Kraft Heinz (KHC) has been having a rough time on Wall Street over the past few years, with KHC stock shedding more than 70% of its value since peaking in February 2017. Once hailed as a defensive staple offering steady growth, high returns on capital, and generous dividends, KHC stock seemed tailor-made for legendary investor Warren Buffett, who remains a major shareholder of the company. But that appeal appears to have faded now.

A heavy focus on cost-cutting, sluggish adaptation to shifts in consumer preferences toward fresher and healthier foods, intensifying competition, and tighter household budgets have all weighed heavily on the business. In fact, in a bid to turn the tide, Kraft Heinz is preparing to split into two separate companies in 2026 — a move designed to sharpen strategy, improve capital allocation, and boost efficiency across its diverse brand stable.

Still, the decision has done little to inspire confidence on Wall Street. With Kraft Heinz shares recently sliding to a fresh 52-week low, is this once-favored Warren Buffett stock still worth owning now?

About Kraft Heinz Stock

Headquartered in Chicago, Illinois, Kraft Heinz is one of the largest food and beverage players in the world, born from the merger of two household names — Kraft and Heinz — in 2015. With a portfolio that spans pantry staples to ready-to-eat meals, its brands have become fixtures in kitchens and restaurants alike. From ketchup to cream cheese, meats, and fruit drinks, Kraft Heinz manages a mix of iconic labels and everyday essentials that have shaped how people eat for generations.

However, shares of the packaged food giant are under pressure from weak consumer demand. In a dramatic shift, the company recently announced plans to split into two publicly traded companies through a tax-free spinoff. Set to be completed in the second half of 2026, the move will effectively unravel the decade-old merger that created Kraft Heinz.

Management insists the goal is to unlock shareholder value and give each company a sharper strategic focus. But investors aren’t happy. The separation brings the risk of operational disruptions and unexpected costs. To many, it serves as an admission that the original merger never delivered on its promised growth.

In fact, Warren Buffett himself voiced a very rare public disapproval, adding fuel to investors' concerns. Buffett admitted that he is “disappointed” with the split, arguing that it won’t fix the company’s core problems. Currently valued at about $29.7 billion by market capitalization, shares of the packaged food company hit a new 52-week low of $24.80 on Oct. 13.

Over the past year, KHC stock has struggled, sliding 28%. Shares are also down roughly 17% year-to-date (YTD). For perspective, the broader S&P 500 Index ($SPX) has been cruising in the opposite direction, up about 13% both over the past year and YTD.

While the performance of KHC stock has been underwhelming, the company continues to deliver for income-focused investors. On Sept. 26, the firm rewarded shareholders with a quarterly dividend of $0.40 per share, bringing the annualized payout to $1.60 per share. That translates to an enticing 6.36% yield. Moreover, KHC stock currently trades at just 9.78 times forward earnings, well below the sector median and its own five-year average.

A Look Inside Kraft Heinz’s Q2 Performance

Kraft Heinz posted its fiscal 2025 second-quarter earnings on July 30, delivering results that outpaced Wall Street expectations but also painted a grim picture. The company reported net sales of $6.4 billion, representing a 1.9% decline from the year-ago quarter. Organic net sales slipped 2%, weighed down by softer performance in cold cuts, coffee, and frozen snacks. Still, the topline exceeded analysts' $6.3 billion forecast.

Profitability faced steeper headwinds. Gross profit fell 4.8% year-over-year (YOY) to $2.2 billion, while GAAP results swung dramatically from a modest $0.08 per-share profit to a loss of $6.60 per share. The sharp GAAP loss was primarily driven by $9.3 billion in non-cash impairment charges, which resulted in an operating loss of $8 billion. Meanwhile, adjusted operating income also slipped 7.5% annually to $1.3 billion.

On an adjusted basis, EPS fell 11.5% YOY to $0.69, weighed down by lower adjusted operating income. Still, that figure comfortably topped analyst estimates of $0.64. Amid the softness in sales and profits, Kraft Heinz also offered a silver lining for investors. Free cash flow soared 28.5% YOY to $1.5 billion, underscoring the company’s strong cash-generating ability even in a challenging quarter.

Kraft Heinz reported returning significant capital to shareholders YTD as well, paying $951 million in cash dividends and repurchasing $435 million of its own shares. As of June 28, the company still had $1.5 billion remaining under its buyback program, highlighting its ongoing commitment to rewarding investors.

Looking ahead, management reaffirmed its fiscal 2025 guidance. The firm anticipated continued declines in organic net sales and adjusted operating income, but projected a solid adjusted EPS range of $2.51 to $2.67, underscoring its resilience even amid headwinds.

What Do Analysts Think About Kraft Heinz Stock?

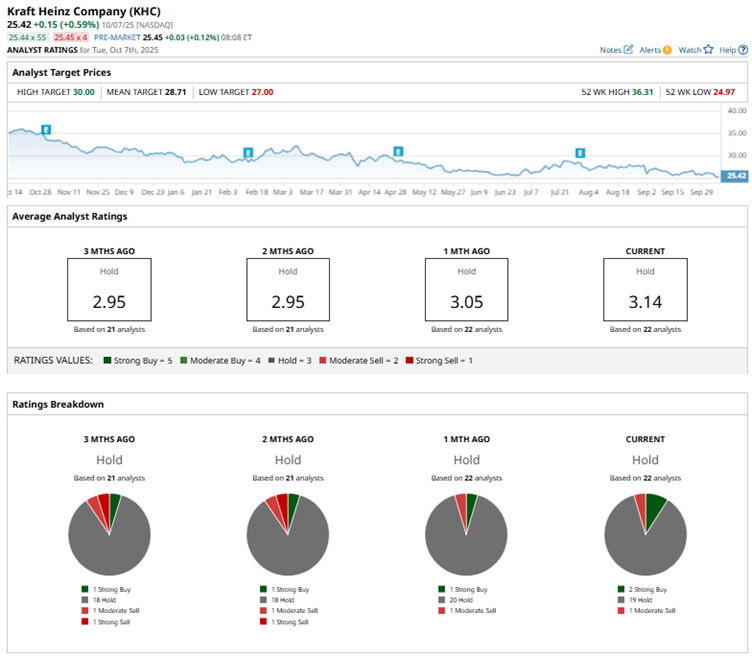

Wall Street is taking a measured approach when it comes to Kraft Heinz, with KHC stock firmly in the consensus “Hold” camp. Of the 22 analysts covering shares, just two issue a “Strong Buy" rating, 19 analysts urge patience with a “Hold,” and one analyst has a “Moderate Sell" rating. The consensus clearly signals that analysts are in wait-and-see mode, weighing the company’s next moves amid ongoing headwinds.

The average analyst price target of $28.52 implies 12% potential upside from current levels. Meanwhile, the Street-high target of $30 suggests that the stock could rally as much as 18% from here.

Key Takeaways

Kraft Heinz still packs iconic brands, a strong dividend yield, and solid cash flow, but investors should tread carefully. Even Warren Buffett, a longtime KHC stock investor, admitted that he’s “disappointed” with the company’s planned split. That's a very unusual public criticism, especially from someone who is almost always a passive investor.

With shares of KHC stock sliding, consumer tastes shifting, competition heating up, and sales softening, a quick turnaround isn’t guaranteed. Wall Street is equally cautious, with most analysts taking a neutral stance. That said, investors who might be tempted to buy KHC stock now should proceed with caution and keep a close eye on how the company executes its next moves.