As of Sept. 12, 2025, two stocks in the consumer discretionary sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

GoPro Inc (NASDAQ:GPRO)

- On Aug. 11, GoPro posted mixed quarterly results. “The initiatives we undertook in 2024 to reduce operating expenses and improve gross margin are beginning to deliver meaningful results. In Q2 2025, year-over-year, we improved gross margin to 36.0%, up from 30.7%, reduced operating expenses 32% and improved adjusted EBITDA 83%,” said Brian McGee, GoPro’s CFO and COO. The company's stock gained around 59% over the past month and has a 52-week high of $2.37.

- RSI Value: 78

- GPRO Price Action: Shares of GoPro gained 22.7% to close at $2.00 on Thursday.

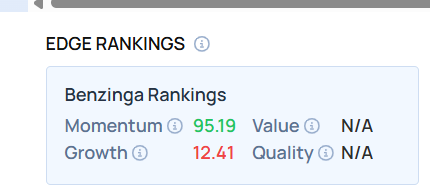

- Edge Stock Ratings: 95.19 Momentum score.

Children’s Place Inc (NASDAQ:PLCE)

- On Sept. 5, Children’s Place posted better-than-expected quarterly revenue. Muhammad Umair, President and Interim Chief Executive Officer said, “This quarter began with operating results that reflected the difficulties we faced in the previous quarter, including unusually cold and wet weather early in the quarter that dampened seasonal demand. However, we ended the quarter with strong momentum for our back-to-school season, and we saw a significant improvement in comparable sales relative to the start of the year. The expansion of licensing, a greater emphasis on fashion-forward assortments, and new partnerships are resonating strongly with our core customer, helping to reinforce our brand promise of delivering amazing fashion at a great value for parents. While we continue to be challenged by the macroeconomic environment, we remain laser-focused on driving profitability in the near and long term.” The company's stock gained around 69% over the past month and has a 52-week high of $19.74.

- RSI Value: 73.6

- PLCE Price Action: Shares of Children’s Place fell 4.2% to close at $7.33 on Thursday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Photo via Shutterstock