If you make frequent cash transfers, you'll know the pain of choosing between waiting a few days or forking over a hefty fee for it to be instant.

Paying for the convenience can add up as Americans, on average, spend over $300 a year on various bank and transfer fees.

Now, and unfortunately for many, PayPal (PYPL) and subsidiary Venmo just announced that they will be raising their instant transfer fees this spring.

How Much Will I Have To Pay For That Transfer Now?

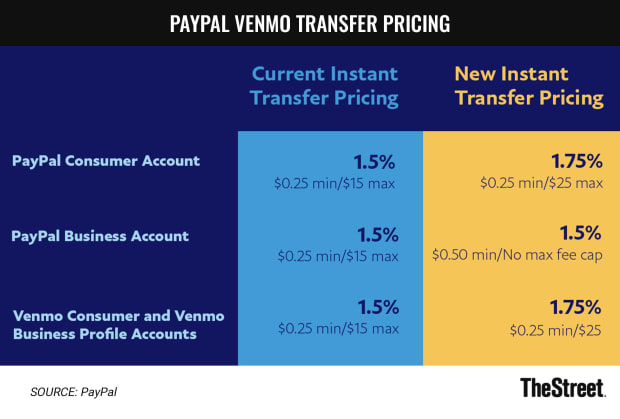

On PayPal, personal accounts will have to pay 1.75% of every instant transfer with a minimum fee of 25 cents and a maximum fee of $25. Previously, transfer costs were at 1.5% and had a fee cap of $15.

While the percentage for PayPal's business accounts remains unchanged at 1.5%, the company is getting rid of the $15 maximum cap entirely.

For those who make particularly large transfers, this will certainly be felt.

Venmo, which was purchased by PayPal in 2013, is raising its transfer fees from 1.5% to 1.75% for both consumer and business accounts.

The maximum fee will also be raised from $15 to $25.

PayPal

The justification for the increases, according to PayPal, is the standard corporate talking point of being "more in line with the value we provide."

That said, the standard transfer that takes between 1-3 days remains free.

"We offer options like Instant Transfer, so customers can choose to transfer their money instantly to a bank account or debit card for a fee, as well as Standard Bank Transfers, so customers who can wait a few days can transfer their money for no fee, which will typically arrive within 1-3 business days," PayPal said in the post announcing the increases.

The changes come into effect on May 23 on Venmo and June 17 on PayPal.

Instant Cash App Or Bank Transfer?

Transferring money from one bank account is a costly undertaking.

A round-up done by ValuePenguin found that, out of the country's 11 biggest banks, it costs on average $13.88 to receive a wire and $28.13 to send a wire domestically.

Internationally, that number goes up to $50.

Some banks, like Capital One and Chase (JPM), draw users in by offering $0 fees for the most basic types of domestic transfers.

But for those who need to transfer money frequently, there is no way to escape those fees if they are using banks, as they will start to add up with as different services are needed.

In large part due to the high fees and lengthy waiting times imposed by banks, instant transfer platforms have started to carve out a rapidly-increasing customer base.

Smartphone users now have an average of 2.5 smartphone apps downloaded onto their phone while a study from Nerdwallet found that 94% of millennials use mobile payment apps.

While PayPal and Venmo are early players in this space, newcomers like Ofx and Square's Cash App have been seeing skyrocketing popularity.

While they were once presented as a less secure option than banking, the ubiquity of instant transfer apps have been putting that question to rest, as many forgo bank transfers entirely for smaller amounts or use another method, like crrptocurrency.

"Lots of people are unbanked by choice," Bankrate Senior Analyst Ted Rossman recently told CNBC. "Maybe they don't trust the banks or are in a banking desert but if you are putting all your eggs in that one basket it can hold you back long-term."