/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

Argan (AGX) is attracting fresh buzz on Wall Street following J.P. Morgan's upgrade of the stock to "Overweight" and its approximately 45% larger price target. AGX stock surged over 13% to a record high this week, continuing a resilient year-long streak that has seen the company's value almost triple. This comes at a time when investors are becoming more eager to bet on second beneficiaries of the buildout of AI infrastructure, especially those with the potential to power the enormous power capacities required to fuel data centers.

The wider market has bounced in 2025 on a growing consensus that the U.S. grid will need hundreds of new gigawatts of generation by 2030. With its record backlog, cashed-up balance sheet, and track record of execution through subsidiary Gemma Power Systems, Argon is fast becoming one of the least obvious but most clear-cut plays on this transformation.

About Argan Stock

Argan is an Arlington, Virginia-based engineering and construction business that focuses on big-energy infrastructure projects on a large scale with subsidiaries like Gemma Power Systems. With a market value of approximately $4 billion, Argan is a top constructor of fossil fuel-based and green-based power plants. Both of which are much needed due to the fast-growing electrification and AI data center buildup in the U.S.

AGX stock has increased by over 120% in the previous 52 weeks, significantly outperforming the S&P 500 Index's ($SPX) approximately 13% rise. Recent shares have touched an all-time high of $320 before settling around $296, highlighting persistent investor optimism following J.P. Morgan's new “Overweight” with a $315 price target.

At these levels, Argan carries a trailing price-to-earnings (P/E) multiple of 37.6 and a forward multiple of approximately 40.3, higher than its historical averages but tolerable given record visibility of growth. With a price-to-sales (P/S) multiple of 4.75 and a price-to-book (P/B) multiple of 10.56, it indicates high-end multiple premiums for a company that carries no debt and has returns on equity exceeding 32%. While valuation seems stretched relative to baseline engineering peers, its distinctive exposure to the AI energy cycle potentially requires the elevated multiple.

Argan also pays capital back to shareholders in the form of quarterly dividends, recently increased to $0.375 per share, resulting in an annualized yield of approximately 0.5%. Growth in dividends has been consistent, underpinned by a healthy free flow of funds and a healthy balance sheet with $572 million in cash and investments.

Argan Trumps on Earnings and Gains Backlog Orders

Argan's fourth-quarter results bolstered its top dog status in the developing U.S. power buildout market. Revenue in fiscal Q2 2026 was $237.7 million, a 4.7% year-over-year (YoY) increase, and EPS was $2.50, up 91% from $1.31 in the comparable year-ago quarter. EBITDA rose 46% to $36.2 million, with margins widening 430 basis points to 15.2%—an unambiguous indication of stronger execution in projects.

High point was a record project backlog of $2.0 billion compared to a year-long beginning-of-the-year total of $1.36 billion. That backlog provides multi-year revenue visibility, with accelerating energy capacity requirements across gas and renewables projects. Management also highlighted operational achievements, such as completing an LNG project in Louisiana and accelerating the construction of main power plants, including Trumbull and the 170-MW Platin Power Station in Ireland.

CEO David Watson commented that Argan is still "well positioned to capitalize on the pressing need for reliable sources of energy to harden the power grid." Argan's history of EPC execution on mega-power projects aligns precisely with the surge in AI infrastructure, where data centers require ever-available baseload generating capability.

Ahead, Argan's diversified project backlog and balance sheet strength position it to capitalize on the structural growth in U.S. power consumption. With no long-term debt, record liquidity, and an expanding pipeline of U.S. and international projects, the company's growth momentum seems sustainable up to FY2027.

