Shares of Bakkt Holdings Inc. (NYSE:BKKT) rose in Thursday’s trading after the cryptocurrency custody company announced plans to raise as much as $1 billion, with proceeds potentially getting allocated to buy Bitcoin (CRYPTO: BTC).

What Happened: The possible shelf offering might include sales of Bakkt’s Class A common stock, preferred stock, warrants, and debt securities, according to an SEC filing. The funds are expected to be used for working capital and general corporate purposes, with a portion potentially allocated to Bitcoin.

Bakkt announced an updated investment policy earlier this month to use the excess capital at its disposal to buy Bitcoin and other digital assets. However, the firm has not yet made any crypto purchases as yet, according to the SEC filing.

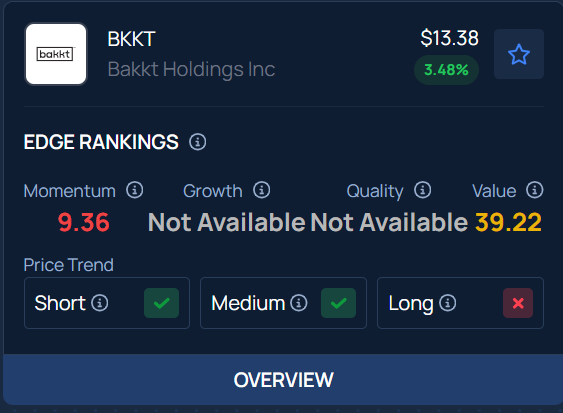

As of this writing, the BKKT stock lags in terms of Momentum and Value. Visit Benzinga Edge Stock Rankings to discover the top five cryptocurrency stocks based on these criteria.

Bakkt, which went public in October 2021 via a SPAC merger, was reportedly being considered for acquisition by Trump Media & Technology Group. (NASDAQ:DJT), which is owned by President Donald Trump, last November. The company’s shares witnessed a significant surge back then.

Price Action: Shares of Bakkt closed 3.09% higher at $13.33 during Thursday’s regular trading session, according to data from Benzinga Pro. Year-to-date, the stock has plunged 46% in value.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo: Shutterstock