As of Oct. 9, 2025, two stocks in the utilities could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

ONE Gas Inc (NYSE:OGS)

- On Sept. 26, Mizuho analyst Gabriel Moreen upgraded ONE Gas from Neutral to Outperform and raised the price target from $77 to $86. The company's stock gained around 8% over the past month and has a 52-week high of $82.25.

- RSI Value: 70.9

- OGS Price Action: Shares of ONE Gas gained 0.8% to close at $81.00 on Wednesday.

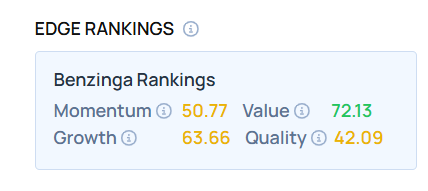

- Edge Stock Ratings: 50.77 Momentum score with Value at 72.13.

NextEra Energy Inc (NYSE:NEE)

- On Oct. 7, Evercore ISI Group analyst Nicholas Amicucci initiated coverage on NextEra Energy with an Outperform rating and announced a price target of $92. The company's stock gained around 20% over the past month and has a 52-week high of $86.00.

- RSI Value: 82.3

- NEE Price Action: Shares of NextEra Energy rose 1% to close at $84.04 on Wednesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock