/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

While investors chase the usual AI darlings, a quieter contender is quietly building the technology backbone for tomorrow’s data centers. Now, with new design wins, expanding margins, and breakthrough products nearing production, this overlooked chip stock could be the unexpected standout of 2026.

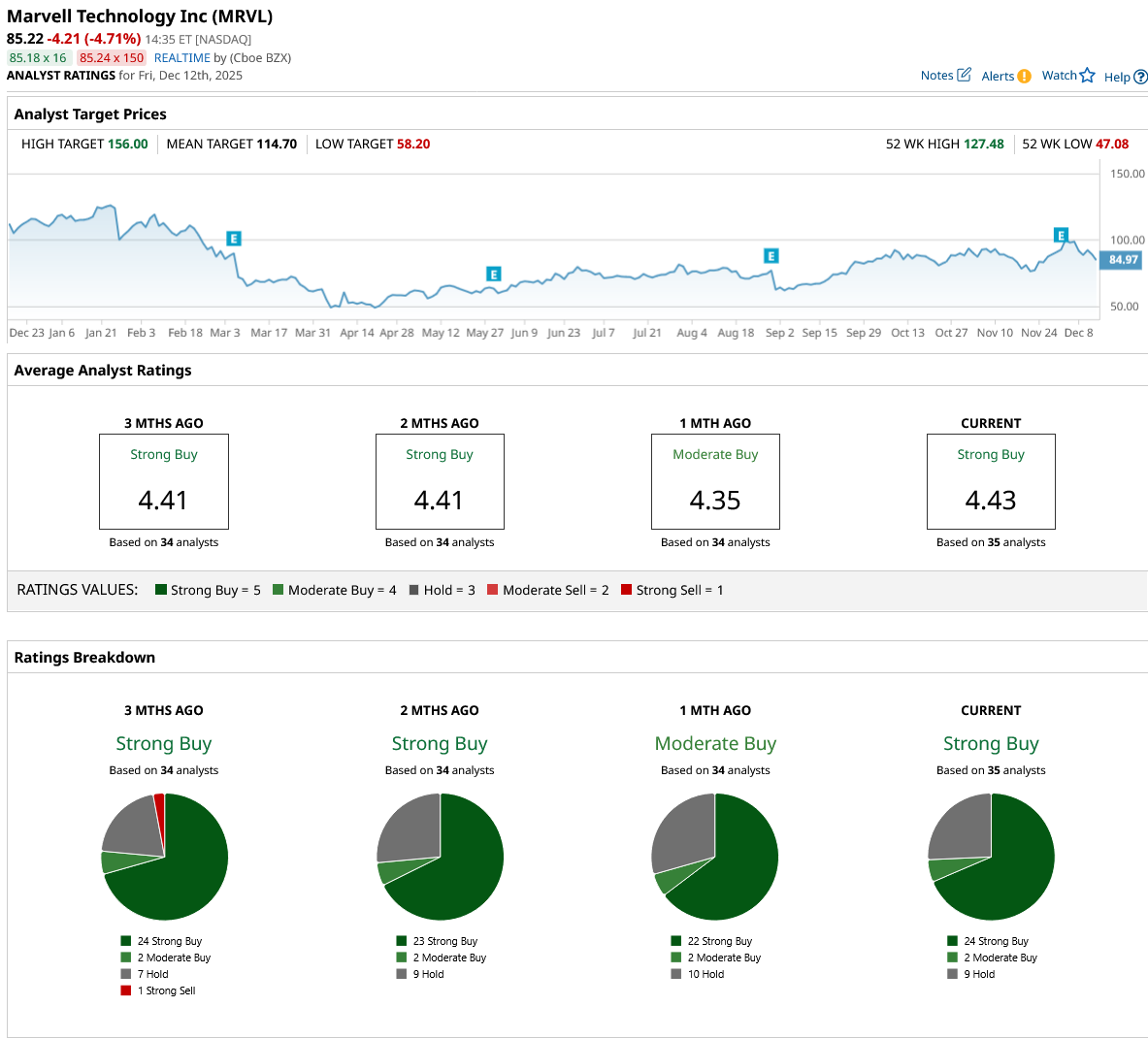

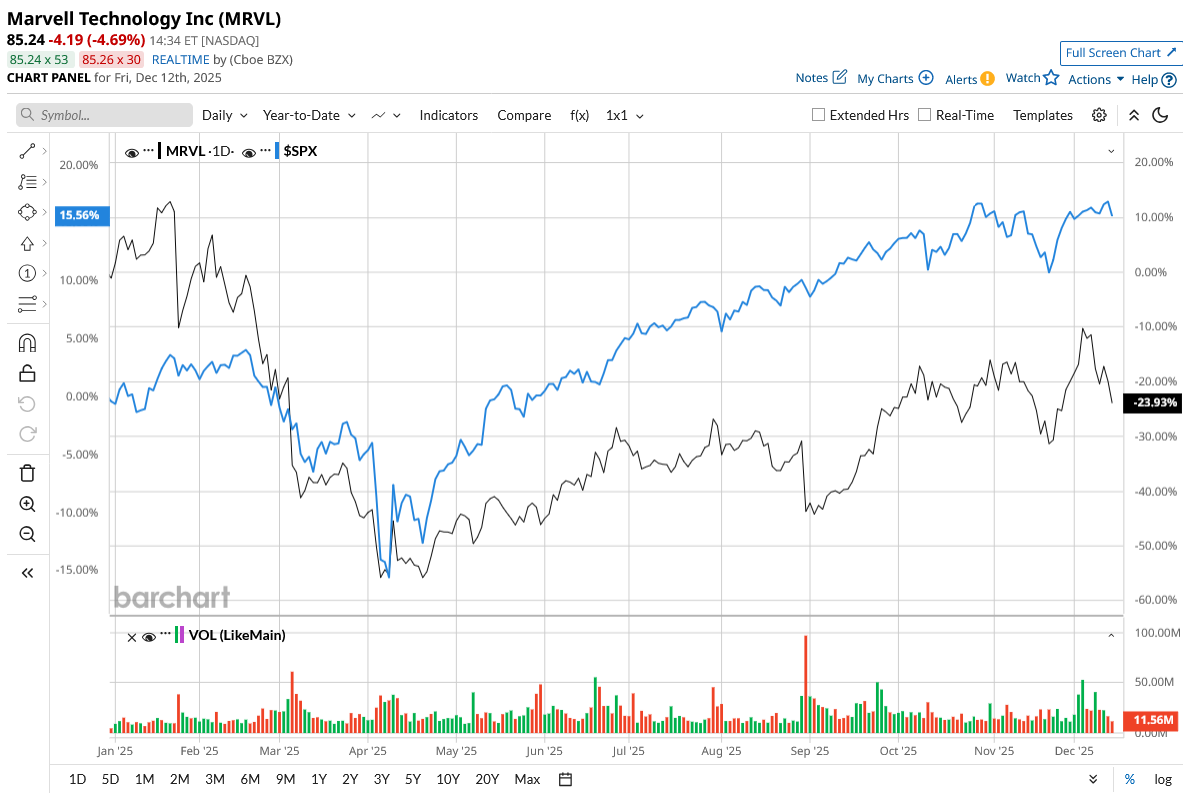

Valued at $78.4 billion, Marvell Technology (MRVL) is a semiconductor company that builds the high-speed chips and connectivity technology that power modern data centers, cloud infrastructure, AI systems, and communications networks. MRVL stock has dipped 23% year-to-date (YTD), yet Wall Street expects huge upside in 2026.

Let's dig into why.

A Quarter That Signals a New Growth Phase

Marvell Technology is stepping into 2026 with extraordinary momentum that few in the market fully appreciate yet. Marvell delivered a standout third quarter for fiscal 2026, reporting record revenue of $2.075 billion, a 37% year-over-year (YoY) increase. Momentum was fueled mostly by higher-than-expected demand in the data center business, which remains the company's growth engine.

