As shares of project management tool Asana Inc. (NYSE:ASAN) continue to languish near their all-time lows, the company’s founder and CEO, Dustin Moskovitz, is signaling confidence by aggressively acquiring its shares.

Check out the current price of ASAN stock here.

What Happened: According to a Form 4 filed with the Securities and Exchange Commission (SEC) last week, Moskovitz acquired 450,000 shares in the company across two transactions on July 1 and July 2, worth a total of $6.1 million, as part of a pre-arranged Rule 10b5-1 trading plan, adopted on September 2024.

Moskovitz, best known as one of the co-founders of Facebook, now referred to as Meta Platforms Inc. (NASDAQ:META), before he started Asana, has been buying shares in the project management platform he heads, hand over fist, in recent months, with year-to-date acquisitions at over $14 million.

With his direct and indirect holdings now exceeding 56 million shares, Moskovitz remains Asana's largest shareholder, wielding significant voting power.

Why It Matters: This comes as Asana shares remain down by 26.5% year-to-date, and 89.78% from its all-time high in 2021, helping shore up confidence in the stock.

During its first quarter earnings results a month ago, Asana reported $187 million in revenue, ahead of consensus estimates at $185 million. Earnings came in at $0.05 per share, well ahead of analyst estimates at $0.02 per share, as the company witnessed strong growth in customers spending $100,000 or more annually.

Senior analyst, Patrick Walravens, at JMP Securities, currently holds the high-end of the Street’s price target for the stock at $22 per share, representing a 50% upside from current levels.

Walravens cited the company’s first-ever positive operating margins during the first quarter for his decision. Analysts, however, continue to caution investors regarding macro uncertainties that could impact the stock going forward.

Price Action: Shares of Asana were down 1.29% on Wednesday, trading at $14.58, and are up 1.85% after hours.

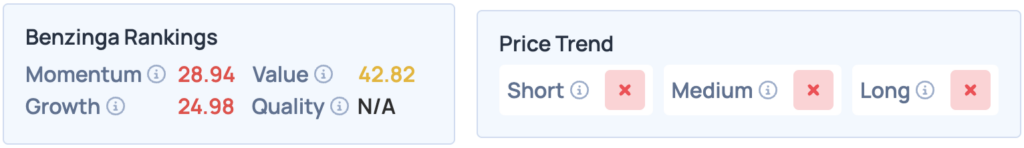

The company scores poorly across the board in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Photo Courtesy: FellowNeko from Shutterstock

Read More: