Apple (AAPL), as most know, is the biggest stock in the U.S. The market cap is now over $2.91 trillion as it nears the $3 trillion dollar market cap.

Certainly, the rally so far this year has been impressive to say the least. Apple stock is now up over 30% in 2023-and we still have half a year to go.

But trees don’t grow to the sky forever, to quote the old stock market adage. Below are three valid concerns surrounding Apple stock that may cool off the recent red-hot rally.

Technicals

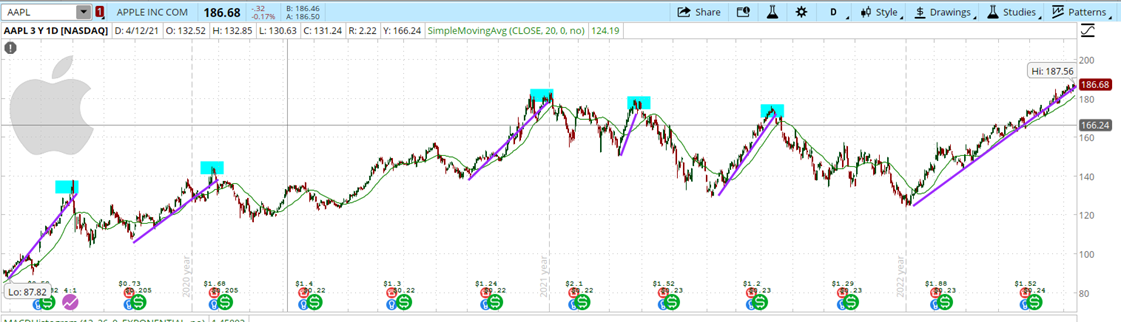

AAPL got overbought once again on a technical basis but is beginning to weaken. 9-day RSI is back above 70 but is curling lower. Bollinger Percent B hit 100 before softening. MACD is poised to generate a sell signal on further weakness.

AAPL has gone over 90 days without breaking under the 20-day moving average-a rare event indeed. Plus, Apple stock traded up to a fresh new-all time high last Friday only to reverse course and close lower on the day. This type of reversal pattern is many times indicative of a short-term top in the stock. The buyers have become exhausted, and the sellers are in control. The rally is looking a little long in the tooth.

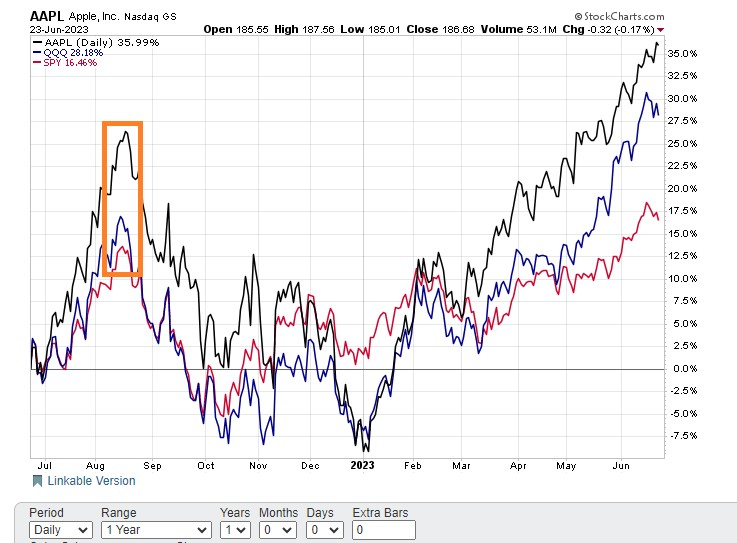

Apple stock is also dramatically outperforming both the S&P 500 (SPY) and NASDAQ 100 (QQQ) over the past few months. That is difficult to accomplish given that AAPL carries the highest weight in the SPY at over 7% and the second highest weight in the QQQ at over 12%.

