Tom Lee, head of research at Fundstrat Global Advisors, predicts that Strategy Inc. (NASDAQ:MSTR) (formerly MicroStrategy) could deliver superior returns compared to Bitcoin (CRYPTO: BTC) itself as the cryptocurrency rallies.

What Happened: “As Bitcoin goes up, MicroStrategy very likely goes up a lot more,” Lee said in a Wealthion interview reposted on X.

MicroStrategy transformed from a software company into one of the world’s largest corporate Bitcoin holders through an aggressive debt-fueled acquisition strategy. The company now holds 592,100 Bitcoin worth approximately $60 billion, generating an unrealized gain of 43% according to recent filings.

Lee explained the company’s innovative financing approach allows it to issue convertible bonds at “almost no interest cost” to purchase additional Bitcoin. This strategy has created a premium valuation mechanism where MicroStrategy trades based on its Bitcoin holdings rather than its legacy software business performance.

The Tyson Corner-based company recently completed a $1 billion Bitcoin purchase funded through its new Stride preferred stock offering, bringing its total cryptocurrency treasury near 600,000 coins. Executive Chairman Michael Saylor targets raising $84 billion through 2027 under the company’s “42/42” plan for continued Bitcoin acquisitions.

Why It Matters: TD Cowen analysts rate the securities “very safe,” noting MicroStrategy holds $63 billion in underlying Bitcoin value against $11.6 billion in total debt plus preferred stock. The firm maintains a “buy” rating with a $590 price target on MSTR shares.

Lee previously projected Bitcoin could reach $250,000 by end-2025, citing supply scarcity with 95% of coins already mined while 95% of the world doesn’t own Bitcoin.

Price Action: Bitcoin currently trades at $106,582, up 1.67% in 24 hours, with a market capitalization exceeding $2.1 trillion. MicroStrategy shares closed at $377.02, gaining 2.68% Tuesday and advancing 25.67% year-to-date.

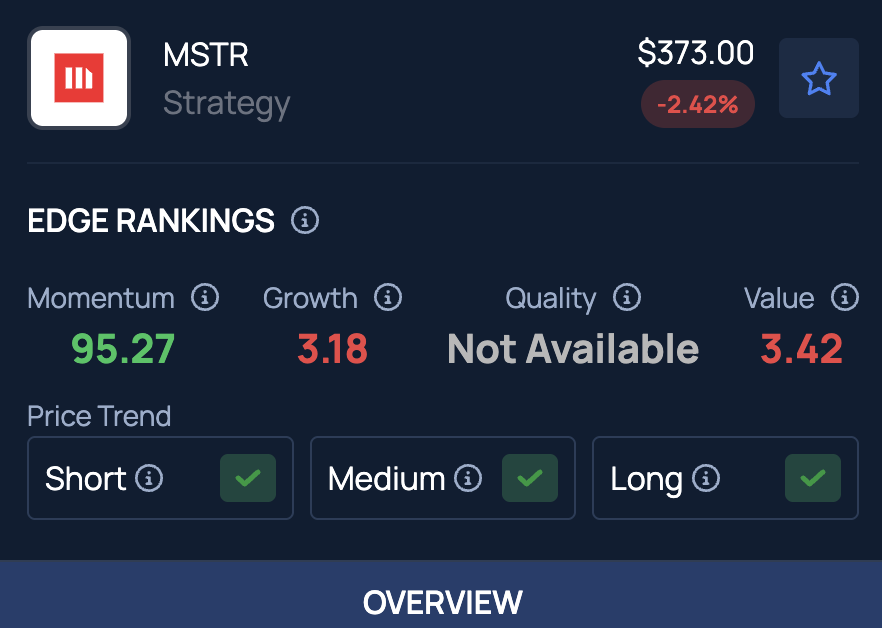

MSTR currently shows a very high momentum score, reflecting strong price action and volatility across multiple timeframes. Explore Benzinga Edge Stock Rankings to find similar high-momentum stocks for your portfolio.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Mamun_Sheikh / Shutterstock.com