/A%20concept%20image%20of%20a%20self-driving%20car%20image%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Pony AI (PONY) is accelerating its global expansion with a strategic partnership to deploy robotaxis in Qatar, marking a key milestone in the company's ambitious rollout of autonomous vehicles across the Middle East. Earlier this week, Pony AI announced a partnership with Mowasalat (Karwa), Qatar's largest transportation provider, to test robotaxis on Doha's public roads.

This collaboration follows Pony AI's existing presence in Dubai and is a key step toward the company's "autonomous mobility everywhere" vision. The initial testing phase includes safety operators as the technology adapts to Qatar's unique driving conditions, weather patterns, and infrastructure.

This partnership provides Pony AI with access to a market that is preparing for major infrastructure investments and smart city initiatives.

Pony AI Focuses on Operational Scale

Pony AI's expansion comes as it demonstrates impressive operational metrics. Over 200 Gen-7 robotaxis have rolled off production lines since mass production began, with the company targeting 1,000 vehicles by year-end.

Fare-charging revenues surged over 300% year-over-year (YoY) in Q2, while total revenue rose by 76%. Pony AI now operates fully driverless commercial services in all four of China's tier-one cities and recently launched 24/7 coverage in certain areas. In the June quarter, registered users increased 136% YoY, indicating strong consumer adoption.

The China-based company has achieved technological differentiation by reaching what management calls the "third stage" of Level 4 (L4) development, where it operates hundreds of fully driverless vehicles at scale.

This distinguishes Pony AI from competitors that still require safety operators. The 70% reduction in bill-of-materials costs for Gen-7 vehicles demonstrates meaningful progress toward viable unit economics, while operational improvements, such as achieving a 1:30 remote assistant-to-vehicle ratio, show clear paths to profitability. Management's emphasis on safety, redundancy, and rigorous engineering practices lends credibility, given their over 2 million kilometers of accident-free driving.

However, the company remains unprofitable as net losses widened to $53.3 million in Q2 from $30.9 million year-ago, despite strong revenue growth. Non-GAAP losses of $46.1 million reflect substantial ongoing cash burn, primarily due to R&D and mass production investments.

While the company holds $747.7 million in cash and equivalents, the current burn rate raises questions about the runway duration without additional funding. Operating expenses surged 75% YoY, indicating costs are scaling faster than revenues.

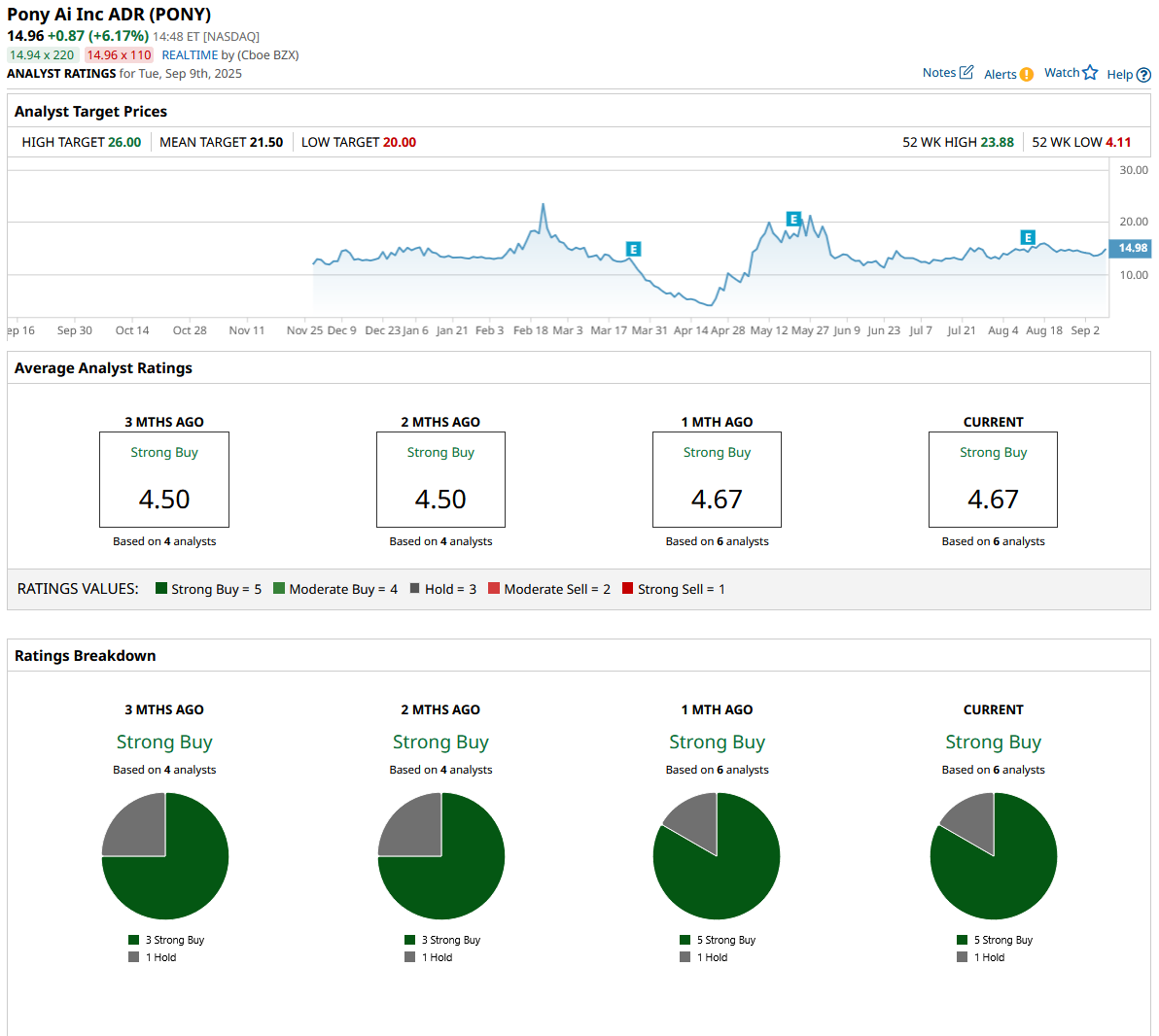

What Is the Price Target for PONY Stock?

Analysts tracking PONY stock forecast revenue to rise from $75 million in 2024 to $1.21 billion in 2029. Moreover, the company is forecast to report adjusted earnings of $157.5 million, or $0.47 per share, in 2029, compared to a loss per share of $0.54 in 2025.

Out of the six analysts covering PONY stock, five recommend “Strong Buy,” and one recommends “Hold.” The average Pony AI stock price target is $21.50, about 43% above the current price.

The Middle East expansion offers access to markets with infrastructure investment and regulatory support for emerging technologies.

Pony AI's expansion demonstrates technological capability and regulatory acceptance. However, the autonomous vehicle industry remains capital-intensive with uncertain timelines to profitability. Competition from Tesla (TSLA), Waymo, and other players is expected to intensify as the market matures.

Pony AI's first-mover advantage in multiple international markets, proven fully driverless operations, and strategic partnerships with established transportation providers position it well for the autonomous mobility transition.