Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- Seaport Global analyst Tom Curran downgraded the rating for Baker Hughes Company (NASDAQ:BKR) from Buy to Neutral. Baker Hughes shares closed at $45.75 on Tuesday. See how other analysts view this stock.

- Keybanc analyst Aleksey Yefremov downgraded the rating for Albemarle Corporation (NYSE:ALB) from Overweight to Sector Weight. Albemarle shares closed at $71.60 on Tuesday. See how other analysts view this stock.

- JP Morgan analyst Brian Ossenbeck downgraded Norfolk Southern Corporation (NYSE:NSC) from Overweight to Neutral and raised the price target from $282 to $288. Norfolk Southern shares closed at $277.70 on Tuesday. See how other analysts view this stock.

- Barclays analyst Emily Field downgraded Novo Nordisk A/S (NYSE:NVO) from Overweight to Equal-Weight. Novo Nordisk shares closed at $53.94 on Tuesday. See how other analysts view this stock.

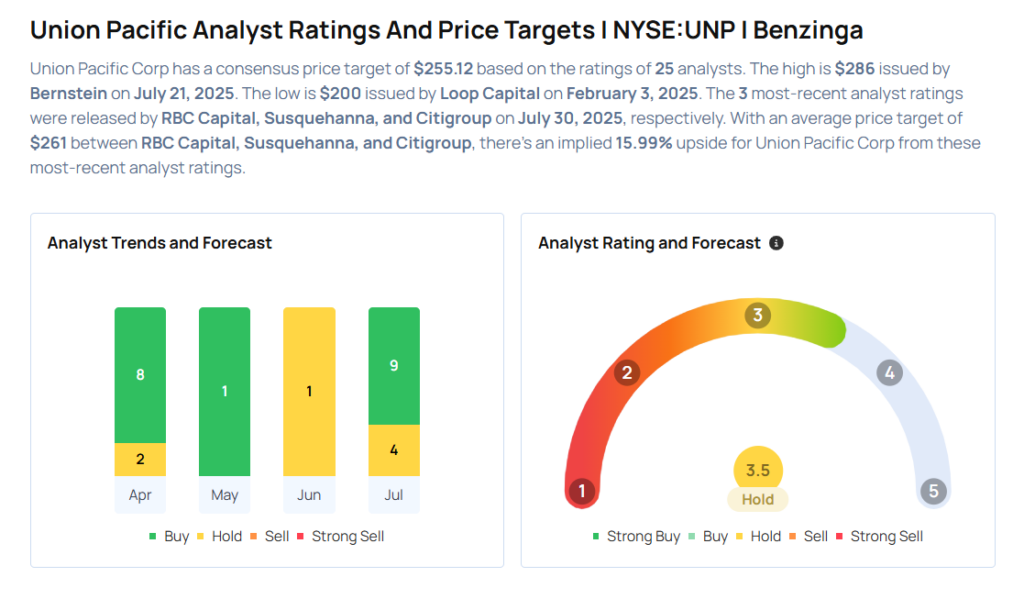

- Citigroup analyst Ariel Rosa downgraded the rating for Union Pacific Corporation (NYSE:UNP) from Buy to Neutral and slashed the price target from $270 to $250. Union Pacific shares closed at $223.77 on Tuesday. See how other analysts view this stock.

Considering buying UNP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock