% over the past month and has a 52-week low of $17.36.

- RSI Value: 22.8

- LCID Price Action: Shares of Lucid Group dipped 10.8% to close at $17.66 on Tuesday.

- Edge Stock Ratings: 10.50 Momentum score with Value at 16.88.

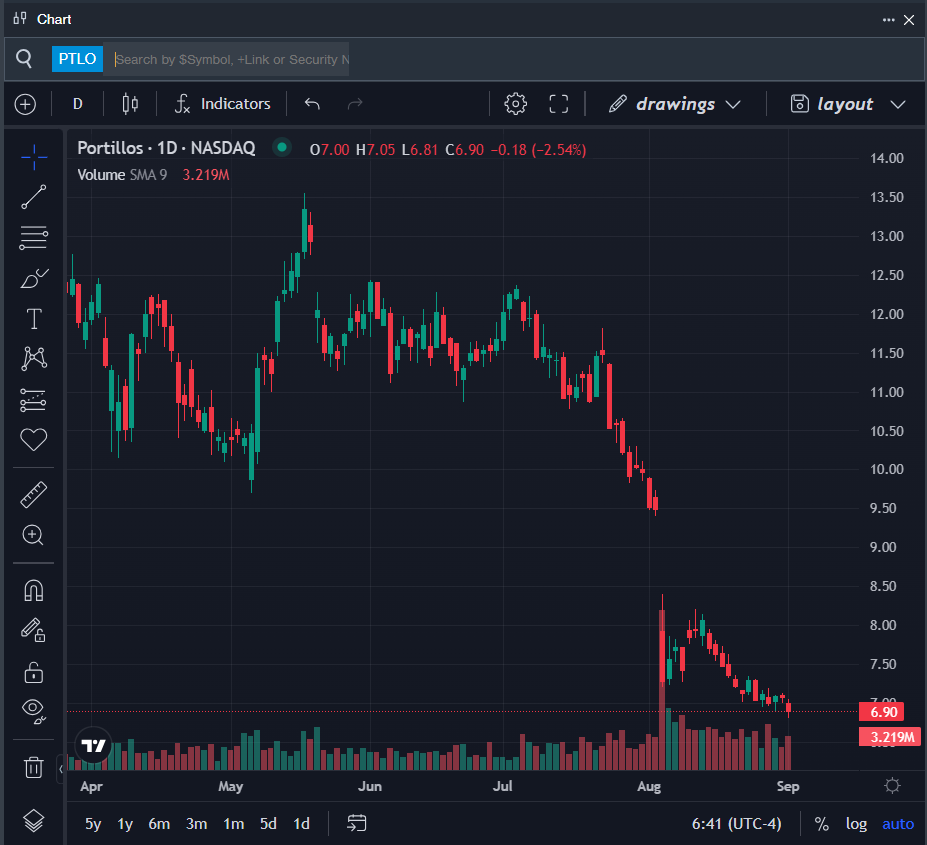

Portillos Inc (NASDAQ:PTLO)

- On Aug. 5, Portillo’s reported a second-quarter sales miss and cut its FY25 sales guidance below estimates. “Our team operated well through a tough traffic environment in the second quarter, managing restaurant-level margins effectively and driving solid earnings,” said Michael Osanloo, President and Chief Executive Officer of Portillo’s. “We’re testing and learning, refining our new market playbook, and focused on continuous improvement to drive consistent sales, expand our restaurant footprint and deliver top-tier shareholder returns.” The company's stock fell around 27% over the past month and has a 52-week low of $6.81.

- RSI Value: 26.1

- PTLO Price Action: Shares of Portillos fell 2.5% to close at $6.90 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in PTLO stock.

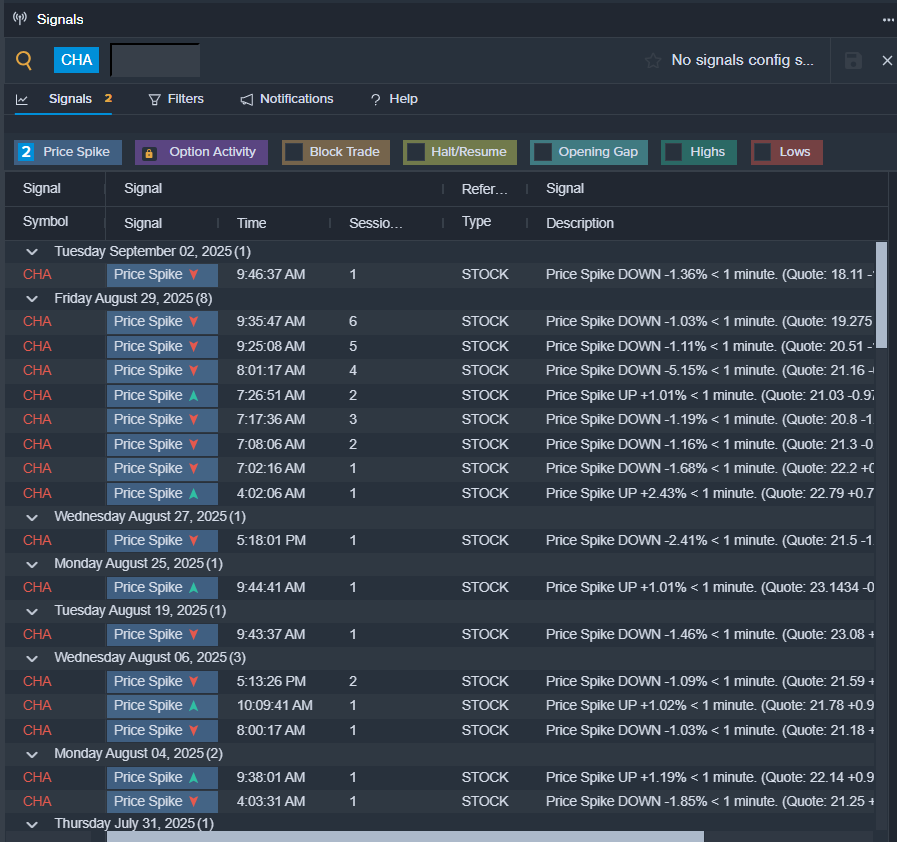

Chagee Holdings Ltd (NASDAQ:CHA)

- On Aug. 29, Chagee Holdings reported a second-quarter sales miss. The company's stock fell around 18% over the past month and has a 52-week low of $17.57.

- RSI Value: 25.6

- CHA Ltd Price Action: Shares of Chagee Holdings fell 3.2% to close at $18.50 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in CHA shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock