The US president said he would lower beef prices, with the USDA obliging by reporting lower prices.

-

Fundamentally, neither the live cattle nor feeder cattle markets have changed, though cash indexes have stalled near recent all-time highs.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. Long-term investment money could look to roll out of cattle, after a profitable ride over the past five years or so, into other markets showing potential.

By definition, a conundrum is a difficult and complicated problem, one admitting of no satisfactory solution. It is also defined as a riddle in which a fanciful question is answered by a pun. Whenever the subject comes up, I’m reminded of Winston Churchill’s famous quote describing Russia as “a riddle, wrapped in a mystery, inside an enigma”. In other words, Churchill viewed an alliance with Russia as a conundrum, but for now, though, let’s focus on the complicated problem that is the cattle markets.

My friend in the industry sent me a message early Tuesday morning that began with, “Something to mix up the muddy waters of the feeder complex…”. He went on to report higher cash feeder indexes from Monday afternoon, all while the feeder cattle futures market, as well as live cattle, closed higher despite continued commercial selling. Recall from Monday’s close that back-month feeders finished the $9.25 daily limit higher, expanding Tuesday’s daily limit to $13.75 and live cattle futures to $10.75.

With that as a background, let’s take a look at some of the moving pieces for US cattle markets.

Boxed Beef: Back on September 8, the US president reportedly said he would bring down the price of beef. While this individual has in the past proclaimed himself to be the greatest of a number of things (president, military mind, virologist, meteorologist, etc.), I have not heard him award himself the title of Greatest Economist. Or maybe I just missed it. Still, since his proclamation, the US boxed beef markets have been freefalling. On Friday, September 5, USDA reported the choice price at $410.76, already down $5.25 from its record high of $416.01 on Tuesday, September 3, while select was reported at $385.19, down $4.81 from its record peak of $390.00 from Friday, August 29. As of Monday, September 22, the markets had plummeted to $381.39 and $362.09 respectively. This undoubtedly proofs the US president has absolute power over markets, right? Just like those individuals controlling Russia, China, and North Korea.

Maybe not. Remember, US boxed beef prices are reported daily by USDA, an organization run by one of the president’s biggest cheerleaders, Ag Secretary Rollins. It doesn’t take much imagination to see daily boxed beef prices are intentionally being reported lower, even if the reality at the meat counter shows the opposite. In this day and age in the United States reality doesn’t mean much, even with a reality television personality on the throne.

Cash Prices: For as long as I can remember, I’ve talked about how livestock futures are driven by their respective underlying cash markets. This is as it should be. It brings back memories of all those analysts, myself included back in the day, who would pompously talk to all who will listen about their technical analysis of the livestock markets. All while those who live and breathe the industry laugh and shake their heads. As I would later openly admit, those who know easily recognize those who don’t.

