/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)

Dell Technologies (DELL), the hardware backbone of the digital economy, has earned a “Strong Buy” rating in the analyst community. Dell, once known primarily for its personal computers, is now soaring to new heights, driven by increasing demand for AI servers and data infrastructure. Analysts’ confidence suggests that the company’s fundamentals, growth potential, and financial outlook are all sufficiently strong to outperform the market and its peers over the next six to 12 months.

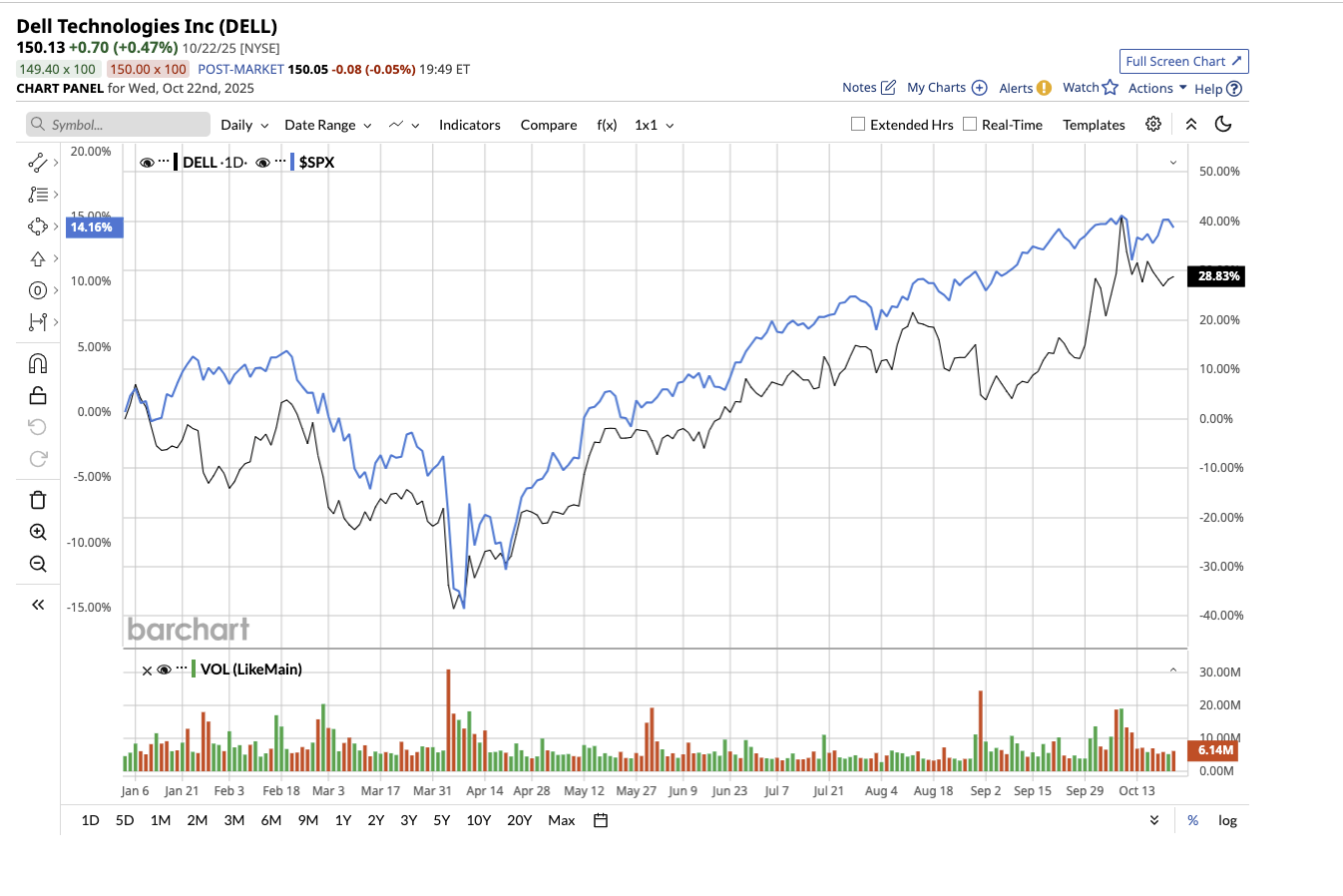

Dell stock has surged 33.8% year-to-date, outpacing the S&P 500 Index ($SPX) gain of 14.6%. Let’s see if the stock is a buy now.

AI Servers Power a Record Quarter

Valued at $100.9 billion, Dell provides everything from personal computers to the high-performance servers that power AI, cloud computing, and enterprise data centers. It also supplies data storage hardware and software, which enterprises use to securely manage and recover large amounts of data.

In its most recent second quarter of fiscal 2026, Dell showcased how its strategic shift toward AI servers, data center modernization, and flawless execution is translating into meaningful growth and shareholder value. The company reported revenue of $29.8 billion, a 19% year-over-year increase, driven by strong demand for AI servers and enterprise adoption. Its Infrastructure Solutions Group (ISG), which drives Dell’s AI and data center business, increased by 44% to a record $16.8 billion. Server and networking revenue in the ISG segment increased by 69% to $12.9 billion, powering enterprise data centers and AI workloads.

The company’s 17th-generation servers, which were introduced this quarter, are geared for increased performance and efficiency, allowing customers to combine workloads and prepare infrastructure for AI integration. With more than 70% of the installed base still using 14th-generation or older servers, Dell sees major upgrade opportunities ahead.

Dell’s Client Solutions Group (CSG), which comprises PCs and notebooks, increased revenue by 1% to $12.5 billion, with business PCs rising 2% and consumer PCs falling 7%. Despite the revenue decline, profitability increased due to deflationary tailwinds and stronger product positioning. At the time, management anticipated that the Windows 10 end-of-life event would kick off a broad PC refresh cycle.

The AI Story Stood Out

Dell’s AI story stood out. The company received $5.6 billion in AI server orders, sold $8.2 billion, and ended the quarter with a $11.7 billion backlog, a clear indication of future revenue. Notably, Dell shipped more AI servers in the first half of 2025 than in the entire year of 2024, exhibiting rapid execution and market momentum.

According to COO Jeffrey Clarke, AI is a “significant tailwind” for the business. He added, “We are innovating at an unprecedented pace, engineering at scale solutions for customers while remaining agile to rapidly changing customer roadmaps and architectures.”

Dell was the first to ship Nvidia’s (NVDA) GB200 NVL72 and GB300 NVL72 systems, which are cutting-edge AI hardware intended for next-generation computing clusters. The company also shipped the first GB300 NVL72 devices to CoreWeave (CRWV) in July, showcasing its ability to adapt to rapidly developing AI architectures. Dell’s latest NVIDIA RTX Pro 6000 AI manufacturing solutions are also gaining popularity.

While revenue growth has been stellar, management also highlighted that structural improvements are driving profitability. Operating expenses fell 4% despite the company’s significant investment in R&D and modernization. This discipline resulted in a 19% increase in adjusted diluted earnings to $2.32 per share in Q2. Additionally, CFO Yvonne McGill stressed the company's ability to execute efficiently while creating substantial cash flow to deliver to shareholders. Dell earned $2.5 billion in operating cash flow in the second quarter and had $9.8 billion in cash and investments at the end. The company returned $1.3 billion to shareholders through buybacks and dividends. Since the beginning of fiscal 2023, Dell has returned $14.5 billion to shareholders, demonstrating its commitment to capital discipline.

Given its blockbuster first half, Dell raised its full-year guidance. The company now forecasts fiscal 2026 revenue to range between $105 billion and $109 billion, up 12% year-over-year at the midpoint. AI server shipments could total around $20 billion. ISG growth is predicted in the mid- to high-20% range, whereas CSG growth is expected in the low- to mid-single digits. Adjusted earnings are expected to be around $9.55 (plus or minus $0.25), a 17% increase at the midpoint.

Management stated that the global demand for AI hardware and services is projected to double from $184 billion in 2024 to $356 billion by 2028. Dell’s ability to scale manufacturing, deploy turnkey AI systems, and retain financial discipline differentiates it from traditional hardware peers and positions it well to capitalize on this wave.

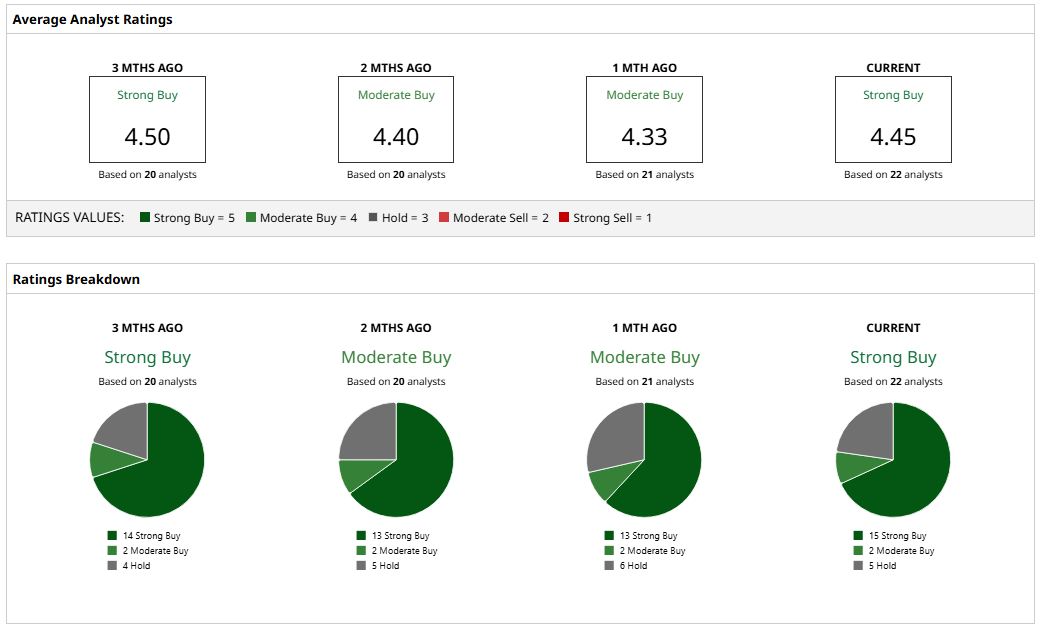

What Does Wall Street Say About Dell Stock?

Overall, analysts have rated Dell stock a “Strong Buy.” Out of 22 analysts covering the stock, 15 have a “Strong Buy” rating, two suggest a “Moderate Buy” rating, and five have a “Hold” rating. The stock has an average target price of $164.58, indicating 6.5% expected upside from current levels. Plus, its high target price of $200 implies the stock could rally 30% over the next 12 months.

With six quarters of double-digit ISG growth, record revenue and EPS, and rising AI momentum, it is no surprise that Dell Technologies has received a “Strong Buy” rating from several analysts. Dell, trading at 15 times forward earnings, is a reasonable AI stock to buy right now.