Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- JP Morgan analyst Rohin Patel downgraded Haemonetics Corp (NYSE:HAE) from Overweight to Neutral and slashed the price target from $85 to $62. Haemonetics shares closed at $55.63 on Thursday. See how other analysts view this stock.

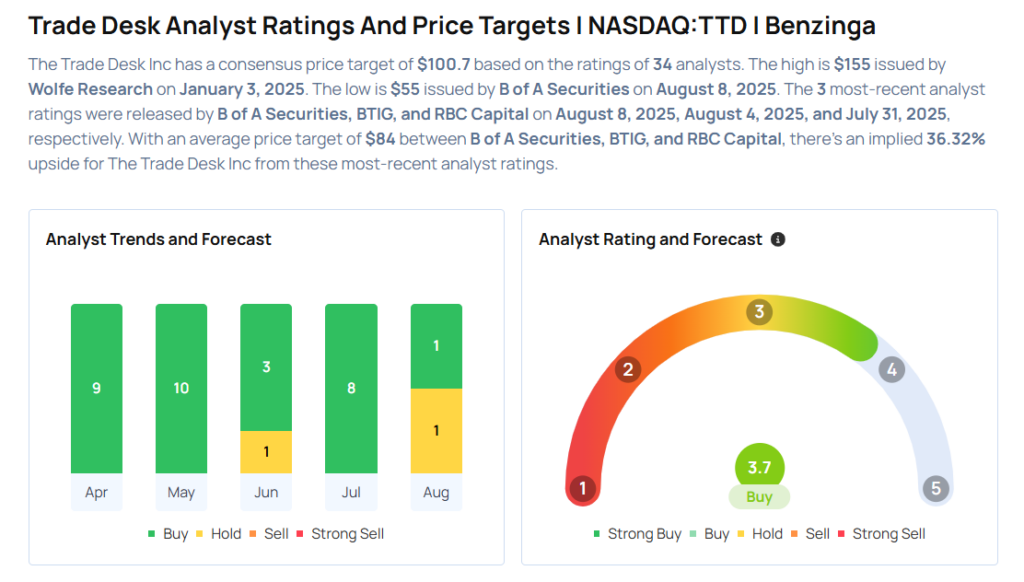

- B of A Securities analyst Jessica Reif Ehrlich downgraded Trade Desk Inc (NASDAQ:TTD) from Buy to Neutral and cut the price target from $130 to $55. Trade Desk shares closed at $88.33 on Thursday. See how other analysts view this stock.

- Barclays analyst Adrienne Yih downgraded Crocs Inc (NASDAQ:CROX) from Overweight to Equal-Weight and lowered the price target from $119 to $81. Crocs shares closed at $74.39 on Thursday. See how other analysts view this stock.

- Loop Capital analyst Jeffrey Stevenson downgraded Installed Building Products Inc (NYSE:IBP) from Buy to Hold. Installed Building Products shares closed at $255.21 on Thursday. See how other analysts view this stock.

- Wells Fargo analyst Joseph O’Dea downgraded the rating for Rockwell Automation Inc (NYSE:ROK) from Overweight to Equal-Weight and slashed the price target from $365 to $345. Rockwell Automation shares closed at $332.59 on Thursday. See how other analysts view this stock.