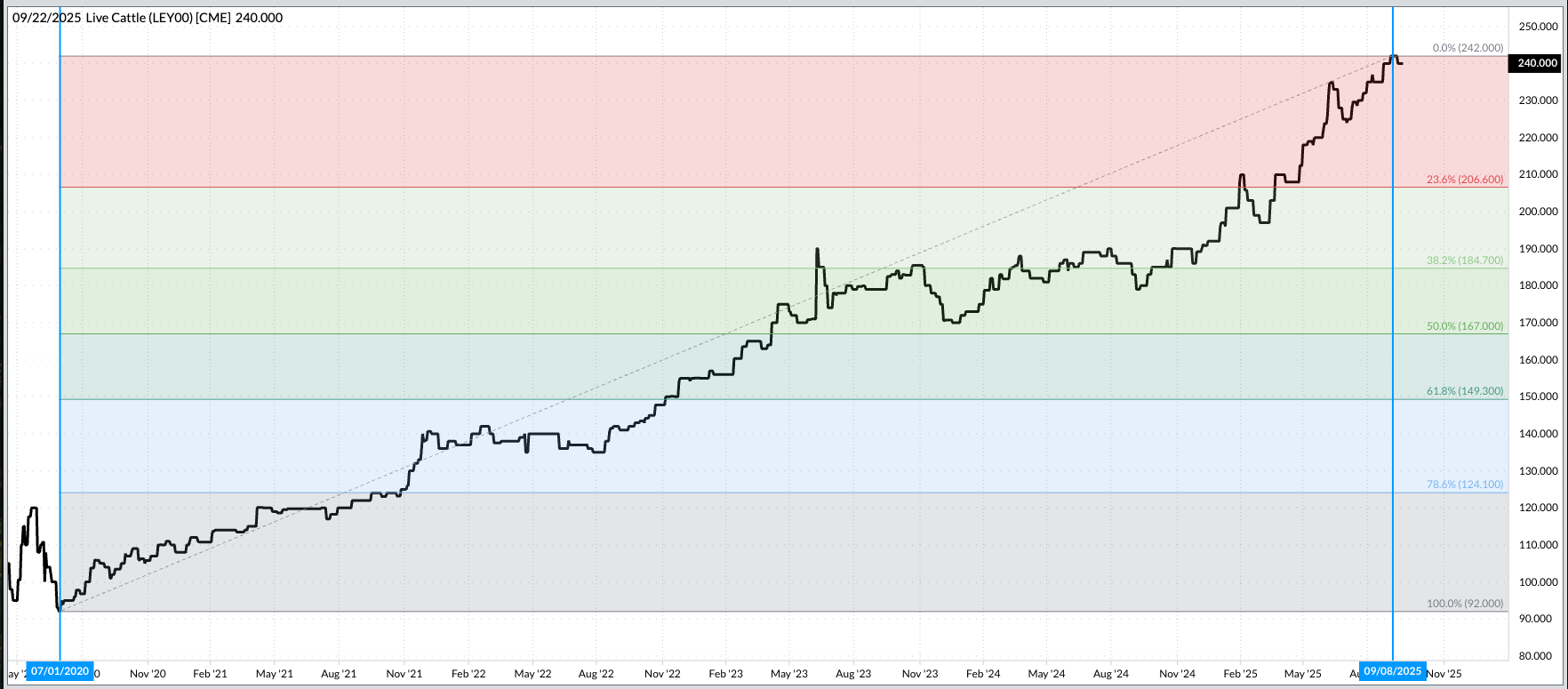

The Live Cattle Cash Index (LEY00) has moved from a low daily close of $92.00 on July 1, 2020, to a recent high daily close of $242.00 on September 8, 2025 (recognize that date?). The past couple weeks have seen the Index slip a couple dollars, last reported at $240 on Friday, September 19. Similarly, the National Feeder Cattle Index (GFY00) has risen from a low daily price of $114.23 on April 15, to a high of $367.03 on September 5, 2025. Yes, the feeder index has taken a breather of late, slipping to $358.78 on Friday, September 19, but it could be premature to say it’s all over for cash cattle.

Why? Because of something the US president is unfamiliar with, the simple economic Law of Supply and Demand. This tells us that market price, in this case the cash indexes, is the price where quantities demanded equal quantities available. Hence the phrase, equilibrium price. To put it simply, the US cattle supply is not in an expansion phase meaning quantities demanded continue to outpace available supplies. There are two ways the US president can actually increase supplies in relation to demand: One is creating more cattle himself, the other is to crush demand for US beef. Those arguing he can’t do this need only look at the US soybean market for proof that he can.

