As of Nov. 12, 2025, two stocks in the consumer staples sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Coca-Cola Consolidated Inc (NASDAQ:COKE)

- On Oct. 29, Coca-Cola Consolidated company reported a year-over-year increase in third-quarter financial results. “Our third quarter results reflect the ongoing dedication and resilience of our 17,000 teammates,” said J. Frank Harrison, III, Chairman and Chief Executive Officer. “We are beginning to see early returns on the teammate investment we announced last quarter, as our continued momentum in sales execution has led to solid market share growth across our portfolio. Our strong financial performance has allowed us to execute on our commitment to return capital to stockholders with over $211 million distributed through share repurchases and dividends during 2025.” The company's stock gained around 22% over the past month and has a 52-week high of $154.44.

- RSI Value: 88.5

- COKE Price Action: Shares of Coca-Cola Consolidated gained 4.7% to close at $152.28 on Tuesday.

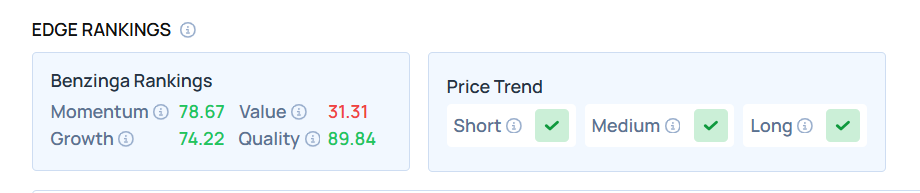

- Edge Stock Ratings: 78.67 Momentum score with Value at 31.31.

Nature’s Sunshine Products (NASDAQ:NATR)

- On Nov. 6, Nature’s Sunshine Products reported better-than-expected third-quarter financial results and raised its FY25 sales guidance above estimates. “The momentum in our business continued to accelerate in the third quarter, with record net sales of $128 million and adjusted EBITDA of $15 million, representing year-over-year growth of 12% and 42%, respectively,” said Shane Jones, CFO of Nature’s Sunshine. The company's stock gained around 45% over the past five days and has a 52-week high of $20.32.

- RSI Value: 81.1

- NATR Price Action: Shares of Nature’s Sunshine rose 1.1% to close at $20.00 on Tuesday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Photo via Shutterstock