Adjusted earnings per share came in at $0.76, surpassing analysts' projections and increasing 76% YoY. The company anticipates the pace to continue into the fourth quarter, guiding to $2.2 billion in revenue, with momentum expected to last far into the next fiscal year and beyond. Marvell’s transformation into a data center–focused company is paying off. The segment delivered $1.52 billion in Q3 revenue, up 38% YoY and ahead of guidance. Marvell’s high-speed connectivity portfolio, including PAM DSPs, TIAs, drivers, and optical interconnect solutions, contributed to this growth.

Looking ahead, Marvell expects high single-digit sequential growth in Q4 and around 20% YoY growth, with acceleration from both custom silicon and interconnect products. Along with the third quarter results, Marvell’s also announced its bold acquisition of Celestial AI, which marks the next step in data center innovation. Celestial AI is a photonic fabric platform developed for next-generation multi-rack scale-up AI systems, which is where the industry is rapidly heading. The company believes this acquisition could be a game-changer, as Celestial’s Photonic Fabric (PF) chiplet delivers 16 Tbps of bandwidth in a single chiplet, 10 times current industry standards.

Management plans to fund the deal with a mix of stock and cash on hand, without taking on additional debt, and to continue returning capital to shareholders through buybacks and dividends. Despite the heavy investments, Marvell maintained a healthy balance sheet with $2.7 billion in cash and equivalents and $4.5 billion in total debt at the end of the quarter. The company also executed its $1 billion accelerated repurchase program, an additional $300 million of buybacks through the ongoing program, and $51 million in dividends during the quarter.

A Company Hitting Its Stride

Marvell's combination of rising data center demand, early leadership in next-generation optical and PAM technologies, and the landmark Celestial AI acquisition positions the company for a strong multiyear growth cycle. Marvell forecasts data center revenue to increase by more than 25% YoY in fiscal 2027, with strength in interconnect, custom silicon, switching, and storage. These forecasts exclude any Celestial AI contribution; thus, the upside remains unpriced.

Management also emphasized that industry estimates indicate that the scale-up switch merchant market may be worth $6 billion and the optical connectivity opportunity market might be worth more than $10 billion by 2030. Celestial AI has landed a major design win with one of the world’s top hyperscalers, signaling strong industry confidence and adoption. Even without Celestial AI, Marvell's established portfolio is growing rapidly, with leadership in high-speed PAM DSPs, TIAs, drivers, and LPO, as well as its 1.6T coherent light solutions, which will ship next year, and 3.2T solutions the year after. After the acquisition closes, Marvell expects Celestial AI to contribute meaningfully with $500 million in annualized run rate by Q4 fiscal 2028 and $1 billion run rate by fiscal 2029, which will ultimately become accretive to adjusted earnings.

Wall Street also expects Marvell to grow at an exponential rate over the next two years. For the full-year fiscal 2026, analysts forecast revenue and earnings growth of 41% and 80%, respectively. Revenue and earnings are further expected to increase by 21% and 26% in fiscal 2027. Trading at 25 times forward 2027 earnings, Marvell is still a reasonable AI stock poised for explosive growth ahead.

What Is Wall Street Saying About MRVL Stock?

Overall, analysts remain strongly bullish about MRVL stock. Out of the 35 analysts covering MRVL, 24 have rated it a “Strong Buy,” two have a “Moderate Buy” recommendation, and nine suggest a “Hold.” The average price target for MRVL stock is $114.70, which implies potential upside of 35% from current levels. Additionally, its high target price of $156.60 implies potential upside of 84% in the next 12 months.

With record revenue, industry-leading technology, in-depth hyperscaler engagements, and exposure to the fastest-growing segments of AI infrastructure, Marvell is emerging as the chip stock few expect but one poised to shine brightly in 2026.