In 2025, few companies have sparked as much interest or controversy as Tesla (TSLA). The electric vehicle (EV) giant has long held a dominant position in the automotive industry. However, following poorly received political entanglements with President Donald Trump, production challenges, and unmet financial expectations, the question arises: Is Tesla more hype than substance?

Tesla will report its second-quarter earnings on July 23, after the market closes. The stock is down 20% year to date, trailing the broader market’s gain of 6.8%. Let’s find out if the stock is a buy, hold, or sell now.

Flashing Warning Signs: Profitability Problem

For more than a decade, Tesla had a tech stock-like valuation multiple based on the promise of exponential growth, higher margins, and a vision of self-driving and AI dominance. However, Tesla’s once-dominant market share is being eroded by legacy automakers such as Ford (F) and General Motors (GM), along with Chinese players such as BYD (BYDDY) and Nio (NIO), which are producing EVs at lower prices and, in some cases, with better battery technology. Furthermore, Tesla’s price cuts in late 2024 and early 2025, which were intended to stimulate demand, have eaten into profits without resulting in significant unit volume increases.

In the first quarter of 2025, total revenue dipped 9%, while adjusted earnings dropped 40%. Overall, deliveries were down 13%. While Tesla’s core automotive business struggles with a 20% decline, energy generation and storage revenue compensated with a 67% increase. Gross margins have fallen to 16%, a far cry from the 25% to 30% margins Tesla once boasted. In June, Tesla launched its long-awaited robotaxi services in Austin, which include Full Self-Driving (FSD) capability. According to Reuters, Musk recently announced that Tesla will extend this service to the San Francisco Bay Area in the next month or two, subject to regulatory approvals.

Tesla’s future depends heavily on two breakthrough innovations: Robotaxis and Optimus, its AI-powered humanoid robot designed to handle repetitive tasks. Musk stated on the Q1 earnings call that the financial impact of robotaxis would be realized by the middle of next year. Optimus, he claimed, will reach mass production of 1 million units per year by 2029 or 2030. While these claims are bold and potentially revolutionary, Musk is also known for failing to deliver on his ambitious promises.

Earlier this month, Tesla reported a 13.5% year-over-year drop in vehicle deliveries to 384,122. Analysts expect revenue to fall 12.3% in the second quarter, with earnings slipping by 21.8% to $0.41 per share.

The Reality Check

Currently, Tesla is trading at a forward price-earnings ratio of around 231x, far exceeding other high-growth tech companies such as Alphabet (GOOGL) (19x) and Nvidia (NVDA) (41x). Tesla’s core business is experiencing margin compression, increased competition, and soft demand in key markets. While energy storage and software services are expanding, they are still insufficient to offset a slowdown in vehicle sales.

Tesla’s valuation still assumes near-perfect execution on a number of high-risk projects, including autonomous driving, robotics, battery technology, and AI infrastructure. However, as of 2025, these future bets remain in the high-risk development stage rather than profit drivers. Analysts expect Tesla’s earnings to fall by 25.9% in 2025 before rising by 54% in 2026.

What Are Analysts Saying About Tesla Stock?

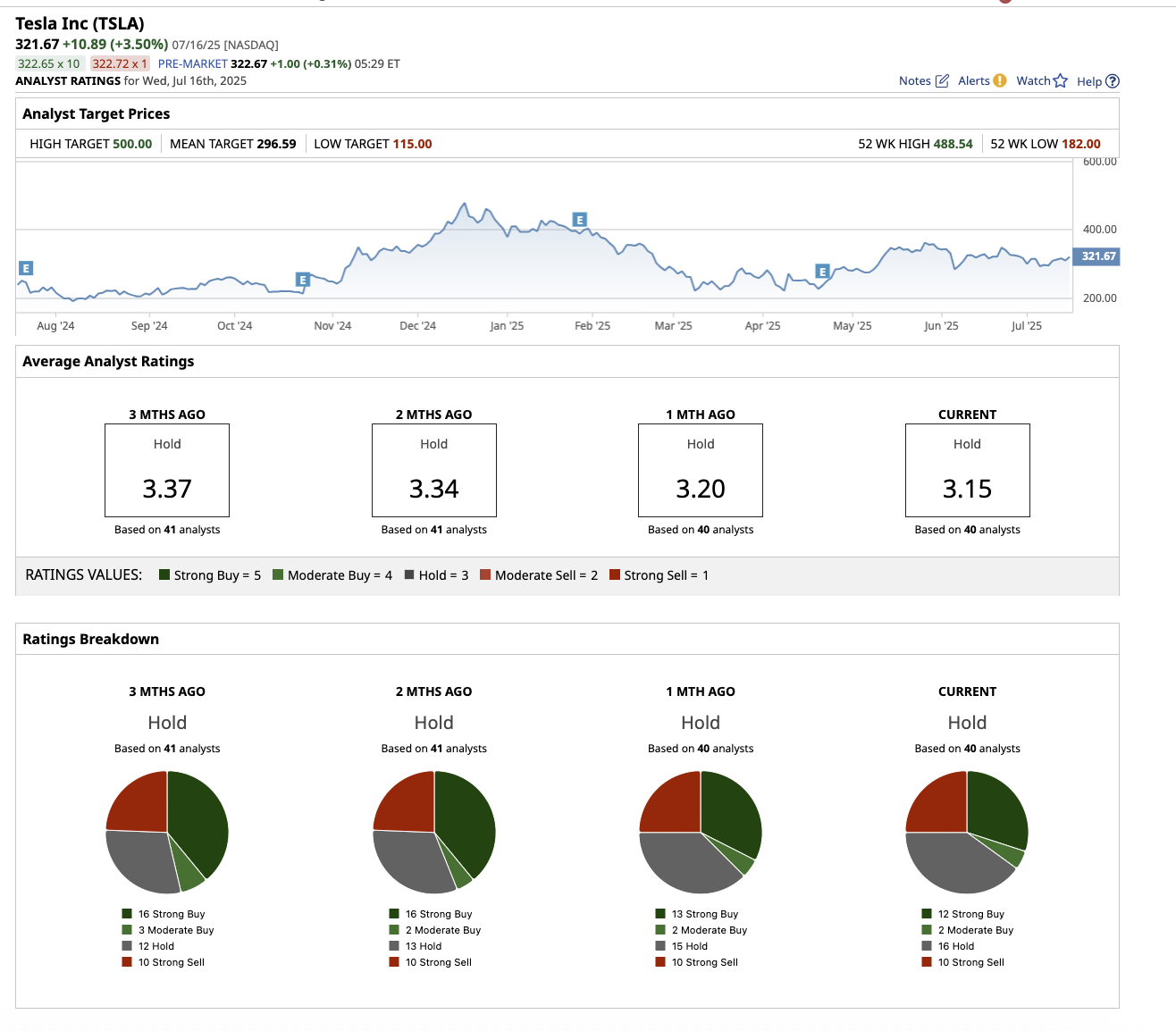

Overall, Tesla remains a “Hold,” on Wall Street. Of the 40 analysts covering the stock, 12 recommend it as a “Strong Buy,” two as a “Moderate Buy,” 16 as a “Hold,” and 10 as a “Strong Sell.” Tesla has surpassed its average analyst target price of $296.59. The high price estimate of $500 implies that the stock can rise by 55.4% in the next 12 months.

The Key Takeaway

Musk is good at praising Tesla, using phrases like “the most valuable company in the world by far” and achieving “sustainable abundance for all.” If Tesla truly delivers on its two breakthrough innovations — autonomy and humanoid robots — the company’s business model could change dramatically in the long run. However, it must operate profitably and sustainably.

Thus, Tesla stock remains a buy or a hold for long-term investors who believe in the company’s vision beyond vehicles and are willing to take on the high risk despite the short-term headwinds.

Meanwhile, risk-averse investors may want to wait to see if Tesla’s finances improve before making any investment decisions.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.