/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

One of the companies that has quietly delivered one of the best performances in the market this year is Ferrovial SE (FER). The stock is up over 60% this year, which is a significantly better performance than most major indices. It will soon be added to the Nasdaq 100 Index ($NASX) when the index is rebalanced on Dec. 22. Such a moment is significant for a lesser-known stock.

Being part of the Nasdaq 100 is important since it supports over $600 billion in assets worldwide. Being added to this index can therefore lead to increased demand through passive investment, enhanced liquidity, and increased awareness. As a company with a business model based on infrastructure and longevity rather than hype, this spotlight can prove critical.

About Ferrovial Stock

Ferrovial SE (FER) is a global infrastructure operator with a focus on Europe and North America. Its main exposure is to toll roads, airports, construction, and services. The company has strong assets in Europe and North America, including a major interest in Heathrow Airport. With a market capitalization of nearly $50 billion, Ferrovial is a large-cap stock and is considered a defensive compounder rather than a cyclical stock.

FER stock's performance has been excellent. The stock is currently trading around $68, just under its 52-week high of $68.01. It began this year in the low $40s. This performance exceeds the gain in the S&P 500 Index ($SPX) over the same time frame. The relative strength is very high due to continuous accumulation rather than a one-off surge.

Where views start to split is in the area of valuation. Ferrovial is currently valued at a multiple of 5x sales, a premium compared to most other typical industrial stocks. Nevertheless, based on the quality of assets, concession lengths, and high margins, this multiple can be explained. The company generates net income of $3.2 billion yearly, with $9.1 billion in sales and margins above 35%. The stock is not based on speculation but rather resilience.

Ferrovial Delivers Solid Results as Visibility Improves

Recently, Ferrovial's financial results have emphasized why the stock has re-rated higher. The company achieved approximately $2.44 billion in revenue during the most recent quarter, which puts it on a strong trajectory to deliver another excellent year. Although earnings per share (EPS) can be a less reliable performance metric in infrastructure companies because of asset revaluations and divestitures, financial fundamentals continue to be good.

The company remains committed to prudent capital allocation, rebalancing existing mature assets, and allocating them to projects with high returns. Such a capital allocation strategy has enabled Ferrovial to maintain a flexible balance sheet with minimal financial risk, which contributes to its low beta of approximately 0.20 over the past five years.

Going forward, this inclusion in the Nasdaq 100 will not have an effect on Ferrovial’s fundamentals but rather will enhance the stock's positioning. Increased institutional ownership may help bridge the gap between Ferrovial and other better-known companies in the U.S. infrastructure space. At this stage, Ferrovial hasn't announced a release in the next two weeks, so index-driven flows have a higher chance of influencing trade in the short term.

What Do Analysts Expect for Ferrovial Stock?

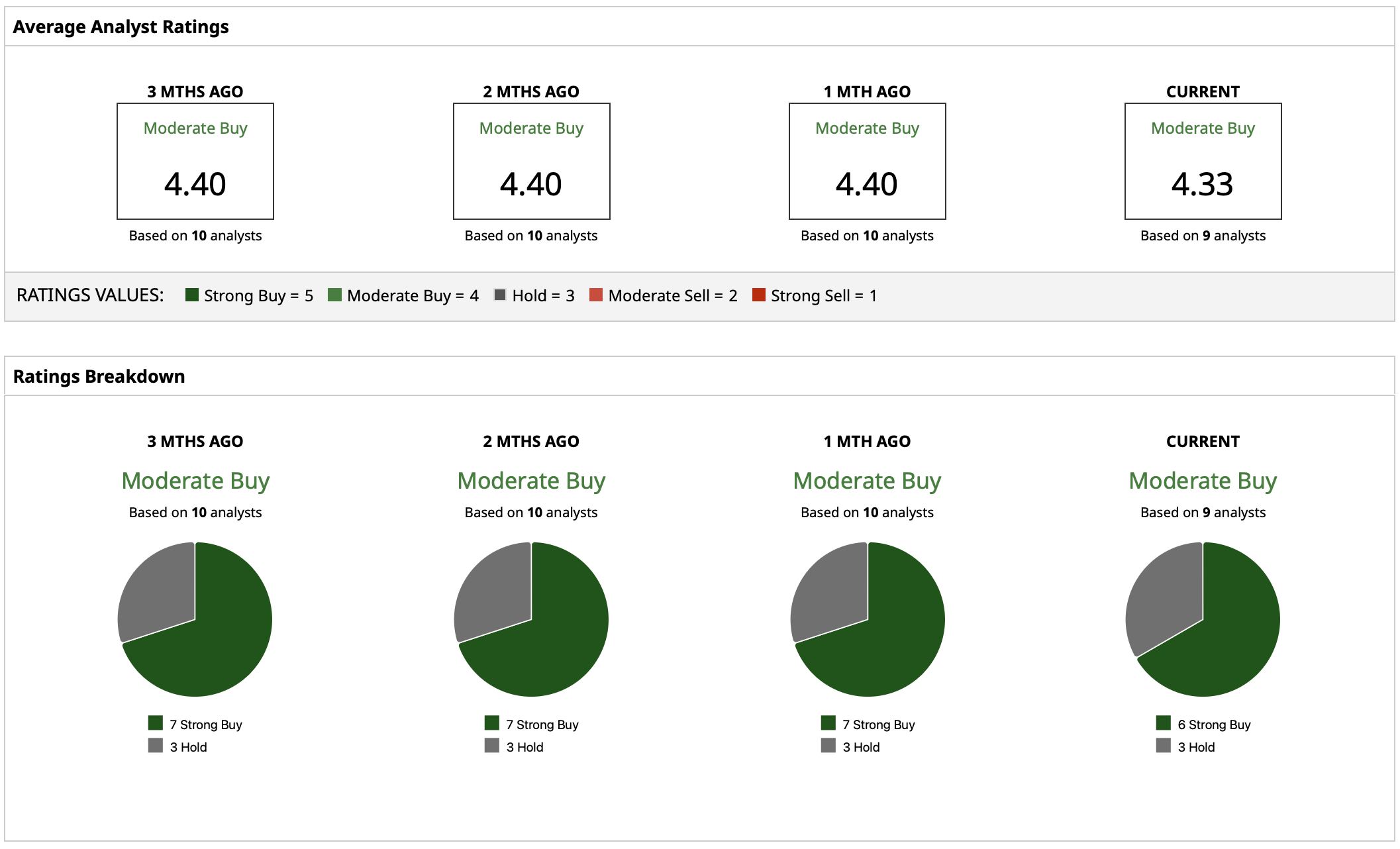

Ferrovial earns a “Moderate Buy” rating and has a wide array of price targets. On the high end, they reach up to $72. The minimum price target is approximately $49. The average price target of approximately $60 represents downside potential of roughly 11%, implying that most of the positive news is already priced in. Most analysts see Ferrovial as part of a good-quality, lower-risk investment portfolio rather than a vehicle for aggressive gains.