Tennessee-based regional bank, First Horizon (FHN), reported its Q3 2025 results yesterday, before the markets opened. While they were reasonably strong, they weren't enough for investors, causing FHN stock to decline nearly 10% on the day.

The price drop could have been an example of the adage, “Buy on rumor, sell on news.” Alternatively, it might have been due to the fear-mongering by JPMorgan & Chase (JPM) CEO Jamie Dimon, whose comments about cockroaches generated considerable controversy.

Whatever the reasons, it was a blow for long-time First Horizon shareholders, erasing 75% of their gains in 2025. On the plus side, they’re still up 98% over the past five years, more than double the performance of the iShares U.S. Regional Banks ETF (IAT).

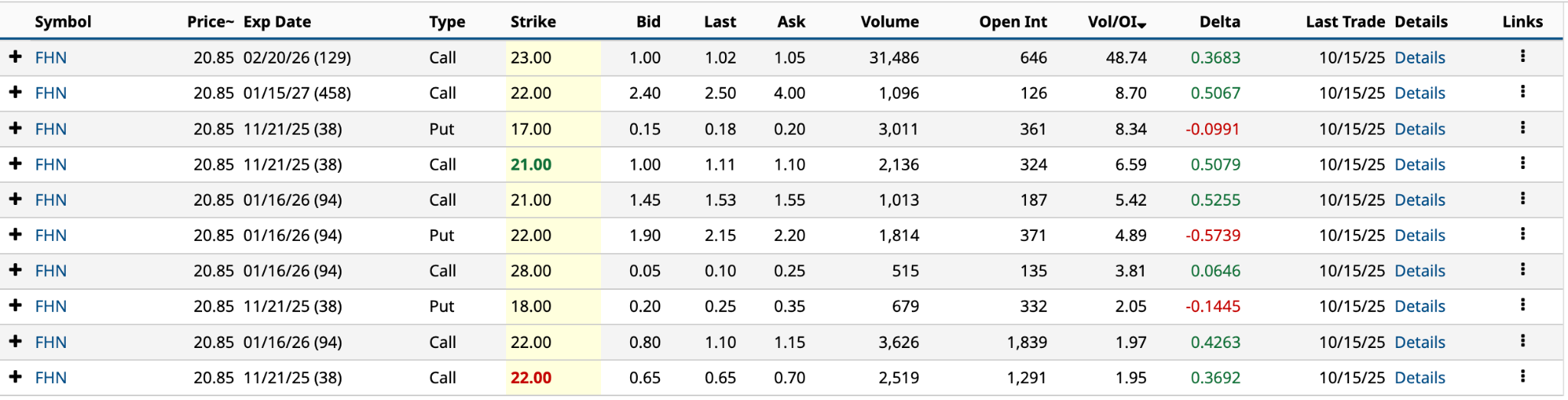

In yesterday’s options trading, FHN’s volume was 173,468, the second-highest daily volume in 2025, 5.8 times the 30-day average.

As a result of the increased activity, the regional bank’s stock had 11 unusually active options yesterday — eight calls and three puts — with two in the top 12.

Whether you’re bullish or bearish on its stock,

First Horizon’s unusual options activity reveals three standout trades.

FHN Income Strategy

I’m going to reach outside my comfort zone on this one, opting for a Stock Repair strategy, also known as a Covered Ratio Spread. It’s not something I’ve recommended before. There’s a first time for everything.

In this situation, you already own 200 shares of First Horizon stock. We’ll say you bought them on Dec. 31, 2024, at the day’s low of $20.04.

Based on yesterday’s closing price, you’re sitting on a slight loss over eight months. You use this strategy to recover some or all of your original $4,008 investment, and if possible, some of the profits lost from yesterday’s trading. You are unwilling to buy more shares.

The strategy combines a Covered Call and a Bull Call Spread. You want to buy one ATM (at the money) call and sell two calls with a higher strike price.

Of the eight calls from yesterday’s unusual options activity, three had expiration dates of around 90.

In this example, you would buy one long $21 call expiring on January 16, 2026, and sell two short $22 or $28 calls.

The premium income from the two short calls would be $160 for the $22 call and $10 for the $28 call. Clearly, the former is the bet to make of the two.

Let’s assume that on Jan. 16, the share price of FHN stock is $23, the Oct. 14th closing price, the day before yesterday’s correction.

1. The profit on the 200 shares would be $592 [$23 share price at expiration - $20.04 price paid * 200 shares].

2. The profit on the long $21 call would be $45 [$23 share price at expiration - $21 strike price - $1.55 ask price].

3. The profit on the two short $22 calls is $160 [bid price of $0.80 * 200 shares].

So, in this example, your total profit would be $797, a return of 19.1% [$797 / $4,163 ($4,008 cost of 200 shares + $155 premium for long call].

Note: The biggest risk to this strategy is if the shares continue to decline in the next 94 days and you don’t sell your shares.

