Lam Research Corp (NASDAQ:LRCX), a go-to supplier for chip giants like Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM) and Samsung Electronics Co (OTCPK:SSNLF), just flashed a golden signal on its chart – a technical Golden Cross – as the stock surged nearly 25% year to date.

For the uninitiated, a Golden Cross occurs when a stock's short-term moving average breaks above its long-term average, hinting at sustained bullish momentum.

And Lam just did it in style – its 50-day simple moving average (SMA) has now decisively crossed above its 200-day average, turning heads in the semiconductor corner of Wall Street.

Read Also: Here’s How Much You Would Have Made Owning Lam Research Stock In The Last 10 Years

Chart created using Benzinga Pro

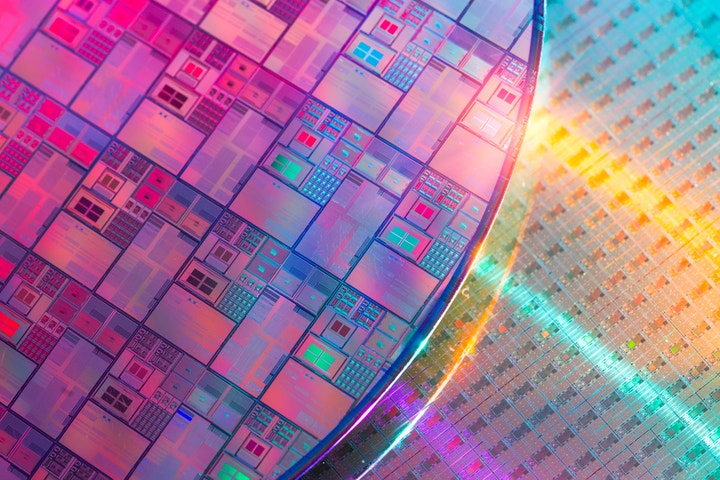

From Fab Floors to Stock Floors

Lam isn't just another tech stock – it's a critical cog in the global chip machine, making the tools that power deposition and etch processes. That's tech-speak for helping build and carve microscopic chip features layer by layer. With a dominant share in etch and a solid second place in deposition, Lam's gear sits inside the fabs of TSMC, Samsung, Intel Corp (NASDAQ:INTC) and Micron Technology Inc (NASDAQ:MU).

Despite a 12% dip over the past month, LRCX is now showing signs of strength. With its price at $90.49, above the 50-day SMA of $79.38 and the 200-day SMA of $77.42, multiple technical signals are flashing green. The MACD (moving average convergence/divergence) at 3.33 and RSI (relative strength index) at 62.01 further support a growing bullish trend.

Betting On The Memory Cycle?

Lam's reliance on memory chipmakers (DRAM and NAND) has made it more cyclical than some peers – but that's turning into a feature, not a bug.

As demand rebounds and capex from big players like Samsung and Micron ramps back up, Lam could ride the wave of equipment upgrades and restocking.

The Quiet Golden Opportunity

The Golden Cross may be quiet, but it’s loud enough for traders and long-term investors to pay attention. With AI, advanced packaging, and chip expansion cycles ramping globally, Lam Research may have just etched a path higher.

Read Next:

Photo: Shutterstock