As the comparative chart shows, the last time Apple got this far ahead of the SPY and QQQ did not end well for AAPL (highlighted in orange).

Valuations

The Price/Sales ratio in Apple just hit the highest reading in well over a year at 7.7X. I prefer to use Price/Sales as a valuation metric since it isn’t subject to the accounting gimmickry and stock buyback boost that can artificially inflate Price/Earnings (P/E).

It is the highest P/S since the December 2021 reading of just over 8x. Compare that to the current P/S ratio of the S&P 500 of just under 2.5x and it is even a loftier level.

Previous times the P/S ratio for AAPL reached similar extremes marked significant short-term tops in Apple stock as the charts below show.

The current P/S ratio for Apple is now more than double the median over the past decade and just below the highest reading in the previous 10 years.

Important to remember this big multiple expansion took place with interest rates rising sharply over the past year. Normally higher rates would tend to contract valuation multiples like Price/Sales.

Volatility

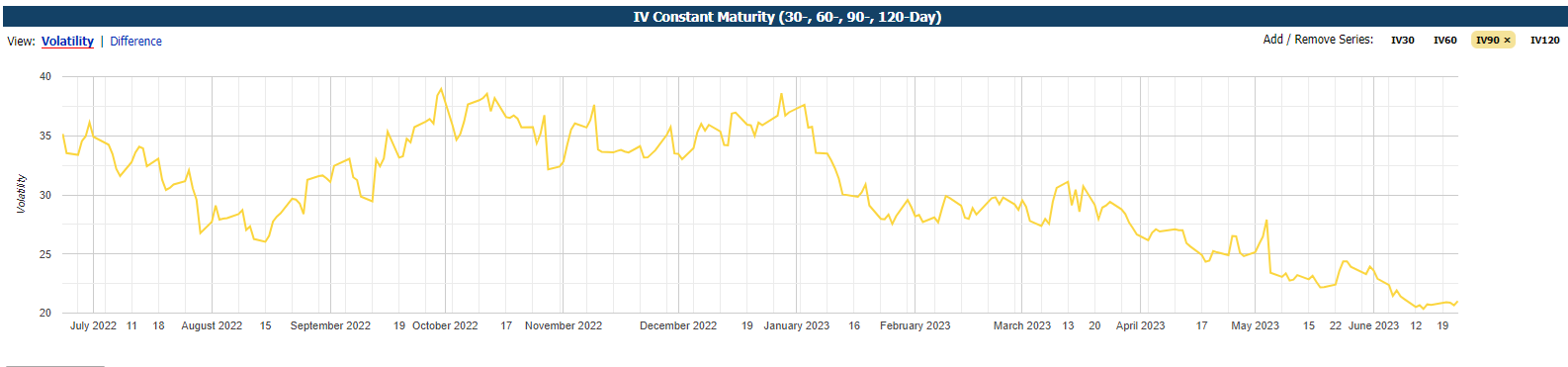

Implied Volatility (IV) reached the lowest level in the past year before upticking slightly. Just as lows in the VIX normally equate to highs in the S&P 500, lows in IV in Apple options is a good harbinger that the rally in AAPL has gotten a little frothy.

Plus, lows in implied volatility (IV) means option prices are at the cheapest they have been in the past year. This sets up ideally for a bearish put play to position to profit from a pullback.

Using cheap options in place of shorting stock is a more cost-effective alternative since the maximum amount required is simply the option premium paid.

For example, shorting 100 shares of Apple stock would require about $9400 in margin requirement. Buying an at-the-money August $185 put for roughly $5.50 would cost only $550 with the maximum loss on the option limited to the premium paid.

Traders looking to take a short position in an overbought and over-valued Apple would be wise to consider the put option alternative. Apple stock hasn’t been this expensive (both price and valuation wise) and option prices haven’t been this cheap in a very long time.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

shares . Year-to-date, has gained 13.67%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

Three Big Reasons Why It’s Finally Time To Short Apple StockNews.com