As of Aug. 12, 2025, two stocks in the utilities sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

PG&E Corp (NYSE:PCG)

- On July 31, PG&E posted downbeat quarterly earnings. “PG&E’s story of progress continues to unfold with another solid quarter of performance. We’re delivering energy safely to our customers every day. We’ve stabilized bills over the past year and expect them to be down in 2026,” said PG&E Corporation CEO Patti Poppe. The company's stock jumped around 16% over the past month and has a 52-week high of $21.72.

- RSI Value: 73

- PCG Price Action: Shares of PG&E gained 2.4% to trade at $15.48 on Tuesday.

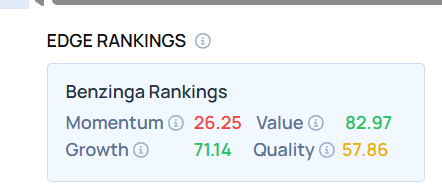

- Edge Stock Ratings: 26.25 Momentum score with Value at 82.97.

Atmos Energy Corp (NYSE:ATO)

- On Aug. 6, Atmos Energy reported better-than-expected Q3 financial results and raised its FY25 EPS guidance above estimates. “Our third quarter results reflect the hard work and dedication of all of our employees who provide exceptional customer service while safely and reliably operating our natural gas distribution, transmission, and storage systems,” said Kevin Akers, president and chief executive officer of Atmos Energy Corporation. “Their continued focus on our vision to be the safest provider of natural gas services, while pursuing our proven strategy continues to benefit our customers and the communities we are proud to serve.” The company's stock gained around 6% over the past five days and has a 52-week high of $167.45.

- RSI Value: 70.8

- ATO Price Action: Shares of Atmos Energy gained 0.4% to trade at $165.64 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock