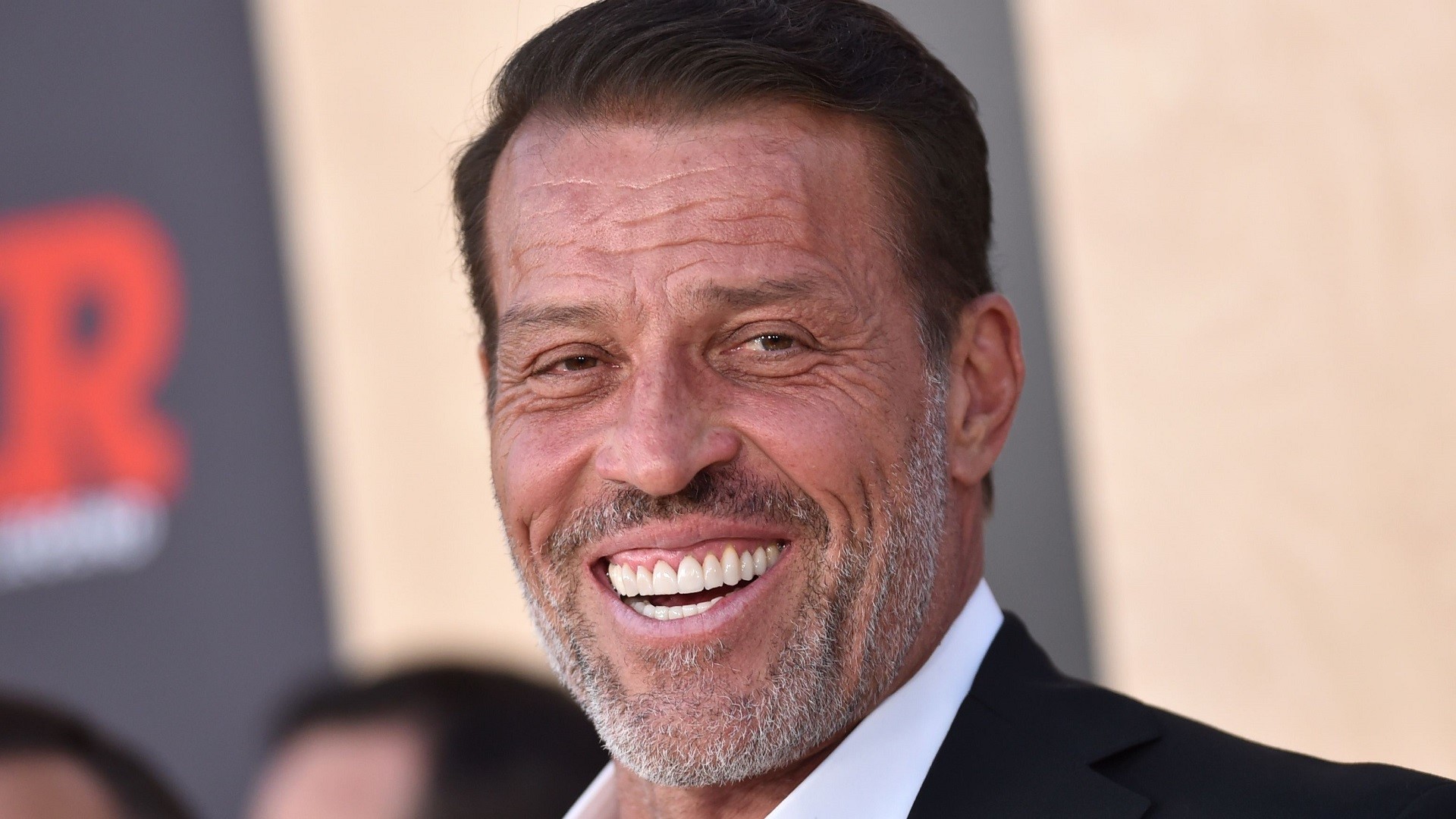

If you don’t know Tony Robbins by now, here’s a reintroduction: He is one of the top leading strategists for life, business and how to merge the two. Along with writing the best-selling personal finance book, “Unshakeable,” Robbins has coached more than 50 million people from all over the globe for decades.

Trending Now: Why You Should Start Investing Now (Even If You Only Have $10)

For You: How Much Money Is Needed To Be Considered Middle Class in Your State?

His wisdom is so sage that it’s applicable in 2026 and beyond, but only if those taking his advice apply consistency and follow-through in the process.

Don’t Panic During a Market Correction

The market will always be in flux, constantly shifting in good and bad directions, then correcting. On the official Tony Robbins’ website, Robbins cited that “[o]n average, corrections happen about once per year (since 1900). A correction is a 10% drop, but not more than 20%.”

Robbins, like most people, was shaken by that stat, but urges that anyone worried about it set their fears aside and that corrections do not instantly mean a bear market is occurring, only that it was a blip in the markets and that a bounce back is likely to be in the near future.

When the market corrects, Robbins advises to not pull out, but to simply ride the wave of ups and downs, noting that “most of the short-term volatility should usually be ignored.”

Learn More: Suze Orman — These Are the 3 Biggest Mistakes You Can Make as an Investor

Compound the Interest in Your Accounts

Interest compounds — you just have to wait and be patient, as well as diligent, about adding to your various financial accounts and saving the money so that it grows, rather than regularly withdrawing funds. Robbins pointed to some data sets that indicate 60% of Americans don’t have $1,000 saved for retirement.

Robbins encouraged that in order to have financial stability everyone “must make the decision to not be left behind and begin saving today — no matter what it takes. This is especially true for millennials, who came of age during the financial crises of 2008 and are still fearful of the markets.”

Get Rid of High Fees and Taxes

Robbins pointed out that a large portion of Americans do not know that fees are being applied from their various financial accounts, including retirement plans. Robbins encouraged business owners to get free review of 401(k) plan fees by going to sites like AB401ks.

“Paying excessive fees or unnecessary commissions to brokers will erode your account values,” Robbins originally told CNBC.

Work With a Trusted Financial Advisor

More than 90% of financial advisors are also, technically, brokers or “fiduciary” advisors, according to Robbins, who described this as “a world driven primarily by compensation, so commission-laden investments and more profitable proprietary (aka name brand) funds are quite common.”

Robbins explained that “a fiduciary is someone required by law to put your interests first,” so having one on your side, who you trust with your financial decisions and overall fiscal wellbeing, is essential for success.

More From GOBankingRates

- 9 Costco Items Retirees Need To Buy Ahead of Fall

- Mark Cuban Reveals His Formula for Side Hustle Success

- How Much Money Is Needed To Be Considered Middle Class in Your State?

- 10 Used Cars That Will Last Longer Than the Average New Vehicle

This article originally appeared on GOBankingRates.com: Tony Robbins’ ‘Unshakeable’ Investing Tips Still Work — If You Do This