I selected this strategy primarily for demonstration purposes. I wouldn’t try it unless you’re confident the shares will rebound from yesterday’s correction.

The First Horizon Bullish Strategy

This next strategy is also new to me. I’m really pushing my boundaries today.

The Call Ratio Back Spread is an extremely bullish strategy that looks to benefit from a stock’s near-term significant upside.

In this example, you would sell one short call and buy two higher strike calls. Ideally, the short call is ATM or ITM (in the money), while the two long calls are OTM (out of the money). All three have the same DTE (days to expiration).

Referencing the 11 unusually active options from yesterday, the Jan. 16/2026 DTE is the only reasonable setup for this strategy.

So, sell the short $21 call and buy two long $22 or $28 calls.

The net debit when combined with the long $22 call would be $85 [2 * $22 strike’s ask price of $1.15 - $21 strike’s bid price of $1.45]. The net credit for the long $28 call would be $95 [$21 strike’s bid price of $1.45 - 2 * $28 strike’s ask price of $0.25].

The maximum loss for the long $22 call would be $1.85 or $185 [$22 long call strike price - $21 short call strike price + $0.85 net debit].

The maximum loss for the long $28 call would be $6.05 or $605 [$28 long call strike price - $21 short call strike price - $0.95 net credit].

The maximum profit for both long call strike prices is unlimited, depending on how much the share price appreciates over the next three months above the upper breakeven price.

The $22 long call’s upper breakeven price is $23.85 [$22 strike price + ($22 long call strike price - $21 short call strike price) + $0.85 net debit.

The $28 long call’s upper breakeven price is $34.05 [$28 strike price + ($28 long call strike price - $21 short call strike price) - $0.95 net credit.

The $22 long call is the better play in this instance.

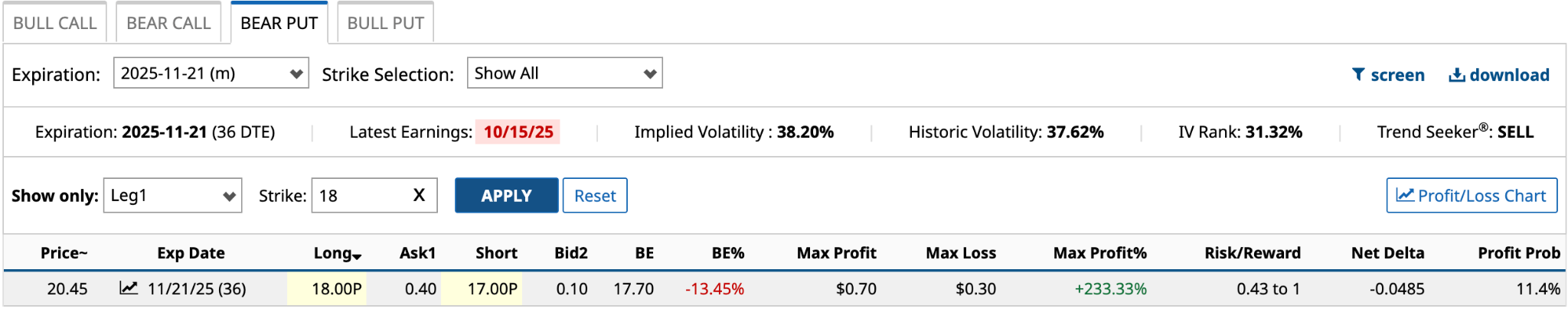

The Bearish Play on FHN Stock

The most straightforward of the three options’ strategies is the Bear Put Spread. You use this when you are bullish about the future share price of a stock.

It involves buying a long put option at one strike price and selling a lower-priced short put option. The strategy has limited profits and losses, making it a good play for risk-averse investors.

First Horizon had three unusually active put options yesterday, two of which expire on Nov. 21. They’ll be the ones to use for this strategy.

Here’s what I see in late Thursday morning trading.

So, you’re buying one long $18 put at an ask price of $0.40 and selling one short $17 put at a bid price of $0.10, for a net debit of $0.30 or $30. That’s also your maximum loss. The maximum profit is $70, which is the strike price differential of $1 minus the $0.30 net debit.

So, you’re buying one long $18 put at an ask price of $0.40 and selling one short $17 put at a bid price of $0.10, for a net debit of $0.30 or $30. That’s also your maximum loss. The maximum profit is $70, which is the strike price differential of $1 minus the $0.30 net debit.

The risk/reward is 0.43 to 1, calculated as the maximum loss divided by the maximum profit. Meanwhile, the maximum profit percentage is 233.33%, calculated as the maximum profit divided by the maximum loss.

Of course, the breakeven is $17.70 [$18 long call - $0.30 net debit], which means First Horizon’s share price must fall by at least 13.45% in the next 36 days to make a profit on this trade.

That explains why the profit probability is just 11.4%. Fortunately, at $30 per bear put spread, the cost isn’t a dealbreaker.