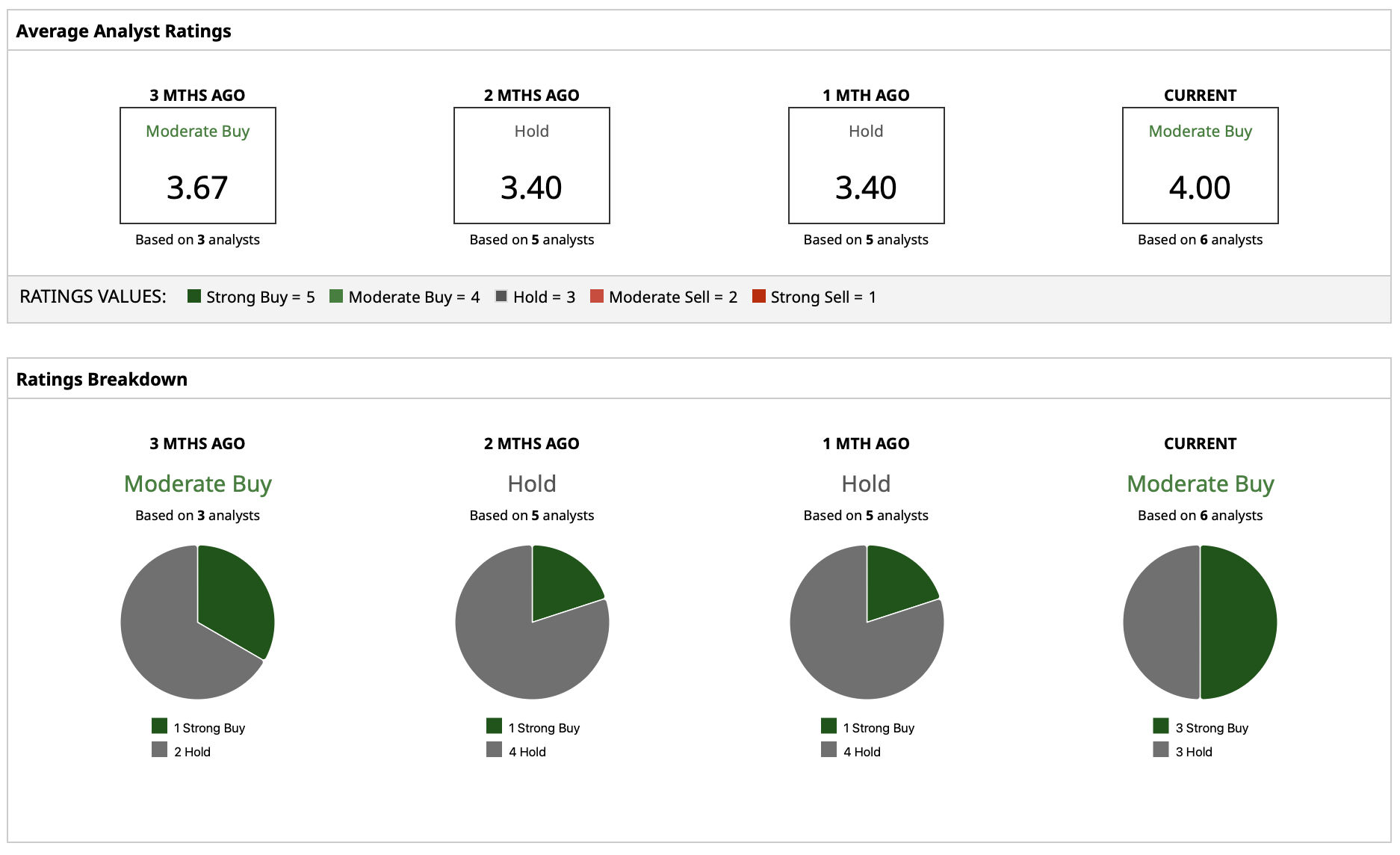

What Do Analysts Expect for AGX Stock?

In the aftermath of the strong earnings and sector bull winds, J.P. Morgan elevated Argan to “Overweight” from “Neutral” due to its "underappreciated exposure to AI-centric power demand." The bank increased its price target to $315 from $220, reflecting that the backlog extending easily into a multi-year outlook, likely in excess of $2 billion by year-end, provides visibility into multi-year margin expansion.

Additionally, AGX earns a “Moderate Buy” rating with a mean price target of $244, with the Street-low of $315 and bottom estimate of $150. Based on the latest share price in the mid-$280s, that represents approximately -15% downside to the mean and potential upside elsewhere if execution stays ahead of estimates.