As of Aug. 6, 2025, two stocks in the industrials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Resideo Technologies Inc (NYSE:REZI)

- On Aug. 5, Resideo Technologies reported better-than-expected second-quarter financial results and raised its FY25 guidance. “Resideo had an exceptional second quarter, reporting record high results that were above the high-end of the range for all our key financial metrics. We are pleased to report that both the ADI and Products and Solutions segments generated organic net revenue growth, gross margin expansion, and robust Adjusted EBITDA growth,” said Jay Geldmacher, Resideo’s President and CEO. The company's stock jumped around 12% over the past month and has a 52-week high of $29.40.

- RSI Value: 70.8

- REZI Price Action: Shares of Resideo Technologies gained 1.8% to close at $26.23 on Tuesday.

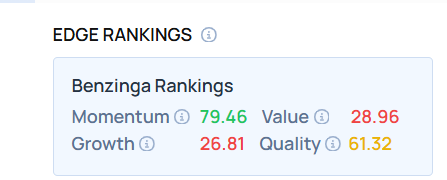

- Edge Stock Ratings: 79.46 Momentum score with Value at 28.96.

Aecom (NYSE:ACM)

- On Aug. 4, AECOM reported better-than-expected quarterly adjusted EPS results and raised both its FY25 GAAP EPS and adjusted EPS guidance. “The strength of our third quarter results, which included outperformance on all key financial metrics, demonstrated the benefits of our competitive edge platform and the high returns we earn on our growth investments,” said Troy Rudd, AECOM’s chairman and chief executive officer. The company's stock gained around 10% over the past six months has a 52-week high of $121.73.

- RSI Value: 76.7

- ACM Price Action: Shares of Aecom gained 6.3% to close at $119.00 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock