As of Sept. 24, 2025, two stocks in the real estate sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Anywhere Real Estate Inc (NYSE:HOUS)

- On Sept. 22, Compass and Anywhere Real Estate announced a $10 billion all-stock merger, including debt. "We are excited to unite our renowned brands, international footprint, and leading businesses to build a better real estate experience in concert with Compass," said Anywhere CEO & President Ryan Schneider. The company's stock gained around 72% over the past month and has a 52-week high of $12.03.

- RSI Value: 84.1

- HOUS Price Action: Shares of Anywhere Real Estate gained 1.7% to close at $10.46 on Tuesday.

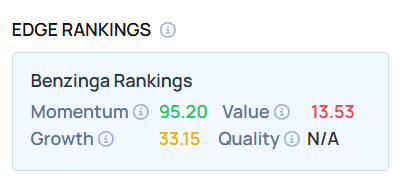

- Edge Stock Ratings: 95.20 Momentum score with Value at 13.53.

Diversified Healthcare Trust (NASDAQ:DHC)

- On Sept. 17, B. Riley Securities analyst Bryan Maher maintaied Diversified Healthcare with a Buy and raised the price target from $4.5 to $5.5. The company's stock gained around 24% over the past month and has a 52-week high of $4.65.

- RSI Value: 75.2

- DHC Price Action: Shares of Diversified Healthcare Trust gained 0.4% to close at $4.60 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock