Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- Needham analyst Gil Blum downgraded the rating for Sarepta Therapeutics, Inc. (NASDAQ:SRPT) from Hold to Underperform. Sarepta Therapeutics shares closed at $14.07 on Friday. See how other analysts view this stock.

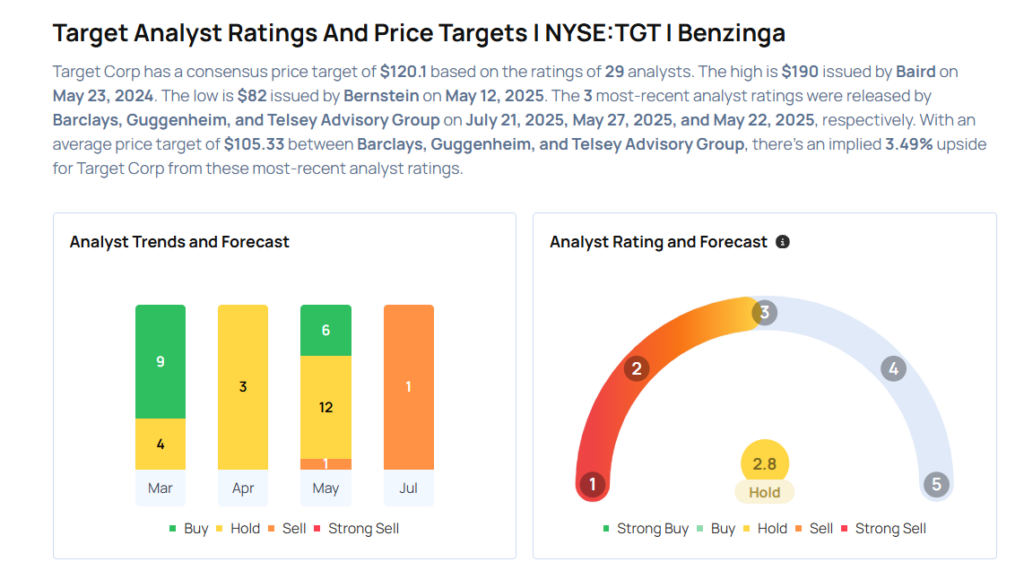

- Barclays analyst Seth Sigman downgraded Target Corporation (NYSE:TGT) from Equal-Weight to Underweight and announced a $91 price target. Target shares closed at $103.46 on Friday. See how other analysts view this stock.

- Leerink Swann analyst Mani Foroohar downgraded Sarepta Therapeutics, Inc. (NASDAQ:SRPT) from Outperform to Market Perform and cut the price target from $45 to $10. Sarepta Therapeutics shares closed at $14.07 on Friday. See how other analysts view this stock.

- Truist Securities analyst Patrick Scholes downgraded Royal Caribbean Cruises Ltd. (NYSE:RCL) from Buy to Hold but raised the price target from $275 to $337. Royal Caribbean shares closed at $350.10 on Friday. See how other analysts view this stock.

- TD Cowen analyst Ryan Langston downgraded Centene Corporation (NYSE:CNC) from Buy to Hold and cut the price target from $73 to $33. Centene shares closed at $27.95 on Friday. See how other analysts view this stock.

Considering buying TGT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock