/Western%20Digital%20Corp_%20logo%20on%20sign-by%20360b%20via%20Shutterstock.jpg)

The world is in the midst of a technological investment boom unlike any before it. Global spending on AI-driven infrastructure is set to skyrocket to $6.7 trillion by 2030, with nearly $3.1 trillion earmarked specifically for advanced chips and data center technology powering artificial intelligence (AI). This staggering allocation has ignited unprecedented demand for high-capacity data storage solutions, rapidly increasing the stakes for providers at the center of this transformation.

Riding this is the Western Digital Corporation (WDC), a name familiar to many but more relevant than ever in today’s financial headlines. Morgan Stanley recently made headlines by reiterating its “Outperform” rating and raising its price target to $171, citing the explosive, multi-trillion-dollar opportunity unfolding in AI infrastructure.

With its strategic pivot to focus squarely on hard disk drives, Western Digital now finds itself at the heart of a burgeoning global data boom. Can Western Digital’s timely transformation and dominant position keep pace with the world’s runaway AI ambitions, or will fresh challenges test even the boldest optimists? Let’s explore what’s really driving this storage giant’s remarkable ascent.

Numbers That Tell the Story

Western Digital Corporation designs innovative hard disk drives and storage solutions for AI-powered data centers and enterprise customers. This company instituted a recurring dividend, offering an annual payment of $0.40 per share, with a forward yield of 0.37%. The most recent quarterly payout was $0.10, issued on Sept. 4. This payout ratio stands at 286.66%, signaling aggressive capital returns.

Today alone, shares have climbed 8% to $129.98, with a 188.45% year-to-date (YTD) and 157.64% over the past 52 weeks.

The company is valued at $40.7 billion, trading at 18.15x trailing earnings and 17.80x forward earnings, both figures lower than the sector medians of 24.72x and 25.33x, respectively. This highlights relative affordability given the sector’s robust expectations.

This most recent earnings report, released on June 27, showed that Western Digital delivered revenue of $2.61 billion, up 30% from a year earlier. It achieved a quarterly EPS of $1.51, beating consensus estimates by $0.16 and delivering a positive surprise of 11.85%. This result exceeded internal guidance, with gross margins also coming in higher than forecast.

It generated $746 million in operating cash flow, converting most of this into $675 million in free cash flow. The company paid down $2.6 billion in debt that quarter and initiated its first dividend program. This achievement helped boost fiscal year revenue to $9.52 billion, a strong 51% year-over-year (YoY) increase.

Reported GAAP diluted EPS stood at $0.67, and non-GAAP diluted EPS at $1.66. That performance reflected disciplined execution and surging AI-linked demand for enterprise-scale data storage. The company’s continued revenue growth and improving profitability clearly position it to capture the enormous opportunity playing out as AI spending accelerates.

Storage Demand Powers Ahead

Western Digital made headlines on Feb. 21 by finalizing the separation of its flash memory business, birthing Sandisk Corporation (SNDK) as a standalone entity. This bold move meant Western Digital’s financial statements stopped including Sandisk's performance. The company redirected focus entirely to hard disk drives and related storage solutions. That shift is widely seen as crucial for strengthening core capabilities, especially as demand accelerates for enterprise-grade storage in data centers fueled by AI.

It wasn't just corporate restructuring making news for Western Digital this year. The board greenlit a massive $2 billion share repurchase just as the separation closed. Management also rolled out Western Digital’s first-ever recurring cash dividend program. This dual allocation is no coincidence, as it signals deep confidence in the strength of cash flows and the long-term strategic plan. Western Digital is betting that repurchases and regular dividends will amplify shareholder returns while maintaining enough flexibility to invest in high-growth segments.

Rising Targets Signal Conviction

Rising expectations for Western Digital’s growth outlook are difficult to ignore. The spotlight is now fixed on the company’s next earnings release, scheduled for Oct. 23. Analysts see the current quarter delivering earnings of $1.45, compared to $1.55 last year, reflecting a modest -6.45% YoY dip. Management, for its part, expects fiscal first-quarter revenue to climb 22% YoY at the midpoint, adding further weight to a bullish setup.

The conviction among top Wall Street shops underscores the scale of what’s driving this optimism. Morgan Stanley recently hiked its target to $171 from $99, while Rosenblatt raised its own to $125 from $90, both citing the AI-fueled surge in storage demand. These upgrades complement Western Digital’s record-breaking price performance.

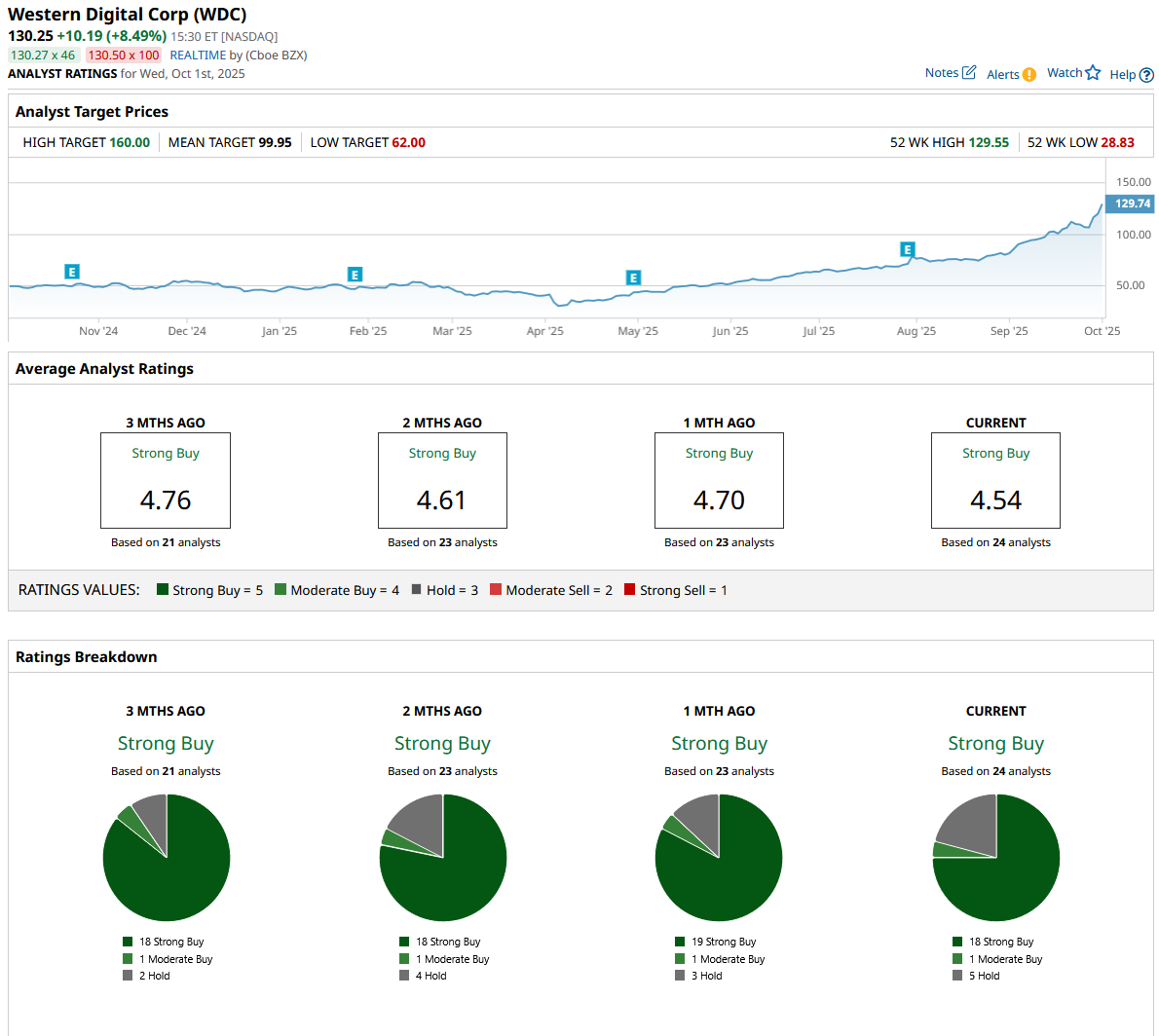

Analyst sentiment is unequivocally positive and keeps getting louder. Of the 24 surveyed, all continue to rate Western Digital a “Strong Buy.” The mean price target stands at $98.36. At the current trading price, this reflects an average downside of roughly 16.8%.

Conclusion

Western Digital has all the hallmarks of a stock poised to keep climbing. Strong earnings trends, a streamlined HDD-focused business, and aggressive AI infrastructure spending create a powerful tailwind. Morgan Stanley’s $171 target and “Strong Buy” consensus reflect deep conviction in WDC’s role in supplying cost-effective mass storage. With analysts forecasting 32.9% revenue growth next fiscal year and Q1 guidance pointing to a 22% jump, shares look set to push higher as the AI data boom accelerates.