Cryptocurrency stocks have long been a magnet for speculative investors, with wild swings that can generate both fortunes and heavy losses in short order. Bitcoin miners, in particular, often ride the momentum of crypto rallies, only to face sharp reversals when energy costs rise or digital assets stumble. Still, the potential upside keeps drawing attention to the sector, especially when political ties or high-profile backers add fuel to the story.

One of the latest entrants is American Bitcoin (ABTC), which made its market debut this week after merging with Gryphon Digital Mining. Shares more than doubled in early trading on opening day as the company announced it had boosted its installed hashrate to 24 EH/s, powered by thousands of new ASIC servers.

For investors intrigued by the mix of politics, crypto, and scale expansion, ABTC is one to watch closely.

About ABTC Stock

American Bitcoin, a bitcoin-mining company backed by President Donald Trump’s sons, made its Nasdaq debut last week and quickly drew attention with sharp trading swings.

The stock opened near $8 and surged intraday to $14.65, more than doubling at its peak. Shares later reversed, closing the session at $7.33, below the initial trading price. At its high, the rally temporarily valued the Trump family’s roughly 20% stake at $2.6 billion before ending the day at nearly $1.5 billion.

The volatile debut came against a softer backdrop for cryptocurrencies. Bitcoin (BTCUSD) slipped 2% during the session, while other crypto-related stocks also moved lower, raising questions about whether ABTC’s first-day moves reflected enthusiasm for the Trump-linked venture or short-term speculative trading.

Trump Family-Backed Miner Expands Bitcoin Capacity

ABTC is 80% owned by crypto miner Hut 8 (HUT) and 20% by Donald Trump Jr. and Eric Trump. The new company was created via a merger with Gryphon Digital Mining, and its stated strategy is to both mine bitcoin and accumulate bitcoin as a treasury asset. The firm even touts plans to use its public-market capital to keep buying BTC in the open market.

At its debut, it held about 2,443 bitcoins (worth roughly $269 million at current prices) on its balance sheet. ABTC doubled its mining power to 24 EH/s by adding new rigs. The machines run efficiently, keeping bitcoin mining costs about half of the current bitcoin prices.

Financials

Financially, ABTC is still very much in a build-out phase. In Q2 2025, it reported about $30.3 million in revenue versus $13.9 million a year earlier, with a cost of revenue (mining expenses) around $15.3 million. That left a small operating profit of $4.4 million and a net income of $3.4 million for the quarter, compared to large losses in 2024. On a year-to-date (YTD) basis, the company has swung back to a net loss due largely to non-cash swings in bitcoin values.

Notably, the combined balance sheet as of June 30 showed $205.9 million in cash on hand, reflecting funds from the merger and capital raises. In other words, ABTC starts trading with a very strong cash cushion and expanding asset base, but it has also spent heavily on new equipment and bitcoin purchases.

Analysts' Opinion and Final Words

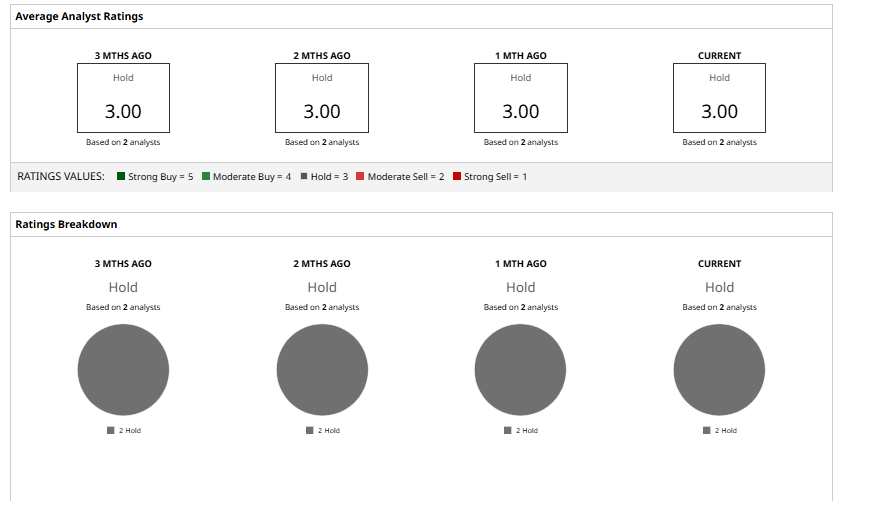

Wall Street has taken a cautious stance on ABTC stock. Among the only two analysts covering the stock, the unanimous rating is “Hold.”

In my opinion, ABTC’s debut highlights both its potential and its risks. The company has strong backing and ample capital, and it is rapidly scaling up mining capacity and bitcoin holdings. However, the bitcoin mining business remains extremely competitive: power costs are high and margins thin, so profitability depends on keeping costs low and bitcoin prices high.

As of now, ABTC is not yet a proven profit generator; it swings between modest gains and losses as it builds out its infrastructure. On valuation, the stock is trading near its IPO level, implying that today’s price already reflects significant growth expectations.

Given the above, a cautious stance is warranted. ABTC may have promise if it can consistently mine cheaply and accumulate bitcoin to ride any rally, but for now investors should wait for more of a track record.