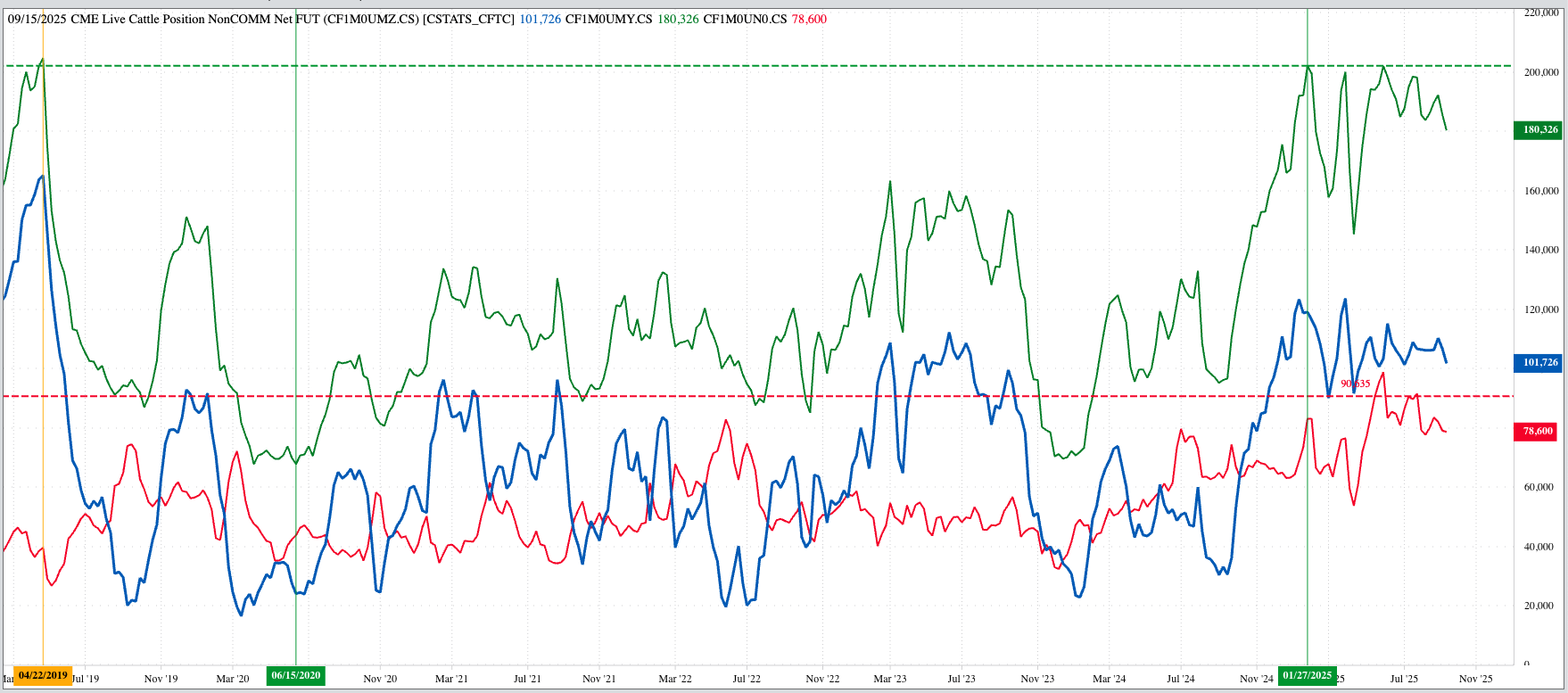

Watson: The algorithm driven investment industry recognized early the changing supply and demand situation in the US cattle market and adjusted their futures positions accordingly. According to CFTC Commitments of Traders reports, noncommercial interests held long futures of only 67,700 contracts on June 16, 2020, as part of a net-long futures position of 24,000 contracts. While there has been and ebb and flow of these positions, the general trend has been for an increase in both long and net-long futures. As of this past January Watson reportedly held long futures of 202,150 contracts putting the net-long futures position near 123,300 contracts.

As we know by applying Newton’s First Law of Motion to markets, a trending market will stay in that trend until acted upon by an outside force, with that outside force usually noncommercial activity. The latest Commitments of Traders report showed funds had cut their net-long futures position to 101,726 contracts as of Tuesday, September 16, including long futures of 180,326 contracts. This could be an early indication that long-term investors are losing interest in cattle, possibly looking at rolling money over to the corn market based on the bullish longer-term fundamental picture pained by the May-July futures spread.

I’ve said for a number of months we need to be careful with the cattle market, now more than ever.

.png?w=600)