HSBC Holdings (HSBC) has delivered the world's first empirical evidence that current quantum computers can solve real-world algorithmic trading problems. This event marked a significant breakthrough for the banking giant's technological capabilities.

Working alongside IBM (IBM), Europe's largest lender achieved a 34% improvement in predicting bond trade execution probability compared to traditional classical computing methods.

The quantum-enhanced system successfully optimized corporate bond trading in over-the-counter (OTC) markets, where complex algorithms must rapidly process real-time market conditions and risk estimates to inform trading decisions.

HSBC demonstrated superior performance in analyzing pricing signals within noisy market data for European corporate bond transactions. This was done using IBM's Heron quantum processor integrated with classical computing workflows.

Philip Intallura, HSBC's Group Head of Quantum Technologies, emphasized it represents tangible evidence of quantum computing's competitive advantages at production scale. The breakthrough positions HSBC ahead of competitors in adopting next-generation computing for financial services applications.

The Bull Case for HSBC

HSBC continues to execute its strategic transformation under the leadership of CEO George Quinn. In the first half of 2025, HSBC delivered an impressive 18% return on tangible equity, with all four priority businesses achieving mid-teens returns while generating consistent revenue growth.

CFO Pam Kaur outlined the bank's dual-track approach to value creation, which involves $1.5 billion in cost savings from organizational simplification and an additional $1.5 billion from strategic exits and portfolio optimization. The cost reduction program is ahead of schedule, with $400 million flowing to the bottom line by year-end, above the initially projected $300 million.

Wealth Management emerged as a standout performer as sales rose by 22% due to strong inflows from Hong Kong, a region that added 100,000 new customers each month. The bank added $75 billion in net new invested assets and maintained its dominant deposit franchise with $83 billion in annual growth.

Despite challenging conditions in Hong Kong's commercial real estate, HSBC maintains comfortable capital levels. It ended the quarter with a CET1 ratio of 14% while deploying capital towards buybacks and dividends. It announced a $3 billion share buyback and paid a $0.10 dividend per share. Total cash returned to shareholders hit $9.5 billion for the half-year.

Management's disciplined approach to acquisitions and focus on organic growth in wealth management and wholesale transaction banking positions HSBC well for sustained outperformance.

HSBC posted solid second-quarter results, despite the decline in Hong Kong interest rates. Revenue in Q2 climbed 5% to $17.7 billion, while fee income from transaction banking and wealth management drove most of the growth.

The bank maintained its full-year net interest income target of approximately $42 billion. Deposit growth and hedging strategies helped offset the impact from lower Hong Kong rates. Furthermore, management anticipates that rates will rebound above 2% in the third quarter.

However, Hong Kong’s commercial real estate segment continued to struggle. The bank has raised its credit loss forecast to 40 basis points for the year, up from the previously expected range of 30-40 basis points. About $1.4 billion in troubled loans have debt-to-value ratios above 70%, and HSBC has already set aside $500 million to cover potential losses.

Customer deposits jumped $83 billion over the past year, and the wealth division generated $75 billion in new invested assets.

What Is the Price Target for HSBC Stock?

Analysts tracking HSBC stock forecast revenue to rise from $67.4 billion in 2025 to $72.6 billion in 2028. In this period, adjusted earnings are forecast to expand from $1.38 per share to $1.63 per share.

Today, HSBC stock is priced at 9.9 times forward earnings, which is below its 10-year average of 10.1 times. If HSBC is priced at 10 times earnings, it could gain over 12% from current levels.

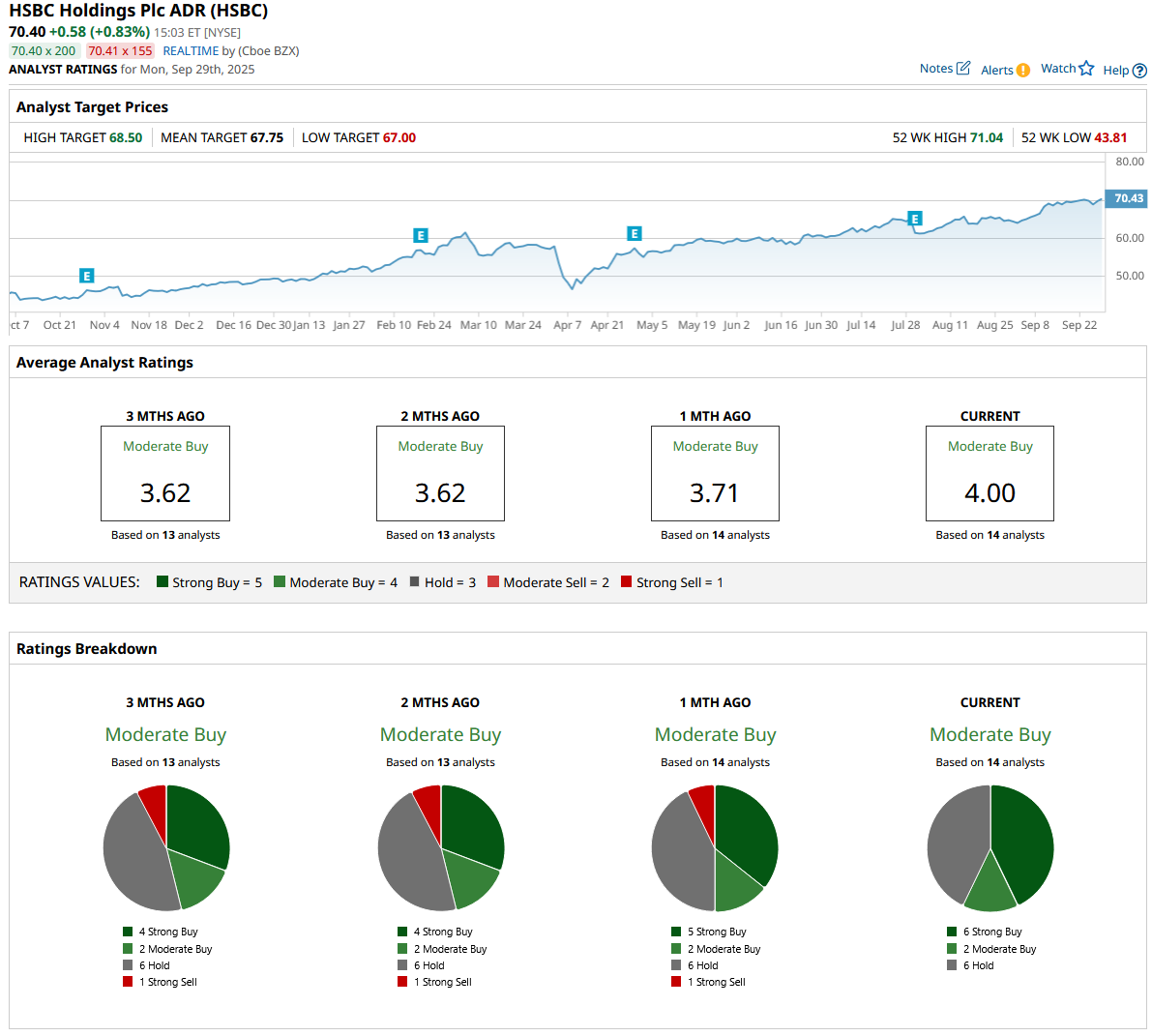

Out of the 14 analysts covering HSBC stock, six recommend “Strong Buy,” two recommend “Moderate Buy,” and six recommend “Hold.” The average HSBC stock price target is $68, just below the current price of $70.