As of Aug. 11, 2025, two stocks in the real estate sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Cushman & Wakefield PLC (NYSE:CWK)

- On Aug. 5, Cushman & Wakefield posted better-than-expected quarterly earnings. “Our second quarter results highlight the strong and resilient growth engine we have successfully built over the past two years. Capital markets revenue growth of 26% in the quarter underscores our solid market positioning and the early success of our expanded recruiting efforts. Leasing and Services revenue growth continued to exceed expectations as our teams consistently developed and executed compelling market opportunities for our clients. Through the first half of 2025, we achieved 95% adjusted earnings per share growth and are raising our earnings per share outlook for the full year. We also continue to focus on fortifying our balance sheet and this morning have announced an additional $150 million debt paydown,” said Michelle MacKay, Chief Executive Officer of Cushman & Wakefield. The company's stock jumped around 17% over the past month and has a 52-week high of $16.11.

- RSI Value: 76.3

- CWK Price Action: Shares of Cushman & Wakefield gained 2.2% to close at $13.69 on Friday.

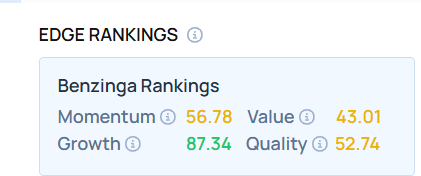

- Edge Stock Ratings: 56.78 Momentum score with Value at 43.01.

Compass Inc (NYSE:COMP)

- On July 30, Compass posted downbeat quarterly earnings. “Compass delivered the best quarterly results in our history, marked by ten all-time highs, including market share, Revenue, GAAP Net Income, Adjusted EBITDA2, Adjusted EBITDA Margin, Free Cash Flow3, T&E revenue, T&E attach, and weekly agent sessions on the platform,” said Robert Reffkin, Founder and Chief Executive Officer of Compass. The company's stock gained around 25% over the past month and has a 52-week high of $10.25.

- RSI Value: 70.9

- COMP Price Action: Shares of Compass fell 0.7% to close at $8.15 on Friday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock